Property Valuation Information

- Serial Number : 550850003

- Tax Year : 2024

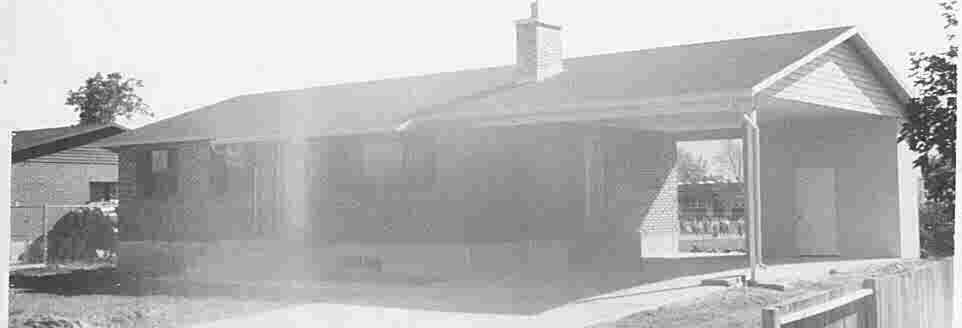

- Owner Names : CHRISTENSEN, MARC R & PATRICIA G

- Property Address : 419 W 600 NORTH - SPANISH FORK

- Tax District : 150 - SPANISH FORK CITY

- Acreage : 0.2

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 15, PLAT D, WESTERN PARK SUB'D.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $431,500 |

$425,300 |

|||||||

| Total Property Market Value | $431,500 | $425,300 | |||||||