Property Valuation Information

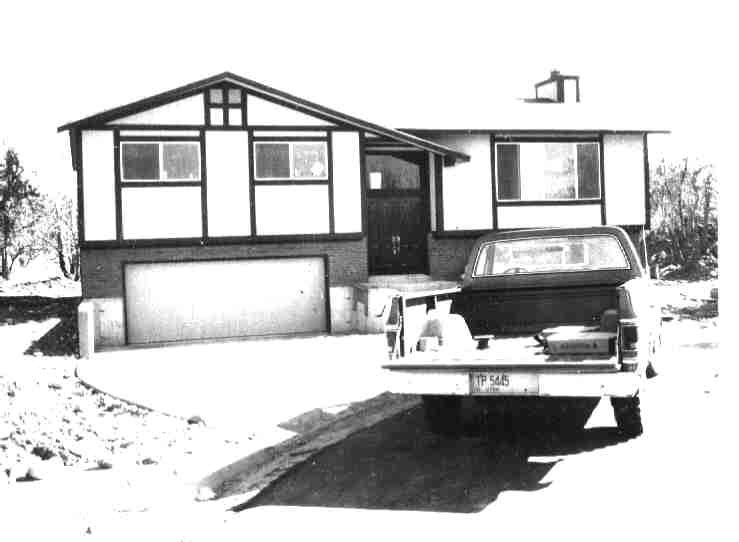

- Serial Number : 480410027

- Tax Year : 2024

- Owner Names : COLEBECK, DIANE

- Property Address : 1002 N 885 EAST - OREM

- Tax District : 090 - OREM CITY

- Acreage : 0.308953

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 27, PLAT A, ORCHARD VILLAGE SUB AREA 0.309 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $479,600 |

$478,200 |

|||||||

| Total Property Market Value | $479,600 | $478,200 | |||||||