Property Information

mobile view

| Serial Number: 19:022:0101 |

Serial Life: 2008... |

|

|

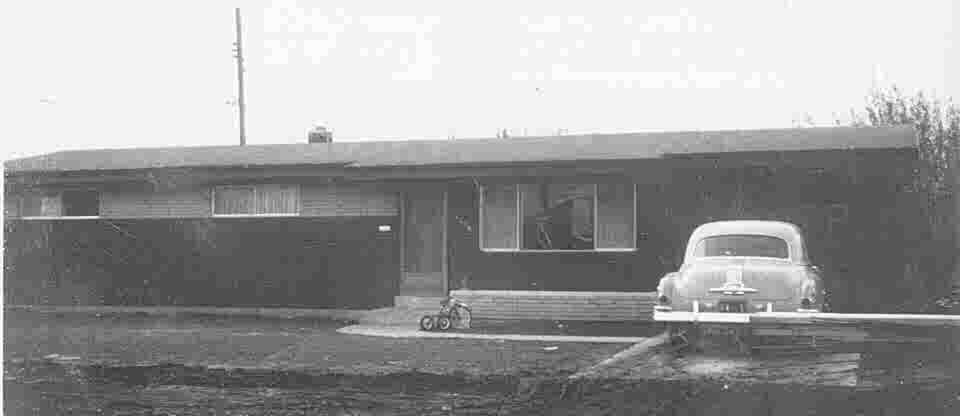

Total Photos: 1

|

| |

|

|

| Property Address: 1776 S 450 EAST - OREM |

|

| Mailing Address: 1776 S 450 E OREM, UT 84058-7937 |

|

| Acreage: 0.248508 |

|

| Last Document:

63110-2023

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM N 1345.9 FT & S 88 DEG 53' 19" E 323.1 FT & N 1 DEG 6' 41" E 137 FT FR S 1/4 COR. SEC. 26, T6S, R2E, SLB&M.; N 88 DEG 53' 0" W 75 FT; N 1 DEG 7' 0" E 3 FT; N 88 DEG 53' 0" W 70 FT; N 1 DEG 7' 0" E 70 FT; S 88 DEG 53' 0" E 145 FT; S 1 DEG 7' 0" W 73 FT TO BEG. AREA 0.238 AC. ALSO COM N 1345.9 FT & S 88 DEG 53' 0" E 323.1 FT & N 1 DEG 6' 41" E 137 FT FR S 1/4 COR. SEC. 26, T6S, R2E, SLB&M.; N 88 DEG 53' 0" W 75 FT; S 1 DEG 6' 0" W 6 FT; S 88 DEG 53' 0" E 75 FT; N 1 DEG 6' 0" E 6 FT TO BEG. AREA 0.010 AC. TOTAL AREA .249 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$220,100 |

$0 |

$220,100 |

$0 |

$224,000 |

$0 |

$224,000 |

$0 |

$0 |

$0 |

$444,100 |

| 2023 |

$0 |

$220,000 |

$0 |

$220,000 |

$0 |

$219,900 |

$0 |

$219,900 |

$0 |

$0 |

$0 |

$439,900 |

| 2022 |

$0 |

$234,600 |

$0 |

$234,600 |

$0 |

$202,600 |

$0 |

$202,600 |

$0 |

$0 |

$0 |

$437,200 |

| 2021 |

$0 |

$138,000 |

$0 |

$138,000 |

$0 |

$187,600 |

$0 |

$187,600 |

$0 |

$0 |

$0 |

$325,600 |

| 2020 |

$0 |

$110,400 |

$0 |

$110,400 |

$0 |

$182,100 |

$0 |

$182,100 |

$0 |

$0 |

$0 |

$292,500 |

| 2019 |

$0 |

$95,700 |

$0 |

$95,700 |

$0 |

$169,600 |

$0 |

$169,600 |

$0 |

$0 |

$0 |

$265,300 |

| 2018 |

$0 |

$92,000 |

$0 |

$92,000 |

$0 |

$150,200 |

$0 |

$150,200 |

$0 |

$0 |

$0 |

$242,200 |

| 2017 |

$0 |

$84,700 |

$0 |

$84,700 |

$0 |

$130,600 |

$0 |

$130,600 |

$0 |

$0 |

$0 |

$215,300 |

| 2016 |

$0 |

$73,600 |

$0 |

$73,600 |

$0 |

$126,800 |

$0 |

$126,800 |

$0 |

$0 |

$0 |

$200,400 |

| 2015 |

$0 |

$73,600 |

$0 |

$73,600 |

$0 |

$110,300 |

$0 |

$110,300 |

$0 |

$0 |

$0 |

$183,900 |

| 2014 |

$0 |

$75,800 |

$0 |

$75,800 |

$0 |

$95,600 |

$0 |

$95,600 |

$0 |

$0 |

$0 |

$171,400 |

| 2013 |

$0 |

$77,100 |

$0 |

$77,100 |

$0 |

$83,100 |

$0 |

$83,100 |

$0 |

$0 |

$0 |

$160,200 |

| 2012 |

$0 |

$65,400 |

$0 |

$65,400 |

$0 |

$73,500 |

$0 |

$73,500 |

$0 |

$0 |

$0 |

$138,900 |

| 2011 |

$0 |

$71,300 |

$0 |

$71,300 |

$0 |

$68,900 |

$0 |

$68,900 |

$0 |

$0 |

$0 |

$140,200 |

| 2010 |

$0 |

$56,600 |

$0 |

$56,600 |

$0 |

$92,423 |

$0 |

$92,423 |

$0 |

$0 |

$0 |

$149,023 |

| 2009 |

$0 |

$56,600 |

$0 |

$56,600 |

$0 |

$97,000 |

$0 |

$97,000 |

$0 |

$0 |

$0 |

$153,600 |

| 2008 |

$0 |

$56,600 |

$0 |

$56,600 |

$0 |

$122,000 |

$0 |

$122,000 |

$0 |

$0 |

$0 |

$178,600 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2024 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2023 |

$1,840.96 |

$0.00 |

$1,840.96 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2022 |

$1,888.57 |

$0.00 |

$1,888.57 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2021 |

$1,688.37 |

$0.00 |

$1,688.37 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2020 |

$1,543.27 |

$0.00 |

$1,543.27 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2019 |

$1,346.07 |

$0.00 |

$1,346.07 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2018 |

$1,286.14 |

$0.00 |

$1,286.14 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2017 |

$1,173.85 |

$0.00 |

$1,173.85 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2016 |

$1,184.87 |

$0.00 |

$1,184.87 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2015 |

$1,149.72 |

$0.00 |

$1,149.72 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2014 |

$1,076.47 |

$0.00 |

$1,076.47 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2013 |

$1,084.99 |

$0.00 |

$1,084.99 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2012 |

$960.13 |

$0.00 |

$960.13 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2011 |

$964.49 |

$0.00 |

$964.49 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2010 |

$959.79 |

$0.00 |

$959.79 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2009 |

$917.03 |

$0.00 |

$917.03 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2008 |

$988.10 |

$0.00 |

$988.10 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 63110-2023 |

09/25/2023 |

09/25/2023 |

SP WD |

DIXON, KAREN M |

DIXON, KAREN M TEE (ET AL) |

| 63109-2023 |

09/25/2023 |

09/25/2023 |

AF DC |

DIXON, WILLIAM FRANK & WILLIAM F AKA |

WHOM OF INTEREST |

| 57-2007 |

|

01/02/2007 |

N SPREC |

UTAH COUNTY RECORDER |

WHOM OF INTEREST |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 7/14/2024 11:45:17 AM |