Property Valuation Information

- Serial Number : 461100003

- Tax Year : 2024

- Owner Names : KIENE, BRUCE PAUL & MARY PETERSON (ET AL)

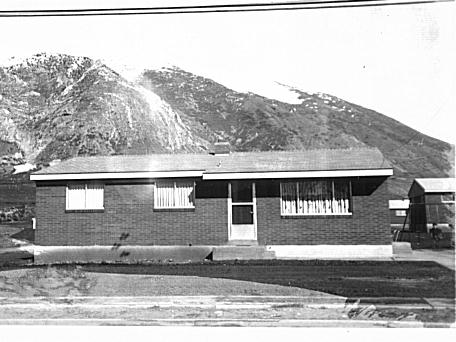

- Property Address : 520 N 100 EAST - SPRINGVILLE

- Tax District : 130 - SPRINGVILLE CITY

- Acreage : 0.19

- Property Classification : RP - RES PRIMARY

- Legal Description : COM AT NE COR, LOT 3, MT VISTA SUBD, PLAT A; SPRINGVILLE; W 100 FT; S 1 11' W 80 FT; S 88 34'E 101.68 FT; N 82.55 FT TO BEG.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $375,400 |

$390,800 |

|||||||

| Total Property Market Value | $375,400 | $390,800 | |||||||