Property Valuation Information

- Serial Number : 524840095

- Tax Year : 2025

- Owner Names : ALLISON, BRUCE KURT ERIC & JULIE ANN (ET AL)

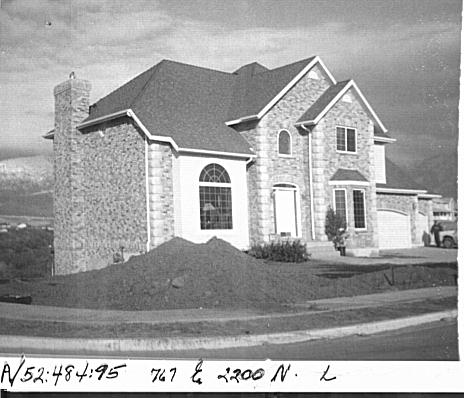

- Property Address : 767 E 2200 NORTH - LEHI

- Tax District : 010 - LEHI CITY

- Acreage : 0.354

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 95, PLAT C, SUMMER CREST SUBDV. AREA 0.354 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Primary Residential | $829,600 |

$883,400 |

|||||||

| Total Property Market Value | $829,600 | $883,400 | |||||||