Property Information

mobile view

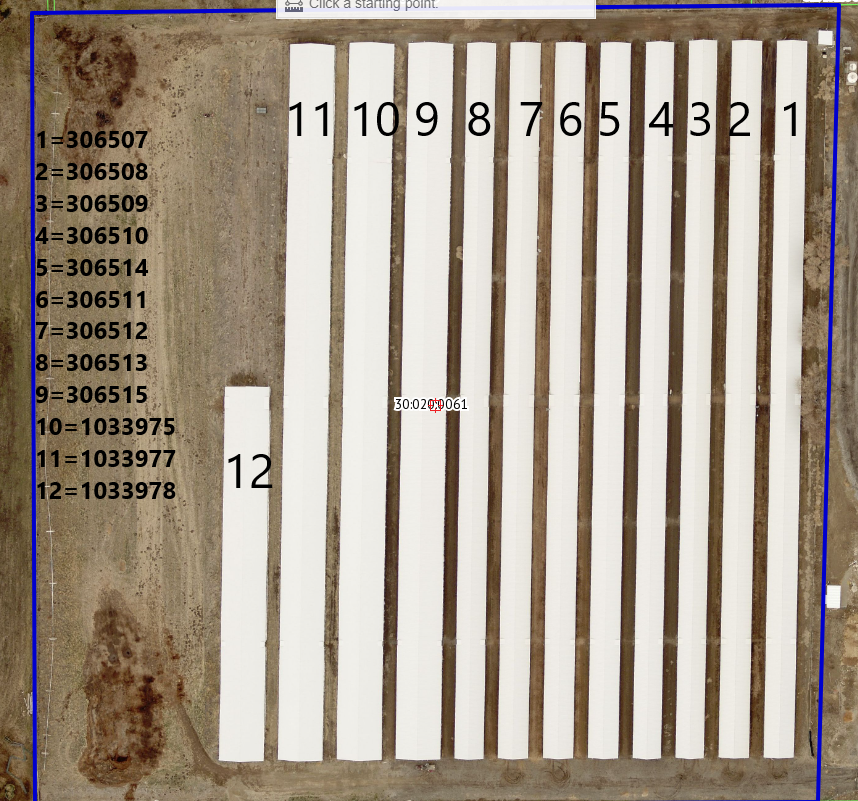

| Serial Number: 30:020:0061 |

Serial Life: 2013... |

|

|

Total Photos: 2

Total Photos: 2

|

| |

|

|

| Property Address: |

|

| Mailing Address: 1078 S 830 W PAYSON, UT 84651-3120 |

|

| Acreage: 8.262185 |

|

| Last Document:

21547-2012

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM N 1214.7 FT & E 201.53 FT FR W 1/4 COR. SEC. 7, T9S, R2E, SLB&M.; N 89 DEG 26' 54" E 270.86 FT; N 89 DEG 38' 38" E 327.8 FT; N 89 DEG 46' 22" E 10.01 FT; S 1 DEG 39' 3" W 601.87 FT; S 89 DEG 52' 54" W 591.45 FT; N 0 DEG 0' 46" E 598.16 FT TO BEG. AREA 8.262 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$0 |

$369,000 |

$369,000 |

$0 |

$0 |

$494,900 |

$494,900 |

$3,882 |

$0 |

$3,882 |

$863,900 |

| 2023 |

$0 |

$0 |

$369,000 |

$369,000 |

$0 |

$0 |

$494,900 |

$494,900 |

$3,560 |

$0 |

$3,560 |

$863,900 |

| 2022 |

$0 |

$0 |

$393,400 |

$393,400 |

$0 |

$0 |

$372,500 |

$372,500 |

$3,601 |

$0 |

$3,601 |

$765,900 |

| 2021 |

$0 |

$0 |

$231,400 |

$231,400 |

$0 |

$0 |

$338,600 |

$338,600 |

$3,527 |

$0 |

$3,527 |

$570,000 |

| 2020 |

$0 |

$0 |

$206,600 |

$206,600 |

$0 |

$0 |

$338,600 |

$338,600 |

$3,502 |

$0 |

$3,502 |

$545,200 |

| 2019 |

$0 |

$0 |

$140,500 |

$140,500 |

$0 |

$0 |

$338,600 |

$338,600 |

$3,511 |

$0 |

$3,511 |

$479,100 |

| 2018 |

$0 |

$0 |

$140,500 |

$140,500 |

$0 |

$0 |

$325,500 |

$325,500 |

$3,915 |

$0 |

$3,915 |

$466,000 |

| 2017 |

$0 |

$0 |

$140,500 |

$140,500 |

$0 |

$0 |

$105,600 |

$105,600 |

$4,105 |

$0 |

$4,105 |

$246,100 |

| 2016 |

$0 |

$0 |

$140,500 |

$140,500 |

$0 |

$0 |

$122,000 |

$122,000 |

$4,023 |

$0 |

$4,023 |

$262,500 |

| 2015 |

$0 |

$0 |

$140,500 |

$140,500 |

$0 |

$0 |

$122,000 |

$122,000 |

$3,998 |

$0 |

$3,998 |

$262,500 |

| 2014 |

$0 |

$0 |

$140,500 |

$140,500 |

$0 |

$0 |

$122,000 |

$122,000 |

$4,138 |

$0 |

$4,138 |

$262,500 |

| 2013 |

$0 |

$148,700 |

$0 |

$148,700 |

$0 |

$0 |

$0 |

$0 |

$4,386 |

$0 |

$4,386 |

$148,700 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2024 |

$4,989.82 |

$0.00 |

$4,989.82 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2023 |

$4,982.61 |

$0.00 |

$4,982.61 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2022 |

$3,828.33 |

$0.00 |

$3,828.33 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2021 |

$4,054.89 |

$0.00 |

$4,054.89 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2020 |

$4,176.04 |

$0.00 |

$4,176.04 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2019 |

$4,092.67 |

$0.00 |

$4,092.67 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2018 |

$4,119.01 |

$0.00 |

$4,119.01 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2017 |

$1,411.03 |

$0.00 |

$1,411.03 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2016 |

$1,671.82 |

$0.00 |

$1,671.82 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2015 |

$1,685.60 |

$0.00 |

$1,685.60 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2014 |

$4,490.49 |

($2,803.90) |

$1,686.59 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2013 |

$61.00 |

$0.00 |

$61.00 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 51087-2024 |

07/31/2024 |

07/31/2024 |

D TR |

BECKSTEAD, MAX ZACHARY |

UNITED STATES DEPARTMENT OF AGRICULTURE BY (ET AL) |

| 8026-2023 |

02/08/2023 |

02/09/2023 |

RC |

FARM SERVICE AGENCY |

WHOM OF INTEREST |

| 8025-2023 |

02/08/2023 |

02/09/2023 |

D TR |

BECKSTEAD, MAX ZACHARY |

UNITED STATES DEPARTMENT OF AGRICULTURE |

| 100741-2021 |

05/28/2021 |

06/01/2021 |

FARM |

BECKSTEAD, MAX ZACHARY |

WHOM OF INTEREST |

| 201449-2020 |

12/17/2020 |

12/17/2020 |

TR D |

BECKSTEAD, MAX ZACHARY |

UTAH DEPARTMENT OF AGRICULTURE & FOOD/UTAH RURAL REHAB LOAN PROGRAM |

| 129537-2020 |

08/25/2020 |

08/27/2020 |

WD |

BECKSTEAD, BRENT E & JAN TEE (ET AL) |

BECKSTEAD, MAX ZACHARY |

| 139201-2019 |

12/30/2019 |

12/30/2019 |

D TR |

BECKSTEAD, BRENT E & JAN TEE (ET AL) |

WESTERN AGCREDIT |

| 37133-2017 |

04/18/2017 |

04/18/2017 |

N |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 7042-2015 |

01/26/2015 |

01/29/2015 |

REC |

CENTRAL BANK COMPANY TEE |

WHITING, DAN & T DAN (ET AL) |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 517-2013 |

01/02/2013 |

01/03/2013 |

FARM |

BECKSTEAD, BRENT E & JAN TEE |

WHOM OF INTEREST |

| 21547-2012 |

01/31/2012 |

03/19/2012 |

S PLAT |

BECKSTEAD, BRENT E & JAN TEE (ET AL) |

B BECKSTEAD PLAT A |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 3/28/2025 10:05:09 AM |