Property Information

mobile view

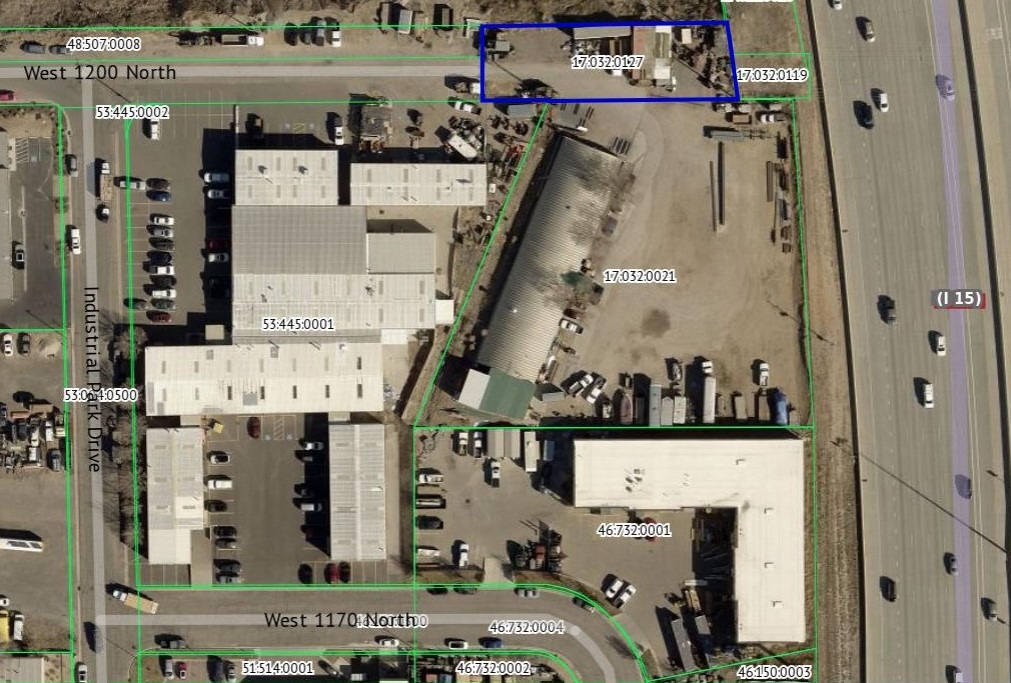

| Serial Number: 17:032:0127 |

Serial Life: 2015... |

|

|

Total Photos: 4

Total Photos: 4

|

| |

|

|

| Property Address: OREM |

|

| Mailing Address: 2876 N 1230 W PLEASANT GROVE, UT 84062-8000 |

|

| Acreage: 0.242543 |

|

| Last Document:

70919-2022

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 4.89 FT & W 615.64 FT FR N 1/4 COR. SEC.9, T6S, R2E, SLB&M.; S 7 DEG 51' 28" E 33.27 FT; S 89 DEG 32' 45" W 141.63 FT; N 22 DEG 28' 58" E .71 FT; S 89 DEG 44' 1" W 49.46 FT; N 32.18 FT; N 8 DEG 48' 1" W .11 FT; N 0 DEG 0' 24" E 23.09 FT; N 89 DEG 11' 42" E 182.93 FT; S 7 DEG 51' 28" E 24.43 FT TO BEG. AREA 0.243 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$110,300 |

$0 |

$0 |

$110,300 |

$4,800 |

$0 |

$0 |

$4,800 |

$0 |

$0 |

$0 |

$115,100 |

| 2023 |

$100,000 |

$0 |

$0 |

$100,000 |

$4,700 |

$0 |

$0 |

$4,700 |

$0 |

$0 |

$0 |

$104,700 |

| 2022 |

$94,900 |

$0 |

$0 |

$94,900 |

$4,600 |

$0 |

$0 |

$4,600 |

$0 |

$0 |

$0 |

$99,500 |

| 2021 |

$83,500 |

$0 |

$0 |

$83,500 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$83,500 |

| 2020 |

$83,500 |

$0 |

$0 |

$83,500 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$83,500 |

| 2019 |

$41,600 |

$0 |

$0 |

$41,600 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$41,600 |

| 2018 |

$37,900 |

$0 |

$0 |

$37,900 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$37,900 |

| 2017 |

$36,100 |

$0 |

$0 |

$36,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$36,100 |

| 2016 |

$34,400 |

$0 |

$0 |

$34,400 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$34,400 |

| 2015 |

$33,300 |

$0 |

$0 |

$33,300 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$33,300 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2024 |

$941.29 |

$0.00 |

$941.29 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2023 |

$796.66 |

$0.00 |

$796.66 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2022 |

$781.47 |

$0.00 |

$781.47 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2021 |

$787.24 |

$0.00 |

$787.24 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2020 |

$801.02 |

$0.00 |

$801.02 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2019 |

$383.76 |

$0.00 |

$383.76 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2018 |

$365.92 |

$0.00 |

$365.92 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2017 |

$357.86 |

$0.00 |

$357.86 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2016 |

$369.80 |

$0.00 |

$369.80 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2015 |

$378.52 |

$0.00 |

$378.52 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 70919-2022 |

06/13/2022 |

06/15/2022 |

WD |

BONHAM, JOSEPH DAVID |

OLSEN, STEVEN R & AMANDALIE (ET AL) |

| 70918-2022 |

06/13/2022 |

06/15/2022 |

AF DC |

BONHAM, RALPH DENEEN & RALPH AKA |

WHOM OF INTEREST |

| 20398-2022 |

02/08/2022 |

02/15/2022 |

SUB TEE |

WELLS FARGO BANK |

WELLS FARGO BANK NORTHWEST SUCTEE |

| 20246-2022 |

02/08/2022 |

02/15/2022 |

REC |

WELLS FARGO BANK NORTHWEST TEE |

GENEVA HOLDINGS LLC |

| 2476-2020 |

01/07/2020 |

01/08/2020 |

R/W |

BONHAM, RALPH & JOSEPH DAVID |

ALLEN, BRIAN D TEE (ET AL) |

| 19994-2019 |

03/11/2019 |

03/12/2019 |

SUB TEE |

WELLS FARGO BANK |

WELLS FARGO BANK NORTHWEST SUCTEE |

| 77428-2018 |

07/13/2018 |

08/15/2018 |

QCD |

BONHAM, RALPH |

BONHAM, RALPH & JOSEPH DAVID |

| 28257-2014 |

04/16/2014 |

04/29/2014 |

BLA |

GENEVA HOLDINGS LLC |

BONHAM, RALPH |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/30/2024 4:26:56 PM |