Property Information

mobile view

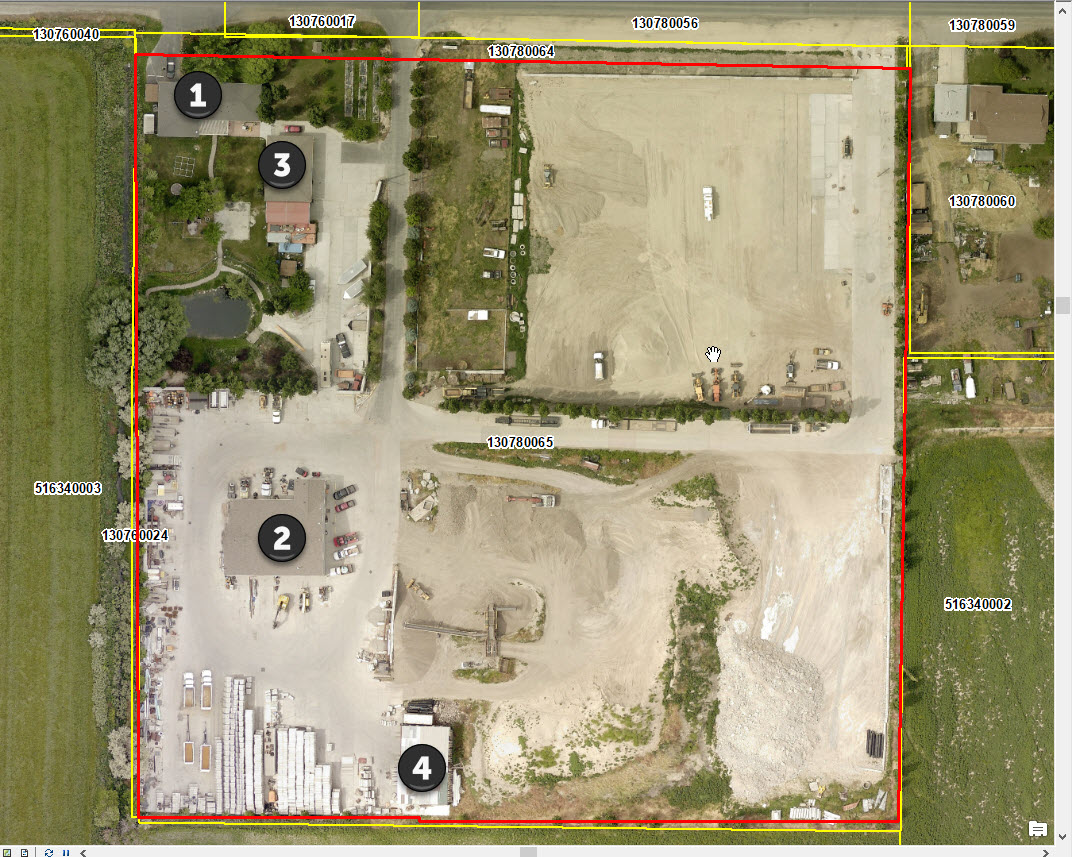

| Serial Number: 13:078:0065 |

Serial Life: 2014... |

|

|

Total Photos: 15

Total Photos: 15

|

| |

|

|

| Property Address: 232 E 1500 SOUTH - AMERICAN FORK

more see "Addrs" tab below..

|

|

| Mailing Address: 232 E 1500 S AMERICAN FORK, UT 84003 |

|

| Acreage: 9.410285 |

|

| Last Document:

72941-2022

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 160.26 FT & E 412.2 FT FR NW COR. SEC. 36, T5S, R1E, SLB&M.; S 0 DEG 53' 16" W 631.81 FT; W 402.42 FT; N 2.82 FT; W 112.79 FT; N .5 FT; W 122.83 FT; N 0 DEG 14' 51" W 640.27 FT; S 88 DEG 57' 24" E 650.7 FT TO BEG. AREA 9.410 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

- Addrs

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$836,400 |

$313,600 |

$1,312,200 |

$2,462,200 |

$356,200 |

$625,900 |

$4,100 |

$986,200 |

$276,278 |

$50,000 |

$326,278 |

$3,448,400 |

| 2023 |

$830,600 |

$311,500 |

$1,303,100 |

$2,445,200 |

$321,900 |

$610,900 |

$4,100 |

$936,900 |

$275,977 |

$50,000 |

$325,977 |

$3,382,100 |

| 2022 |

$789,900 |

$296,200 |

$1,239,300 |

$2,325,400 |

$307,100 |

$674,000 |

$4,300 |

$985,400 |

$276,013 |

$50,000 |

$326,013 |

$3,310,800 |

| 2021 |

$265,700 |

$84,900 |

$448,600 |

$799,200 |

$295,500 |

$275,600 |

$6,000 |

$577,100 |

$275,947 |

$50,000 |

$325,947 |

$1,376,300 |

| 2020 |

$265,700 |

$84,900 |

$448,600 |

$799,200 |

$295,500 |

$275,600 |

$6,000 |

$577,100 |

$275,929 |

$50,000 |

$325,929 |

$1,376,300 |

| 2019 |

$246,700 |

$78,800 |

$416,400 |

$741,900 |

$295,500 |

$275,600 |

$6,000 |

$577,100 |

$275,941 |

$50,000 |

$325,941 |

$1,319,000 |

| 2018 |

$224,900 |

$71,900 |

$379,600 |

$676,400 |

$113,600 |

$222,100 |

$15,500 |

$351,200 |

$276,327 |

$50,000 |

$326,327 |

$1,027,600 |

| 2017 |

$205,800 |

$65,800 |

$347,400 |

$619,000 |

$113,600 |

$222,100 |

$15,500 |

$351,200 |

$276,507 |

$50,000 |

$326,507 |

$970,200 |

| 2016 |

$205,800 |

$65,800 |

$347,400 |

$619,000 |

$113,600 |

$222,100 |

$15,500 |

$351,200 |

$276,429 |

$50,000 |

$326,429 |

$970,200 |

| 2015 |

$293,000 |

$64,500 |

$140,300 |

$497,800 |

$113,600 |

$222,100 |

$15,500 |

$351,200 |

$276,405 |

$50,000 |

$326,405 |

$849,000 |

| 2014 |

$286,200 |

$63,200 |

$138,600 |

$488,000 |

$112,800 |

$231,400 |

$16,200 |

$360,400 |

$276,538 |

$50,000 |

$326,538 |

$848,400 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2024 |

$27,230.63 |

$0.00 |

$27,230.63 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2023 |

$25,187.03 |

$0.00 |

$25,187.03 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2022 |

$24,723.95 |

$0.00 |

$24,723.95 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2021 |

$12,156.53 |

$0.00 |

$12,156.53 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2020 |

$12,534.11 |

$0.00 |

$12,534.11 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2019 |

$11,574.33 |

$0.00 |

$11,574.33 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2018 |

$9,346.93 |

$0.00 |

$9,346.93 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2017 |

$5,907.43 |

$0.00 |

$5,907.43 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2016 |

$6,357.41 |

$0.00 |

$6,357.41 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2015 |

$6,698.56 |

$0.00 |

$6,698.56 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2014 |

$6,853.69 |

$0.00 |

$6,853.69 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 72941-2022 |

04/26/2018 |

06/22/2022 |

WD |

ROGERS, ROBERT & DENISE |

ROGERS, ROBERT DAVID & VALERIE DENISE TEE (ET AL) |

| 58027-2018 |

06/21/2018 |

06/21/2018 |

R FARM |

UTAH COUNTY TREASURER |

JOHNSON, LESLIE (ET AL) |

| 42230-2018 |

05/01/2018 |

05/07/2018 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 16363-2016 |

02/24/2016 |

02/29/2016 |

REC |

HALLIDAY, PAUL M JR TEE |

ROGERS, ROBERT & DENISE |

| 16362-2016 |

02/05/2016 |

02/29/2016 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

HALLIDAY, PAUL M JR SUCTEE |

| 115956-2015 |

12/21/2015 |

12/28/2015 |

D TR |

ROGERS, ROBERT & DENISE |

UNITED WHOLESALE MORTGAGE |

| 115955-2015 |

12/21/2015 |

12/28/2015 |

CORR AF |

ROGERS, ROBERT & DENISE (ET AL) |

WHOM OF INTEREST |

| 64784-2015 |

07/14/2015 |

07/20/2015 |

REC |

HALLIDAY, PAUL M JR SUCTEE |

ROGERS, ROBERT & DENISE |

| 64783-2015 |

06/24/2015 |

07/20/2015 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

HALLIDAY, PAUL M JR SUBTEE |

| 93060-2013 |

09/25/2013 |

10/01/2013 |

FARM |

ROGERS, ROBERT & DENISE |

WHOM OF INTEREST |

| 28221-2013 |

04/24/2012 |

03/25/2013 |

EAS |

ROGERS, ROBERT D & V DENISE |

CITY OF AMERICAN FORK |

| 28220-2013 |

04/24/2012 |

03/25/2013 |

EAS |

ROGERS, ROBERT D & V DENISE |

CITY OF AMERICAN FORK |

| 28219-2013 |

04/24/2012 |

03/25/2013 |

CONVEY |

ROGERS, ROBERT D & V DENISE |

CITY OF AMERICAN FORK |

232 E 1500 SOUTH - AMERICAN FORK

258 E 1500 SOUTH - AMERICAN FORK

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/24/2024 9:39:24 PM |