Property Information

mobile view

| Serial Number: 20:027:0117 |

Serial Life: 1995... |

|

|

Total Photos: 20

Total Photos: 20

|

| |

|

|

| Property Address: 5160 N CANYON RD - PROVO |

|

| Mailing Address: 5255 N EDGEWOOD DR # 175 PROVO, UT 84604 |

|

| Acreage: 8.304 |

|

| Last Document:

63119-1992

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 1264.63 FT & W 1695.31 FT FR N 1/4 COR. SEC. 18, T6S, R3E, SLB&M.; N 5 DEG 50' 0" W 111.33 FT; N 88 DEG 40' 0" E 508.9 FT; N 5 DEG 30' 0" W 200.4 FT; N 88 DEG 40' 0" E 478.8 FT; N 31 DEG 45' 0" E 103 FT; N 59 DEG 30' 0" E 70 FT; N 19 DEG 45' 0" W 30 FT; N 54 DEG 45' 0" W 50 FT; N 74 DEG 38' 0" W 54 FT; N 22 DEG 30' 0" E 84.93 FT; N 89 DEG 15' 0" E 345.37 FT; S 17 DEG 31' 3" W 16.58 FT; N 87 DEG 52' 39" E 183.38 FT; S 11 DEG 48' 13" E 311.52 FT; S 86 DEG 5' 13" W 346.72 FT; N 87 DEG 32' 10" W 157.92 FT; N 87 DEG 38' 52" W 119.44 FT; S 17 DEG 48' 2" W 145.17 FT; S 0 DEG 47' 12" W 122.43 FT; N 89 DEG 58' 0" W 918.32 FT TO BEG. AREA 8.304 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

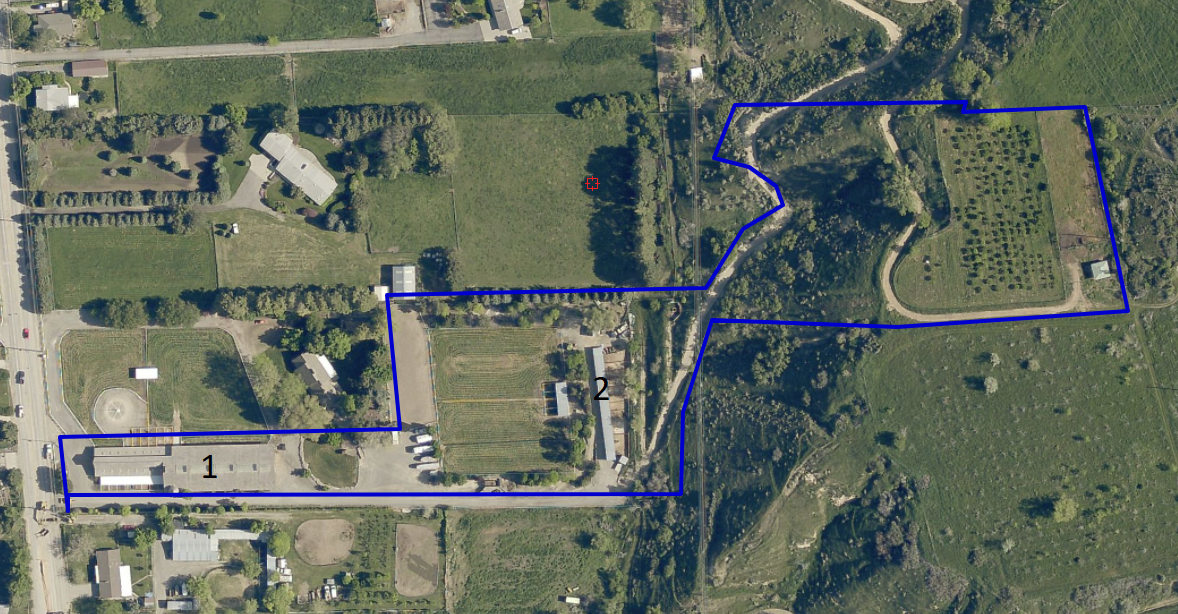

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$97,300 |

$0 |

$1,519,400 |

$1,616,700 |

$207,000 |

$0 |

$140,700 |

$347,700 |

$3,043 |

$0 |

$3,043 |

$1,964,400 |

| 2023 |

$71,300 |

$0 |

$1,112,300 |

$1,183,600 |

$203,300 |

$0 |

$140,800 |

$344,100 |

$2,845 |

$0 |

$2,845 |

$1,527,700 |

| 2022 |

$71,300 |

$0 |

$1,112,300 |

$1,183,600 |

$173,600 |

$0 |

$114,200 |

$287,800 |

$2,974 |

$0 |

$2,974 |

$1,471,400 |

| 2021 |

$59,700 |

$0 |

$931,400 |

$991,100 |

$70,900 |

$0 |

$303,500 |

$374,400 |

$2,992 |

$0 |

$2,992 |

$1,365,500 |

| 2020 |

$59,700 |

$0 |

$931,400 |

$991,100 |

$70,900 |

$0 |

$303,500 |

$374,400 |

$3,027 |

$0 |

$3,027 |

$1,365,500 |

| 2019 |

$55,300 |

$0 |

$863,400 |

$918,700 |

$71,600 |

$0 |

$306,000 |

$377,600 |

$3,147 |

$0 |

$3,147 |

$1,296,300 |

| 2018 |

$50,300 |

$0 |

$785,200 |

$835,500 |

$347,700 |

$0 |

$0 |

$347,700 |

$3,468 |

$0 |

$3,468 |

$1,183,200 |

| 2017 |

$47,900 |

$0 |

$747,800 |

$795,700 |

$55,400 |

$0 |

$206,300 |

$261,700 |

$3,594 |

$0 |

$3,594 |

$1,057,400 |

| 2016 |

$45,700 |

$0 |

$713,900 |

$759,600 |

$55,400 |

$0 |

$206,300 |

$261,700 |

$3,522 |

$0 |

$3,522 |

$1,021,300 |

| 2015 |

$0 |

$0 |

$723,500 |

$723,500 |

$55,400 |

$0 |

$206,300 |

$261,700 |

$3,506 |

$0 |

$3,506 |

$985,200 |

| 2014 |

$510,100 |

$0 |

$0 |

$510,100 |

$366,600 |

$0 |

$0 |

$366,600 |

$3,569 |

$0 |

$3,569 |

$876,700 |

| 2013 |

$463,700 |

$0 |

$0 |

$463,700 |

$366,600 |

$0 |

$0 |

$366,600 |

$3,758 |

$0 |

$3,758 |

$830,300 |

| 2012 |

$463,700 |

$0 |

$0 |

$463,700 |

$366,600 |

$0 |

$0 |

$366,600 |

$3,824 |

$0 |

$3,824 |

$830,300 |

| 2011 |

$463,700 |

$0 |

$0 |

$463,700 |

$366,600 |

$0 |

$0 |

$366,600 |

$3,965 |

$0 |

$3,965 |

$830,300 |

| 2010 |

$504,000 |

$0 |

$0 |

$504,000 |

$385,900 |

$0 |

$0 |

$385,900 |

$3,936 |

$0 |

$3,936 |

$889,900 |

| 2009 |

$504,000 |

$0 |

$0 |

$504,000 |

$385,900 |

$0 |

$0 |

$385,900 |

$3,993 |

$0 |

$3,993 |

$889,900 |

| 2008 |

$504,000 |

$0 |

$0 |

$504,000 |

$385,900 |

$0 |

$0 |

$385,900 |

$3,982 |

$0 |

$3,982 |

$889,900 |

| 2007 |

$480,000 |

$0 |

$0 |

$480,000 |

$367,500 |

$0 |

$0 |

$367,500 |

$3,982 |

$0 |

$3,982 |

$847,500 |

| 2006 |

$400,000 |

$0 |

$0 |

$400,000 |

$334,077 |

$0 |

$0 |

$334,077 |

$3,713 |

$0 |

$3,713 |

$734,077 |

| 2005 |

$400,000 |

$0 |

$0 |

$400,000 |

$334,077 |

$0 |

$0 |

$334,077 |

$3,713 |

$0 |

$3,713 |

$734,077 |

| 2004 |

$400,000 |

$0 |

$0 |

$400,000 |

$334,077 |

$0 |

$0 |

$334,077 |

$3,627 |

$0 |

$3,627 |

$734,077 |

| 2003 |

$400,000 |

$0 |

$0 |

$400,000 |

$334,077 |

$0 |

$0 |

$334,077 |

$3,288 |

$0 |

$3,288 |

$734,077 |

| 2002 |

$400,000 |

$0 |

$0 |

$400,000 |

$334,077 |

$0 |

$0 |

$334,077 |

$3,288 |

$0 |

$3,288 |

$734,077 |

| 2001 |

$371,922 |

$0 |

$0 |

$371,922 |

$362,155 |

$0 |

$0 |

$362,155 |

$3,231 |

$0 |

$3,231 |

$734,077 |

| 2000 |

$347,591 |

$0 |

$0 |

$347,591 |

$362,155 |

$0 |

$0 |

$362,155 |

$3,170 |

$55,916 |

$59,086 |

$709,746 |

| 1999 |

$347,591 |

$0 |

$0 |

$347,591 |

$348,504 |

$0 |

$0 |

$348,504 |

$2,893 |

$55,916 |

$58,809 |

$696,095 |

| 1998 |

$334,222 |

$0 |

$0 |

$334,222 |

$354,000 |

$0 |

$0 |

$354,000 |

$2,811 |

$55,916 |

$58,727 |

$688,222 |

| 1997 |

$283,239 |

$0 |

$0 |

$283,239 |

$300,000 |

$0 |

$0 |

$300,000 |

$2,764 |

$55,916 |

$58,680 |

$583,239 |

| 1996 |

$283,239 |

$0 |

$0 |

$283,239 |

$300,000 |

$0 |

$0 |

$300,000 |

$3,037 |

$55,916 |

$58,953 |

$583,239 |

| 1995 |

$283,239 |

$0 |

$0 |

$283,239 |

$300,000 |

$0 |

$0 |

$300,000 |

$0 |

$0 |

$0 |

$583,239 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2024 |

$3,563.20 |

$0.00 |

$3,563.20 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2023 |

$3,575.27 |

$0.00 |

$3,575.27 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2022 |

$2,971.71 |

$0.00 |

$2,971.71 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2021 |

$4,020.73 |

$0.00 |

$4,020.73 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2020 |

$4,289.46 |

$0.00 |

$4,289.46 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2019 |

$4,160.80 |

$0.00 |

$4,160.80 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2018 |

$3,783.84 |

$0.00 |

$3,783.84 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2017 |

$2,861.20 |

$0.00 |

$2,861.20 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2016 |

$3,068.88 |

$0.00 |

$3,068.88 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2015 |

$3,036.08 |

$0.00 |

$3,036.08 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2014 |

$4,065.20 |

$0.00 |

$4,065.20 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2013 |

$4,353.56 |

$0.00 |

$4,353.56 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2012 |

$4,493.24 |

$0.00 |

$4,493.24 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2011 |

$4,363.03 |

$0.00 |

$4,363.03 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2010 |

$4,216.08 |

$0.00 |

$4,216.08 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2009 |

$4,112.98 |

$0.00 |

$4,112.98 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2008 |

$3,792.38 |

$0.00 |

$3,792.38 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2007 |

$3,260.50 |

$0.00 |

$3,260.50 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2006 |

$3,631.58 |

$0.00 |

$3,631.58 |

$0.00 |

|

$0.00

|

$0.00 |

030 - ALPINE SCHOOL DIST SA 6-7-8 |

| 2005 |

$4,110.57 |

$0.00 |

$4,110.57 |

$0.00 |

|

$0.00

|

$0.00 |

030 - ALPINE SCHOOL DIST SA 6-7-8 |

| 2004 |

$4,106.48 |

$0.00 |

$4,106.48 |

$0.00 |

|

$0.00

|

$0.00 |

030 - ALPINE SCHOOL DIST SA 6-7-8 |

| 2003 |

$4,049.39 |

$0.00 |

$4,049.39 |

$0.00 |

|

$0.00

|

$0.00 |

030 - ALPINE SCHOOL DIST SA 6-7-8 |

| 2002 |

$3,710.68 |

$0.00 |

$3,710.68 |

$0.00 |

|

$0.00

|

$0.00 |

030 - ALPINE SCHOOL DIST SA 6-7-8 |

| 2001 |

$3,988.19 |

$0.00 |

$3,988.19 |

$0.00 |

|

$0.00

|

$0.00 |

030 - ALPINE SCHOOL DIST SA 6-7-8 |

| 2000 |

$4,540.04 |

($440.57) |

$4,099.47 |

$0.00 |

|

$0.00

|

$0.00 |

030 - ALPINE SCHOOL DIST SA 6-7-8 |

| 1999 |

$4,470.57 |

$0.00 |

$4,470.57 |

$0.00 |

|

$0.00

|

$0.00 |

030 - ALPINE SCHOOL DIST SA 6-7-8 |

| 1998 |

$4,361.33 |

$0.00 |

$4,361.33 |

$0.00 |

|

$0.00

|

$0.00 |

030 - ALPINE SCHOOL DIST SA 6-7-8 |

| 1997 |

$3,756.16 |

$0.00 |

$3,756.16 |

$0.00 |

|

$0.00

|

$0.00 |

030 - ALPINE SCHOOL DIST SA 6-7-8 |

| 1996 |

$4,053.30 |

$0.00 |

$4,053.30 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 1995 |

$7,101.52 |

($2,921.62) |

$4,179.90 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 127006-2003 |

07/31/2003 |

08/11/2003 |

W WD |

FAUCETT FIELD DITCH COMPANY |

CENTRAL UTAH WATER CONSERVANCY DISTRICT |

| 69771-1997 |

08/25/1997 |

09/08/1997 |

TEE D |

SMITH, LAWRENCE & VIOLA K TEE (ET AL) |

SMITH LAWRENCE AND VIOLA FAMILY PROPERTIES LC |

| 93376-1996 |

07/07/1996 |

11/18/1996 |

BLA |

B AND B PROPERTIES (ET AL) |

WAGNER, JOHN DILWORTH (ET AL) |

| 71485-1994 |

07/01/1994 |

09/09/1994 |

FLA |

B AND B PROPERTIES BY (ET AL) |

GILLESPIE, ROGER S & JANIE M (ET AL) |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 1/30/2025 9:26:59 PM |