Property Information

mobile view

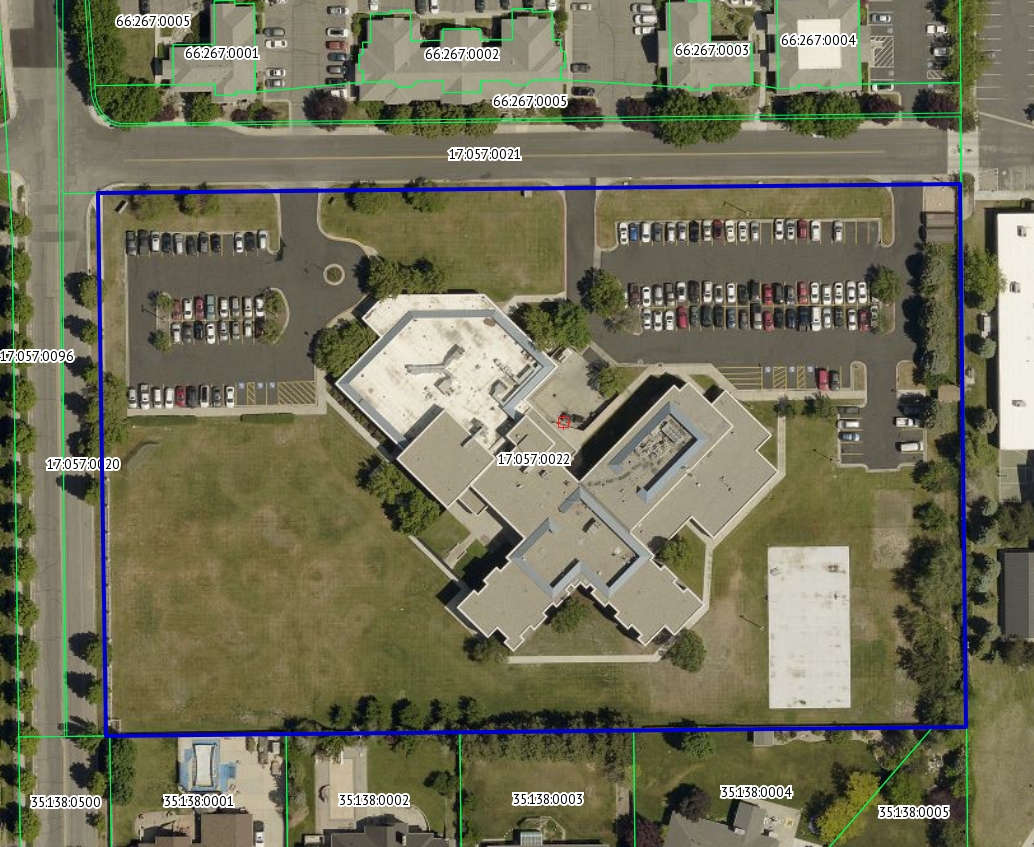

| Serial Number: 17:057:0022 |

Serial Life: 1985... |

|

|

Total Photos: 9

Total Photos: 9

|

| |

|

|

| Property Address: 1350 E 750 NORTH - OREM |

|

| Mailing Address: %ICPG 6200 UTSA BLVD # 2 SAN ANTONIO, TX 78249-1617 |

|

| Acreage: 6.01 |

|

| Last Document:

65399-2000

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM N 89 DEG 35'23"E ALONG 1/4 SEC LINE 3323.27 FT & S 300.96 FT FR W1/4 COR SEC 12, T6S, R2E, SLM; N 89 DEG 29'E 645.06 FT; S 31'10"E 406.02 FT; S 89 DEG 29'W 643.51 FT; N 44'18"W 406.02 FT TO BEG. AREA 6.01 ACRES.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$2,650,600 |

$0 |

$0 |

$2,650,600 |

$5,609,800 |

$0 |

$0 |

$5,609,800 |

$0 |

$0 |

$0 |

$8,260,400 |

| 2023 |

$2,690,600 |

$0 |

$0 |

$2,690,600 |

$5,312,700 |

$0 |

$0 |

$5,312,700 |

$0 |

$0 |

$0 |

$8,003,300 |

| 2022 |

$2,650,600 |

$0 |

$0 |

$2,650,600 |

$5,007,300 |

$0 |

$0 |

$5,007,300 |

$0 |

$0 |

$0 |

$7,657,900 |

| 2021 |

$2,492,300 |

$0 |

$0 |

$2,492,300 |

$4,936,800 |

$0 |

$0 |

$4,936,800 |

$0 |

$0 |

$0 |

$7,429,100 |

| 2020 |

$2,492,300 |

$0 |

$0 |

$2,492,300 |

$5,327,800 |

$0 |

$0 |

$5,327,800 |

$0 |

$0 |

$0 |

$7,820,100 |

| 2019 |

$2,306,400 |

$0 |

$0 |

$2,306,400 |

$5,341,600 |

$0 |

$0 |

$5,341,600 |

$0 |

$0 |

$0 |

$7,648,000 |

| 2018 |

$2,097,000 |

$0 |

$0 |

$2,097,000 |

$4,482,300 |

$0 |

$0 |

$4,482,300 |

$0 |

$0 |

$0 |

$6,579,300 |

| 2017 |

$1,997,500 |

$0 |

$0 |

$1,997,500 |

$4,482,300 |

$0 |

$0 |

$4,482,300 |

$0 |

$0 |

$0 |

$6,479,800 |

| 2016 |

$1,903,300 |

$0 |

$0 |

$1,903,300 |

$4,482,300 |

$0 |

$0 |

$4,482,300 |

$0 |

$0 |

$0 |

$6,385,600 |

| 2015 |

$1,764,500 |

$0 |

$0 |

$1,764,500 |

$4,542,800 |

$0 |

$0 |

$4,542,800 |

$0 |

$0 |

$0 |

$6,307,300 |

| 2014 |

$1,681,600 |

$0 |

$0 |

$1,681,600 |

$4,405,800 |

$0 |

$0 |

$4,405,800 |

$0 |

$0 |

$0 |

$6,087,400 |

| 2013 |

$1,528,700 |

$0 |

$0 |

$1,528,700 |

$4,405,800 |

$0 |

$0 |

$4,405,800 |

$0 |

$0 |

$0 |

$5,934,500 |

| 2012 |

$1,528,700 |

$0 |

$0 |

$1,528,700 |

$4,405,800 |

$0 |

$0 |

$4,405,800 |

$0 |

$0 |

$0 |

$5,934,500 |

| 2011 |

$1,528,700 |

$0 |

$0 |

$1,528,700 |

$4,405,800 |

$0 |

$0 |

$4,405,800 |

$0 |

$0 |

$0 |

$5,934,500 |

| 2010 |

$2,078,133 |

$0 |

$0 |

$2,078,133 |

$5,234,207 |

$0 |

$0 |

$5,234,207 |

$0 |

$0 |

$0 |

$7,312,340 |

| 2009 |

$1,369,800 |

$0 |

$0 |

$1,369,800 |

$6,236,700 |

$0 |

$0 |

$6,236,700 |

$0 |

$0 |

$0 |

$7,606,500 |

| 2008 |

$1,369,800 |

$0 |

$0 |

$1,369,800 |

$6,236,700 |

$0 |

$0 |

$6,236,700 |

$0 |

$0 |

$0 |

$7,606,500 |

| 2007 |

$1,304,600 |

$0 |

$0 |

$1,304,600 |

$5,939,700 |

$0 |

$0 |

$5,939,700 |

$0 |

$0 |

$0 |

$7,244,300 |

| 2006 |

$1,087,164 |

$0 |

$0 |

$1,087,164 |

$5,399,746 |

$0 |

$0 |

$5,399,746 |

$0 |

$0 |

$0 |

$6,486,910 |

| 2005 |

$1,087,164 |

$0 |

$0 |

$1,087,164 |

$5,399,746 |

$0 |

$0 |

$5,399,746 |

$0 |

$0 |

$0 |

$6,486,910 |

| 2004 |

$1,087,164 |

$0 |

$0 |

$1,087,164 |

$5,399,746 |

$0 |

$0 |

$5,399,746 |

$0 |

$0 |

$0 |

$6,486,910 |

| 2003 |

$1,087,164 |

$0 |

$0 |

$1,087,164 |

$5,177,421 |

$0 |

$0 |

$5,177,421 |

$0 |

$0 |

$0 |

$6,264,585 |

| 2002 |

$1,087,164 |

$0 |

$0 |

$1,087,164 |

$3,821,280 |

$0 |

$0 |

$3,821,280 |

$0 |

$0 |

$0 |

$4,908,444 |

| 2001 |

$932,388 |

$0 |

$0 |

$932,388 |

$3,277,256 |

$0 |

$0 |

$3,277,256 |

$0 |

$0 |

$0 |

$4,209,644 |

| 2000 |

$871,391 |

$0 |

$0 |

$871,391 |

$2,475,215 |

$0 |

$0 |

$2,475,215 |

$0 |

$0 |

$0 |

$3,346,606 |

| 1999 |

$871,391 |

$0 |

$0 |

$871,391 |

$2,475,215 |

$0 |

$0 |

$2,475,215 |

$0 |

$0 |

$0 |

$3,346,606 |

| 1998 |

$837,876 |

$0 |

$0 |

$837,876 |

$2,380,014 |

$0 |

$0 |

$2,380,014 |

$0 |

$0 |

$0 |

$3,217,890 |

| 1997 |

$837,876 |

$0 |

$0 |

$837,876 |

$2,380,014 |

$0 |

$0 |

$2,380,014 |

$0 |

$0 |

$0 |

$3,217,890 |

| 1996 |

$837,876 |

$0 |

$0 |

$837,876 |

$2,380,014 |

$0 |

$0 |

$2,380,014 |

$0 |

$0 |

$0 |

$3,217,890 |

| 1995 |

$837,876 |

$0 |

$0 |

$837,876 |

$2,380,014 |

$0 |

$0 |

$2,380,014 |

$0 |

$0 |

$0 |

$3,217,890 |

| 1994 |

$489,986 |

$0 |

$0 |

$489,986 |

$2,380,014 |

$0 |

$0 |

$2,380,014 |

$0 |

$0 |

$0 |

$2,870,000 |

| 1993 |

$489,986 |

$0 |

$0 |

$489,986 |

$2,380,014 |

$0 |

$0 |

$2,380,014 |

$0 |

$0 |

$0 |

$2,870,000 |

| 1992 |

$449,528 |

$0 |

$0 |

$449,528 |

$3,266,114 |

$0 |

$0 |

$3,266,114 |

$0 |

$0 |

$0 |

$3,715,642 |

| 1991 |

$394,323 |

$0 |

$0 |

$394,323 |

$3,266,114 |

$0 |

$0 |

$3,266,114 |

$0 |

$0 |

$0 |

$3,660,437 |

| 1990 |

$394,323 |

$0 |

$0 |

$394,323 |

$3,266,114 |

$0 |

$0 |

$3,266,114 |

$0 |

$0 |

$0 |

$3,660,437 |

| 1989 |

$394,323 |

$0 |

$0 |

$394,323 |

$3,266,114 |

$0 |

$0 |

$3,266,114 |

$0 |

$0 |

$0 |

$3,660,437 |

| 1988 |

$394,324 |

$0 |

$0 |

$394,324 |

$3,237,113 |

$0 |

$0 |

$3,237,113 |

$0 |

$0 |

$0 |

$3,631,437 |

| 1987 |

$406,519 |

$0 |

$0 |

$406,519 |

$3,237,113 |

$0 |

$0 |

$3,237,113 |

$0 |

$0 |

$0 |

$3,643,632 |

| 1986 |

$406,519 |

$0 |

$0 |

$406,519 |

$3,237,113 |

$0 |

$0 |

$3,237,113 |

$0 |

$0 |

$0 |

$3,643,632 |

| 1985 |

$0 |

$0 |

$406,519 |

$406,519 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$406,519 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2024 |

$67,553.55 |

$0.00 |

$67,553.55 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2023 |

$60,897.11 |

$0.00 |

$60,897.11 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2022 |

$60,145.15 |

$0.00 |

$60,145.15 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2021 |

$70,041.55 |

$0.00 |

$70,041.55 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2020 |

$75,018.22 |

$0.00 |

$75,018.22 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2019 |

$70,552.80 |

$0.00 |

$70,552.80 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2018 |

$63,523.14 |

$0.00 |

$63,523.14 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2017 |

$64,234.26 |

$0.00 |

$64,234.26 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2016 |

$68,645.20 |

$0.00 |

$68,645.20 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2015 |

$71,695.08 |

$0.00 |

$71,695.08 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2014 |

$69,512.02 |

$0.00 |

$69,512.02 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2013 |

$73,077.43 |

$0.00 |

$73,077.43 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2012 |

$74,584.80 |

$0.00 |

$74,584.80 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2011 |

$74,228.73 |

$0.00 |

$74,228.73 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2010 |

$85,627.50 |

$0.00 |

$85,627.50 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2009 |

$82,568.56 |

$0.00 |

$82,568.56 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2008 |

$76,513.78 |

$0.00 |

$76,513.78 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2007 |

$72,037.32 |

$0.00 |

$72,037.32 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2006 |

$68,689.89 |

$0.00 |

$68,689.89 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2005 |

$77,531.55 |

$0.00 |

$77,531.55 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2004 |

$76,156.32 |

$0.00 |

$76,156.32 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2003 |

$71,366.15 |

$0.00 |

$71,366.15 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2002 |

$51,101.81 |

$0.00 |

$51,101.81 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2001 |

$43,405.64 |

$0.00 |

$43,405.64 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2000 |

$35,678.17 |

$0.00 |

$35,678.17 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1999 |

$36,732.35 |

$0.00 |

$36,732.35 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1998 |

$33,350.21 |

$0.00 |

$33,350.21 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1997 |

$33,211.84 |

$0.00 |

$33,211.84 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1996 |

$30,341.48 |

$0.00 |

$30,341.48 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1995 |

$34,334.89 |

$0.00 |

$34,334.89 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1994 |

$39,462.50 |

$0.00 |

$39,462.50 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1993 |

$33,685.91 |

$0.00 |

$33,685.91 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1992 |

$49,328.07 |

$0.00 |

$49,328.07 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1991 |

$45,449.81 |

$0.00 |

$45,449.81 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1990 |

$40,923.68 |

$0.00 |

$40,923.68 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1989 |

$41,708.47 |

$0.00 |

$41,708.47 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1988 |

$41,279.26 |

$0.00 |

$41,279.26 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1987 |

$40,732.88 |

$0.00 |

$40,732.88 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1986 |

$40,184.88 |

$0.00 |

$40,184.88 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 1985 |

$4,510.08 |

$0.00 |

$4,510.08 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 63157-2014 |

09/03/2014 |

09/05/2014 |

REC |

BONNEVILLE SUPERIOR TITLE COMPANY INC TEE |

UHS OF PROVO CANYON INC |

| 4388-2013 |

12/14/2012 |

01/15/2013 |

A D TR |

UHS OF PROVO CANYON INC |

JPMORGAN CHASE BANK |

| 1196-2011 |

12/21/2010 |

01/05/2011 |

D TR |

UHS OF PROVO CANYON INC |

JPMORGAN CHASE BANK |

| 33343-2003 |

03/04/2003 |

03/06/2003 |

A N LN |

UHS OF PROVO CANYON INC |

TRITON PLUMBING INC (ET AL) |

| 65399-2000 |

08/11/2000 |

08/21/2000 |

SP WD |

CRESCENT REAL ESTATE FUNDING VII LP |

UHS OF PROVO CANYON INC |

| 102545-1999 |

|

09/20/1999 |

FN ST |

CHARTER BEHAVIORAL HEALTH SYSTEMS LLC (ET AL) |

CRESCENT REAL ESTATE FUNDING VII LP |

| 46674-1997 |

|

06/18/1997 |

T FN ST |

BANKERS TRUST COMPANY |

CHARTER CANYON BEHAVIORAL HEALTH SYSTEMS INC |

| 46673-1997 |

|

06/18/1997 |

T FN ST |

BANKERS TRUST COMPANY |

CHARTER CANYON BEHAVIORAL HEALTH SYSTEM INC |

| 46672-1997 |

06/13/1997 |

06/18/1997 |

SP WD |

CHARTER CANYON BEHAVIORAL HEALTH SYSTEM INC |

CRESCENT REAL ESTATE FUNDING VII LP |

| 38497-1997 |

01/30/1997 |

05/20/1997 |

REC |

LAWYERS TITLE INSURANCE CORPORATION TEE |

CHARTER CANYON BEHAVIORAL HEALTH SYSTEM INC |

| 38496-1997 |

10/10/1996 |

05/20/1997 |

SUB TEE |

BANKERS TRUST COMPANY |

LAWYERS TITLE INSURANCE COMPANY SUCTEE |

| 63475-1996 |

09/13/1994 |

08/02/1996 |

REC |

FIRST SECURITY BANK OF UTAH FKA (ET AL) |

STRATTON, VERN A & JOANN E |

| 24277-1995 |

04/20/1995 |

04/20/1995 |

REL |

UNITED STATES FARMERS HOME ADMINISTRATION |

STRATTON, VERN A & JOANN E |

| 54496-1994 |

|

07/01/1994 |

A FN ST |

CHARTER CANYON BEHAVIORAL HEALTH SYSTEM INC |

BANKERS TRUST COMPANY |

| 54495-1994 |

|

07/01/1994 |

A FN ST |

CHARTER CANYON BEHAVIORAL HEALTH SYSTEM INC |

BANKERS TRUST COMPANY |

| 39971-1994 |

05/01/1994 |

05/13/1994 |

MTGE |

CHARTER CANYON BEHAVIORAL HEALTH SYSTEM INC FKA (ET AL) |

BANKERS TRUST COMPANY |

| 37074-1992 |

|

07/23/1992 |

FN ST |

CHARTER CANYON HOSPITAL INC |

BANKERS TRUST COMPANY |

| 36814-1992 |

07/14/1992 |

07/22/1992 |

A D TR |

CHARTER CANYON HOSPITAL INC |

BANKERS TRUST COMPANY |

| 33472-1990 |

10/04/1990 |

10/09/1990 |

D TR |

CHARTER CANYON HOSPITAL INC |

BANKERS TRUST COMPANY |

| 33471-1990 |

|

10/09/1990 |

FN ST |

CHARTER CANYON HOSPITAL INC |

BANKERS TRUST COMPANY |

| 14440-1986 |

05/12/1986 |

05/12/1986 |

R LN |

DELTA FIRE SYSTEMS INC |

WHOM OF INTEREST |

| 6751-1986 |

03/06/1986 |

03/06/1986 |

N LN |

CHARTER CANYON HOSPITAL INC (ET AL) |

SIERRA WHOLESALE BY (ET AL) |

| 3361-1986 |

01/29/1986 |

02/03/1986 |

N LN |

CHARTER CANYON HOSPITAL INC |

DELTA FIRE SYSTEMS |

| 16848-1985 |

06/13/1985 |

06/14/1985 |

QCD |

OSMOND BROTHERS SUC OF (ET AL) |

CHARTER CANYON HOSPITAL INC |

| 30626-1984 |

10/12/1984 |

10/16/1984 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 30046-1984 |

10/01/1984 |

10/10/1984 |

WD |

STRATTON VERN AND JO ANN FAMILY LIMITED PARTNERSHIP (ET AL) |

CHARTER CANYON HOSPITAL INC |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 1/20/2025 12:51:34 PM |