Property Valuation Information

- Serial Number : 493100011

- Tax Year : 2024

- Owner Names : SOUTH SLOPE INVESTMENTS LLC

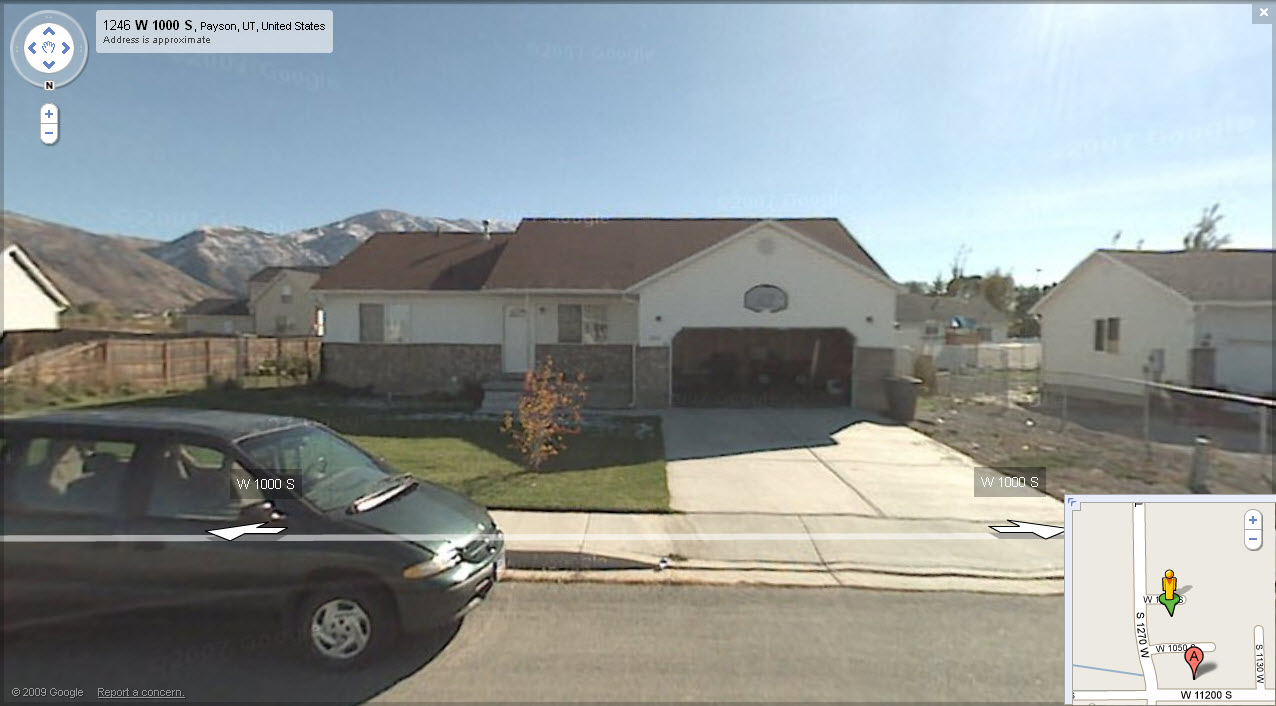

- Property Address : 1245 W 1000 SOUTH - PAYSON

- Tax District : 170 - PAYSON CITY

- Acreage : 0.249

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 11, PLAT A, PAYSON MEADOWS SUBDV. AREA 0.249 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $407,400 |

$404,700 |

|||||||

| Total Property Market Value | $407,400 | $404,700 | |||||||