Property Information

mobile view

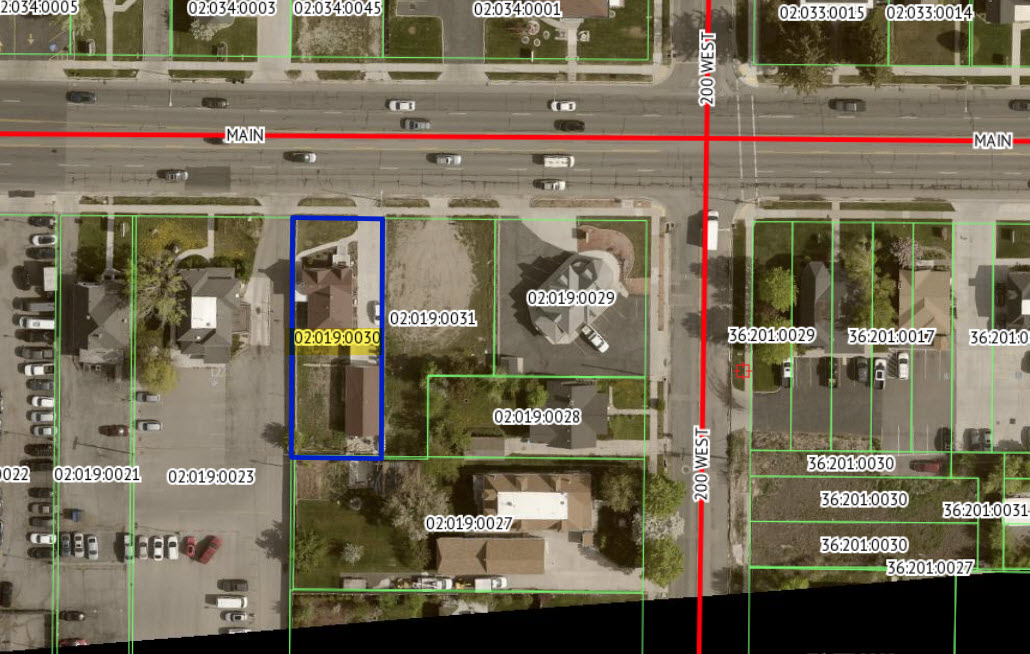

| Serial Number: 02:019:0030 |

Serial Life: 1979... |

|

|

Total Photos: 9

Total Photos: 9

|

| |

|

|

| Property Address: 229 W MAIN - AMERICAN FORK |

|

| Mailing Address: 229 W MAIN ST AMERICAN FORK, UT 84003-2227 |

|

| Acreage: 0.19 |

|

| Last Document:

75408-2020

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM. 164 FT W OF NE COR OF LOT 5, BLK 8, PLAT A, AMERICAN FORK CITY SURVEY; S 149 FT; W 55.78 FT; N 149 FT; E 55.78 FT TO BEG.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| 2023... |

|

EGBERT, CRAIG E JR |

|

| 2023... |

|

SHAW, JACQUELIN |

|

| 2021-2022 |

|

TERESA'S DIAMOND LLC |

|

| 2014-2020 |

|

EGBERT, NORMA |

|

| 2013 |

|

MENESES, AMELIA |

|

| 2013 |

|

MENESES, ISRAEL |

|

| 2013NV |

|

DYNAMIC CAPITAL LLC |

|

| 2012 |

|

CHRISTENSEN, PETER D |

|

| 2012NV |

|

BATE, HELEN T |

|

| 2012NV |

|

BATE, ROBERT T |

|

| 2000-2011 |

|

BATE, HELEN |

|

| 2000-2011 |

|

BATE, HELEN T |

|

| 2000-2011 |

|

BATE, ROBERT T |

|

| 1982-1999 |

|

BATE, HELEN |

|

| 1982-1999 |

|

BATE, RONALD |

|

| 1979-1981 |

|

BATE, HELEN |

|

| 1979-1981 |

|

BATE, RONALD |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$180,500 |

$0 |

$180,500 |

$0 |

$176,500 |

$0 |

$176,500 |

$0 |

$0 |

$0 |

$357,000 |

| 2023 |

$0 |

$209,800 |

$0 |

$209,800 |

$0 |

$165,500 |

$0 |

$165,500 |

$0 |

$0 |

$0 |

$375,300 |

| 2022 |

$230,700 |

$0 |

$0 |

$230,700 |

$165,500 |

$0 |

$0 |

$165,500 |

$0 |

$0 |

$0 |

$396,200 |

| 2021 |

$50,600 |

$56,200 |

$0 |

$106,800 |

$77,600 |

$60,200 |

$0 |

$137,800 |

$0 |

$0 |

$0 |

$244,600 |

| 2020 |

$50,600 |

$56,200 |

$0 |

$106,800 |

$77,600 |

$60,200 |

$0 |

$137,800 |

$0 |

$0 |

$0 |

$244,600 |

| 2019 |

$45,900 |

$51,100 |

$0 |

$97,000 |

$72,700 |

$60,200 |

$0 |

$132,900 |

$0 |

$0 |

$0 |

$229,900 |

| 2018 |

$43,800 |

$48,700 |

$0 |

$92,500 |

$72,700 |

$56,300 |

$0 |

$129,000 |

$0 |

$0 |

$0 |

$221,500 |

| 2017 |

$41,700 |

$46,400 |

$0 |

$88,100 |

$66,200 |

$57,200 |

$0 |

$123,400 |

$0 |

$0 |

$0 |

$211,500 |

| 2016 |

$39,800 |

$44,200 |

$0 |

$84,000 |

$62,400 |

$53,900 |

$0 |

$116,300 |

$0 |

$0 |

$0 |

$200,300 |

| 2015 |

$37,900 |

$42,100 |

$0 |

$80,000 |

$66,700 |

$49,400 |

$0 |

$116,100 |

$0 |

$0 |

$0 |

$196,100 |

| 2014 |

$0 |

$53,500 |

$0 |

$53,500 |

$0 |

$103,700 |

$0 |

$103,700 |

$0 |

$0 |

$0 |

$157,200 |

| 2013 |

$0 |

$48,600 |

$0 |

$48,600 |

$0 |

$122,200 |

$0 |

$122,200 |

$0 |

$0 |

$0 |

$170,800 |

| 2012 |

$0 |

$45,000 |

$0 |

$45,000 |

$0 |

$114,300 |

$0 |

$114,300 |

$0 |

$0 |

$0 |

$159,300 |

| 2011 |

$0 |

$45,000 |

$0 |

$45,000 |

$0 |

$119,200 |

$0 |

$119,200 |

$0 |

$0 |

$0 |

$164,200 |

| 2010 |

$0 |

$50,000 |

$0 |

$50,000 |

$0 |

$117,580 |

$0 |

$117,580 |

$0 |

$0 |

$0 |

$167,580 |

| 2009 |

$0 |

$71,400 |

$0 |

$71,400 |

$0 |

$99,600 |

$0 |

$99,600 |

$0 |

$0 |

$0 |

$171,000 |

| 2008 |

$0 |

$80,200 |

$0 |

$80,200 |

$0 |

$108,000 |

$0 |

$108,000 |

$0 |

$0 |

$0 |

$188,200 |

| 2007 |

$0 |

$84,400 |

$0 |

$84,400 |

$0 |

$113,700 |

$0 |

$113,700 |

$0 |

$0 |

$0 |

$198,100 |

| 2006 |

$0 |

$46,500 |

$0 |

$46,500 |

$0 |

$92,100 |

$0 |

$92,100 |

$0 |

$0 |

$0 |

$138,600 |

| 2005 |

$0 |

$46,530 |

$0 |

$46,530 |

$0 |

$85,417 |

$0 |

$85,417 |

$0 |

$0 |

$0 |

$131,947 |

| 2004 |

$0 |

$46,530 |

$0 |

$46,530 |

$0 |

$85,417 |

$0 |

$85,417 |

$0 |

$0 |

$0 |

$131,947 |

| 2003 |

$0 |

$46,530 |

$0 |

$46,530 |

$0 |

$85,417 |

$0 |

$85,417 |

$0 |

$0 |

$0 |

$131,947 |

| 2002 |

$0 |

$46,530 |

$0 |

$46,530 |

$0 |

$85,417 |

$0 |

$85,417 |

$0 |

$0 |

$0 |

$131,947 |

| 2001 |

$0 |

$46,530 |

$0 |

$46,530 |

$0 |

$85,417 |

$0 |

$85,417 |

$0 |

$0 |

$0 |

$131,947 |

| 2000 |

$0 |

$43,486 |

$0 |

$43,486 |

$0 |

$74,327 |

$0 |

$74,327 |

$0 |

$0 |

$0 |

$117,813 |

| 1999 |

$0 |

$43,486 |

$0 |

$43,486 |

$0 |

$74,327 |

$0 |

$74,327 |

$0 |

$0 |

$0 |

$117,813 |

| 1998 |

$0 |

$38,483 |

$0 |

$38,483 |

$0 |

$65,776 |

$0 |

$65,776 |

$0 |

$0 |

$0 |

$104,259 |

| 1997 |

$0 |

$38,483 |

$0 |

$38,483 |

$0 |

$65,776 |

$0 |

$65,776 |

$0 |

$0 |

$0 |

$104,259 |

| 1996 |

$0 |

$31,087 |

$0 |

$31,087 |

$0 |

$53,135 |

$0 |

$53,135 |

$0 |

$0 |

$0 |

$84,222 |

| 1995 |

$0 |

$28,261 |

$0 |

$28,261 |

$0 |

$53,135 |

$0 |

$53,135 |

$0 |

$0 |

$0 |

$81,396 |

| 1994 |

$0 |

$16,527 |

$0 |

$16,527 |

$0 |

$42,851 |

$0 |

$42,851 |

$0 |

$0 |

$0 |

$59,378 |

| 1993 |

$0 |

$16,527 |

$0 |

$16,527 |

$0 |

$42,851 |

$0 |

$42,851 |

$0 |

$0 |

$0 |

$59,378 |

| 1992 |

$0 |

$15,162 |

$0 |

$15,162 |

$0 |

$39,313 |

$0 |

$39,313 |

$0 |

$0 |

$0 |

$54,475 |

| 1991 |

$0 |

$13,300 |

$0 |

$13,300 |

$0 |

$31,040 |

$0 |

$31,040 |

$0 |

$0 |

$0 |

$44,340 |

| 1990 |

$0 |

$13,300 |

$0 |

$13,300 |

$0 |

$31,040 |

$0 |

$31,040 |

$0 |

$0 |

$0 |

$44,340 |

| 1989 |

$0 |

$13,300 |

$0 |

$13,300 |

$0 |

$31,040 |

$0 |

$31,040 |

$0 |

$0 |

$0 |

$44,340 |

| 1988 |

$0 |

$13,300 |

$0 |

$13,300 |

$0 |

$42,245 |

$0 |

$42,245 |

$0 |

$0 |

$0 |

$55,545 |

| 1987 |

$0 |

$13,300 |

$0 |

$13,300 |

$0 |

$36,733 |

$0 |

$36,733 |

$0 |

$0 |

$0 |

$50,033 |

| 1986 |

$0 |

$13,300 |

$0 |

$13,300 |

$0 |

$36,734 |

$0 |

$36,734 |

$0 |

$0 |

$0 |

$50,034 |

| 1985 |

$0 |

$13,300 |

$0 |

$13,300 |

$0 |

$36,733 |

$0 |

$36,733 |

$0 |

$0 |

$0 |

$50,033 |

| 1984 |

$0 |

$13,433 |

$0 |

$13,433 |

$0 |

$37,108 |

$0 |

$37,108 |

$0 |

$0 |

$0 |

$50,541 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2024 |

$1,767.15 |

$0.00 |

$1,767.15 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2023 |

$3,185.92 |

($1,433.66) |

$1,752.26 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2022 |

$3,408.11 |

$0.00 |

$3,408.11 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2021 |

$1,924.70 |

$0.00 |

$1,924.70 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2020 |

$1,984.48 |

$0.00 |

$1,984.48 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2019 |

$1,794.91 |

$0.00 |

$1,794.91 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2018 |

$1,819.17 |

$0.00 |

$1,819.17 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2017 |

$1,754.16 |

$0.00 |

$1,754.16 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2016 |

$1,788.13 |

$0.00 |

$1,788.13 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2015 |

$1,869.33 |

$0.00 |

$1,869.33 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2014 |

$1,057.58 |

$0.00 |

$1,057.58 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2013 |

$1,238.32 |

$0.00 |

$1,238.32 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2012 |

$1,178.25 |

$0.00 |

$1,178.25 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2011 |

$1,211.24 |

$0.00 |

$1,211.24 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2010 |

$1,160.50 |

$0.00 |

$1,160.50 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2009 |

$1,090.13 |

$0.00 |

$1,090.13 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2008 |

$1,127.84 |

$0.00 |

$1,127.84 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2007 |

$1,141.19 |

$0.00 |

$1,141.19 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2006 |

$858.43 |

$0.00 |

$858.43 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2005 |

$884.06 |

$0.00 |

$884.06 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2004 |

$887.54 |

$0.00 |

$887.54 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2003 |

$873.32 |

$0.00 |

$873.32 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2002 |

$805.97 |

$0.00 |

$805.97 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2001 |

$776.07 |

$0.00 |

$776.07 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2000 |

$720.22 |

$0.00 |

$720.22 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1999 |

$728.64 |

$0.00 |

$728.64 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1998 |

$630.89 |

$0.00 |

$630.89 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1997 |

$631.81 |

$0.00 |

$631.81 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1996 |

$485.64 |

$0.00 |

$485.64 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1995 |

$524.46 |

$0.00 |

$524.46 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1994 |

$603.11 |

$0.00 |

$603.11 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1993 |

$535.00 |

$0.00 |

$535.00 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1992 |

$506.11 |

$0.00 |

$506.11 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1991 |

$402.26 |

$0.00 |

$402.26 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1990 |

$385.89 |

$0.00 |

$385.89 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1989 |

$393.31 |

$0.00 |

$393.31 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1988 |

$490.11 |

$0.00 |

$490.11 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1987 |

$436.67 |

$0.00 |

$436.67 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1986 |

$430.07 |

$0.00 |

$430.07 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1985 |

$432.23 |

$0.00 |

$432.23 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 1984 |

$416.12 |

$0.00 |

$416.12 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 88112-2022 |

08/05/2022 |

08/05/2022 |

D TR |

EGBERT, CRAIG E JR (ET AL) |

DIRECT MORTGAGE CORP |

| 88111-2022 |

08/03/2022 |

08/05/2022 |

WD |

TERESA'S DIAMOND LLC |

EGBERT, CRAIG E JR (ET AL) |

| 55800-2021 |

03/12/2021 |

03/25/2021 |

QCD |

EGBERT, NORMA & NORMA T |

EGBERT, NORMA T TEE (ET AL) |

| 75408-2020 |

06/02/2020 |

06/02/2020 |

SP WD |

EGBERT, NORMA |

TERESA'S DIAMOND LLC |

| 75407-2020 |

06/19/2020 |

06/02/2020 |

SP WD |

EGBERT, NORMA |

NORMA'S DIAMOND LLC |

| 24372-2020 |

01/30/2020 |

02/26/2020 |

ACK |

EGBERT, NORMA TERESA |

WHOM OF INTEREST |

| 24361-2020 |

11/26/2019 |

02/26/2020 |

AGR |

EGBERT, NORMA |

AMERICAN FORK CITY |

| 80192-2014 |

11/06/2014 |

11/06/2014 |

REC |

SELECT TITLE INSURANCE AGENCY INC TEE |

EGBERT, NORMA |

| 51302-2013 |

05/13/2013 |

05/24/2013 |

TR D |

EGBERT, NORMA |

MENESES, ISRAEL & AMELIA |

| 51301-2013 |

05/09/2013 |

05/24/2013 |

WD |

MENESES, ISRAEL & AMELIA |

EGBERT, NORMA |

| 35404-2012 |

04/27/2012 |

04/30/2012 |

SP WD |

DYNAMIC CAPITAL LLC |

MENESES, ISRAEL & AMELIA |

| 11080-2012 |

02/10/2012 |

02/10/2012 |

WD |

CHRISTENSEN, PETER D |

DYNAMIC CAPITAL LLC |

| 28961-2011 |

04/12/2011 |

04/14/2011 |

WD |

BATE, RONALD H & ROBERT T SUCTEE (ET AL) |

CHRISTENSEN, PETER D |

| 28960-2011 |

04/11/2011 |

04/14/2011 |

AF DC |

BATE, RONALD HERBERT & RONALD AKA |

WHOM OF INTEREST |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 3370-1999 |

12/20/1998 |

01/12/1999 |

AF DC |

BATE, RONALD H DEC |

BATE, HELEN & HELEN T AKA (ET AL) |

| 76846-1995 |

11/06/1995 |

11/08/1995 |

RESOL |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/25/2024 9:05:56 PM |