Property Information

mobile view

| Serial Number: 38:310:0050 |

Serial Life: 2002... |

|

|

Total Photos: 2

Total Photos: 2

|

| |

|

|

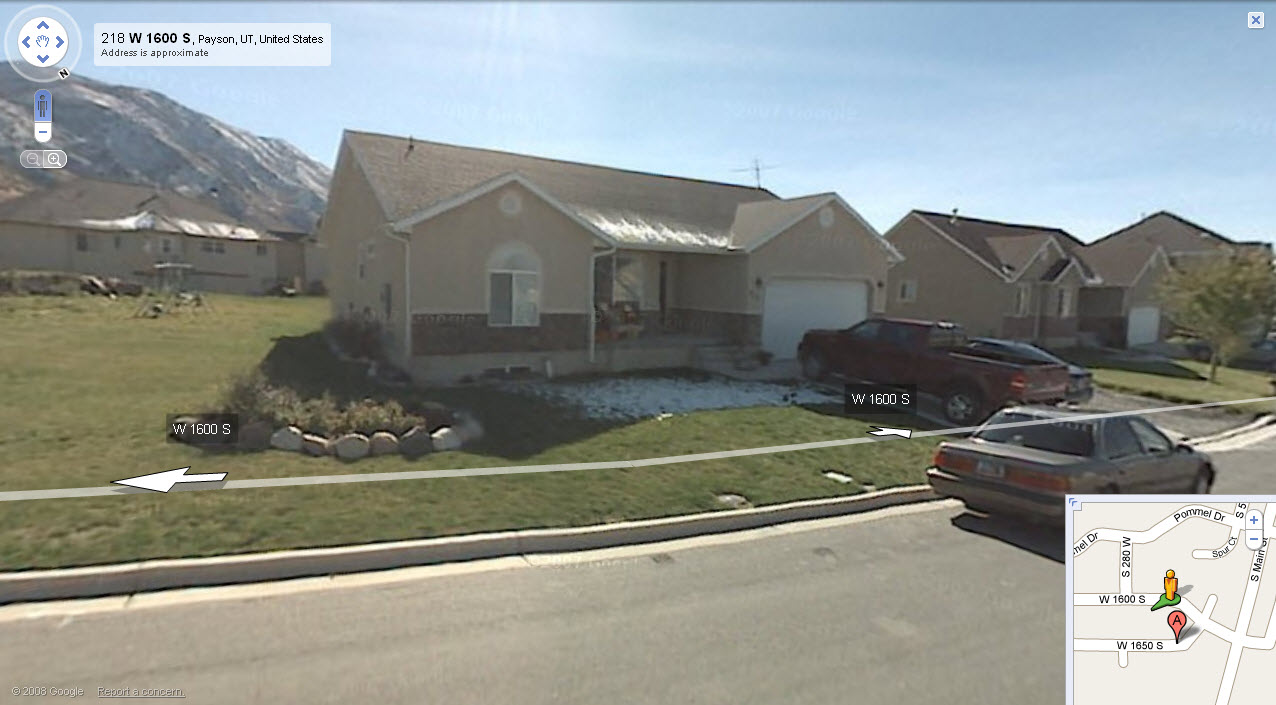

| Property Address: 213 W 1600 SOUTH - PAYSON |

|

| Mailing Address: 213 W 1600 S PAYSON, UT 84651-8615 |

|

| Acreage: 0.247 |

|

| Last Document:

52161-2001

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 50, PLAT B, EAST HILL ESTATES SUBDV. AREA 0.247 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$154,000 |

$0 |

$154,000 |

$0 |

$299,800 |

$0 |

$299,800 |

$0 |

$0 |

$0 |

$453,800 |

| 2023 |

$0 |

$154,000 |

$0 |

$154,000 |

$0 |

$302,900 |

$0 |

$302,900 |

$0 |

$0 |

$0 |

$456,900 |

| 2022 |

$0 |

$164,200 |

$0 |

$164,200 |

$0 |

$289,800 |

$0 |

$289,800 |

$0 |

$0 |

$0 |

$454,000 |

| 2021 |

$0 |

$117,300 |

$0 |

$117,300 |

$0 |

$221,200 |

$0 |

$221,200 |

$0 |

$0 |

$0 |

$338,500 |

| 2020 |

$0 |

$106,600 |

$0 |

$106,600 |

$0 |

$207,100 |

$0 |

$207,100 |

$0 |

$0 |

$0 |

$313,700 |

| 2019 |

$0 |

$88,200 |

$0 |

$88,200 |

$0 |

$206,200 |

$0 |

$206,200 |

$0 |

$0 |

$0 |

$294,400 |

| 2018 |

$0 |

$77,200 |

$0 |

$77,200 |

$0 |

$189,700 |

$0 |

$189,700 |

$0 |

$0 |

$0 |

$266,900 |

| 2017 |

$0 |

$69,800 |

$0 |

$69,800 |

$0 |

$176,000 |

$0 |

$176,000 |

$0 |

$0 |

$0 |

$245,800 |

| 2016 |

$0 |

$62,500 |

$0 |

$62,500 |

$0 |

$171,200 |

$0 |

$171,200 |

$0 |

$0 |

$0 |

$233,700 |

| 2015 |

$0 |

$55,100 |

$0 |

$55,100 |

$0 |

$169,200 |

$0 |

$169,200 |

$0 |

$0 |

$0 |

$224,300 |

| 2014 |

$0 |

$51,500 |

$0 |

$51,500 |

$0 |

$156,100 |

$0 |

$156,100 |

$0 |

$0 |

$0 |

$207,600 |

| 2013 |

$0 |

$44,000 |

$0 |

$44,000 |

$0 |

$150,500 |

$0 |

$150,500 |

$0 |

$0 |

$0 |

$194,500 |

| 2012 |

$0 |

$47,500 |

$0 |

$47,500 |

$0 |

$171,000 |

$0 |

$171,000 |

$0 |

$0 |

$0 |

$218,500 |

| 2011 |

$0 |

$38,300 |

$0 |

$38,300 |

$0 |

$121,200 |

$0 |

$121,200 |

$0 |

$0 |

$0 |

$159,500 |

| 2010 |

$0 |

$57,200 |

$0 |

$57,200 |

$0 |

$112,379 |

$0 |

$112,379 |

$0 |

$0 |

$0 |

$169,579 |

| 2009 |

$0 |

$57,200 |

$0 |

$57,200 |

$0 |

$116,700 |

$0 |

$116,700 |

$0 |

$0 |

$0 |

$173,900 |

| 2008 |

$0 |

$57,200 |

$0 |

$57,200 |

$0 |

$148,800 |

$0 |

$148,800 |

$0 |

$0 |

$0 |

$206,000 |

| 2007 |

$0 |

$59,000 |

$0 |

$59,000 |

$0 |

$153,400 |

$0 |

$153,400 |

$0 |

$0 |

$0 |

$212,400 |

| 2006 |

$0 |

$46,000 |

$0 |

$46,000 |

$0 |

$115,000 |

$0 |

$115,000 |

$0 |

$0 |

$0 |

$161,000 |

| 2005 |

$0 |

$35,747 |

$0 |

$35,747 |

$0 |

$102,830 |

$0 |

$102,830 |

$0 |

$0 |

$0 |

$138,577 |

| 2004 |

$0 |

$35,747 |

$0 |

$35,747 |

$0 |

$102,830 |

$0 |

$102,830 |

$0 |

$0 |

$0 |

$138,577 |

| 2003 |

$0 |

$35,747 |

$0 |

$35,747 |

$0 |

$97,712 |

$0 |

$97,712 |

$0 |

$0 |

$0 |

$133,459 |

| 2002 |

$0 |

$35,747 |

$0 |

$35,747 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$35,747 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2024 |

$2,452.47 |

$0.00 |

$2,452.47 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2023 |

$2,462.44 |

$0.00 |

$2,462.44 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2022 |

$2,487.76 |

$0.00 |

$2,487.76 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2021 |

$2,102.66 |

$0.00 |

$2,102.66 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2020 |

$1,991.74 |

$0.00 |

$1,991.74 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2019 |

$1,823.22 |

$0.00 |

$1,823.22 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2018 |

$1,715.01 |

$0.00 |

$1,715.01 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2017 |

$1,615.11 |

$0.00 |

$1,615.11 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2016 |

$1,545.76 |

$0.00 |

$1,545.76 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2015 |

$1,493.83 |

$0.00 |

$1,493.83 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2014 |

$1,372.67 |

$0.00 |

$1,372.67 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2013 |

$1,346.17 |

$0.00 |

$1,346.17 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2012 |

$1,535.12 |

$0.00 |

$1,535.12 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2011 |

$1,094.02 |

$0.00 |

$1,094.02 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2010 |

$1,134.14 |

$0.00 |

$1,134.14 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2009 |

$1,101.54 |

$0.00 |

$1,101.54 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2008 |

$1,213.78 |

$0.00 |

$1,213.78 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2007 |

$1,241.33 |

$0.00 |

$1,241.33 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2006 |

$1,045.51 |

$0.00 |

$1,045.51 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2005 |

$957.98 |

$0.00 |

$957.98 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2004 |

$960.65 |

$0.00 |

$960.65 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2003 |

$839.73 |

$0.00 |

$839.73 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2002 |

$399.15 |

$0.00 |

$399.15 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 36317-2021 |

02/15/2021 |

02/26/2021 |

RSUBTEE |

SECURITY SERVICE FEDERAL CREDIT UNION (ET AL) |

ANDERSON, DAVID KENT & KRISTY RENEE |

| 161388-2020 |

10/15/2020 |

10/16/2020 |

RSUBTEE |

WELLS FARGO BANK (ET AL) |

ANDERSON, DAVID KENT & KRISTY RENEE |

| 148327-2020 |

09/23/2020 |

09/28/2020 |

D TR |

ANDERSON, KRISTY RENEE & DAVID KENT |

SECURITY SERVICE FEDERAL CREDIT UNION |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 47837-2014 |

03/20/2014 |

07/11/2014 |

WATERAG |

ANDERSON, DAVID KENT & KRISTY RENEE |

STRAWBERRY WATER USERS ASSOCIATION (ET AL) |

| 118770-2009 |

11/04/2009 |

11/16/2009 |

REC |

WELLS FARGO FINANCIAL NATIONAL BANK TEE |

ANDERSON, DAVID KENT & KRISTY RENEE |

| 118769-2009 |

11/04/2009 |

11/16/2009 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

WELLS FARGO FINANCIAL NATIONAL BANK SUCTEE |

| 109346-2009 |

09/29/2009 |

10/16/2009 |

SUB AGR |

FAMILY FIRST FEDERAL CREDIT UNION |

WELLS FARGO BANK |

| 109345-2009 |

10/12/2009 |

10/16/2009 |

D TR |

ANDERSON, DAVID KENT & KRISTY RENEE |

WELLS FARGO BANK |

| 70105-2009 |

06/24/2009 |

06/25/2009 |

REC |

BONNEVILLE SUPERIOR TITLE COMPANY |

PETERSON, RANDELL SCOTT & ALISHA ANN |

| 70104-2009 |

06/24/2009 |

06/25/2009 |

REC |

BONNEVILLE SUPERIOR TITLE COMPANY |

PETERSON, RANDELL SCOTT & ALISHA ANN |

| 70103-2009 |

06/24/2009 |

06/25/2009 |

REC |

BONNEVILLE SUPERIOR TITLE COMPANY |

PETERSON, RANDELL SCOTT & ALISHA ANN |

| 38215-2009 |

03/31/2009 |

04/10/2009 |

RSUBTEE |

HOUSING ASSISTANCE COUNCIL (ET AL) |

HOUSING ASSISTANCE COUNCIL |

| 34974-2009 |

04/01/2009 |

04/02/2009 |

RSUBTEE |

UTAH VALLEY CONSORTIAM (SIC) OF CITIES AND COUNTIES (ET AL) |

RURAL HOUSING DEVELOPMENT CORPORATION |

| 127460-2008 |

12/03/2008 |

12/04/2008 |

RC |

FAMILY FIRST FEDERAL CREDIT UNION |

WHOM OF INTEREST |

| 127459-2008 |

11/28/2008 |

12/04/2008 |

D TR |

ANDERSON, DAVID KENT & KRISTY RENEE |

FAMILY FIRST FEDERAL CREDIT UNION |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 159367-2007 |

10/10/2007 |

11/08/2007 |

REC |

BACKMAN TITLE SERVICES LTD TEE BY (ET AL) |

ANDERSON, DAVID KENT & KRISTY RENEE |

| 159366-2007 |

10/04/2007 |

11/08/2007 |

SUB TEE |

RURAL HOUSING DEVELOPMENT CORPORATION INC |

BACKMAN TITLE SERVICES LTD TEE |

| 113005-2007 |

02/21/2007 |

08/03/2007 |

REC |

US DEPARTMENT OF AGRICULTURE RURAL DEVELOPMENT |

ANDERSON, DAVID KENT & KRISTY RENEE |

| 84163-2007 |

05/25/2007 |

06/08/2007 |

REC |

CENTURY TITLE COMPANY TEE |

ANDERSON, DAVID KENT & KRISTY RENEE |

| 18444-2007 |

02/01/2007 |

02/06/2007 |

REC |

BANK OF AMERICAN FORK TEE |

ANDERSON, DAVID KENT & KRISTY RENEE |

| 10419-2007 |

01/16/2007 |

01/22/2007 |

D TR |

ANDERSON, DAVID KENT & KRISTY RENEE |

TAYLOR BEAN & WHITAKER MORTGAGE CORP |

| 151680-2002 |

10/31/2002 |

12/13/2002 |

REC |

BARNES BANKING COMPANY TEE |

BART SMITH FAMILY INVESTMENTS LLC |

| 117570-2001 |

11/07/2001 |

11/14/2001 |

P REC |

BARNES BANKING COMPANY TEE |

BART SMITH FAMILY INVESTMENTS LLC |

| 116584-2001 |

11/07/2001 |

11/09/2001 |

TR D |

ANDERSON, DAVID KENT & KRISTY RENEE |

STATE OF UTAH OLENE WALKER HOUSING TRUST FUND |

| 116583-2001 |

11/07/2001 |

11/09/2001 |

TR D |

ANDERSON, DAVID KENT & KRISTY RENEE |

RURAL HOUSING DEVELOPMENT CORPORATION INC |

| 116582-2001 |

11/07/2001 |

11/09/2001 |

D TR |

ANDERSON, DAVID KENT & KRISTY RENEE |

RURAL HOUSING SERVICE (ET AL) |

| 116581-2001 |

11/07/2001 |

11/09/2001 |

D TR |

ANDERSON, DAVID KENT & KRISTY RENEE |

BANK OF AMERICAN FORK |

| 116580-2001 |

11/07/2001 |

11/09/2001 |

WD |

RURAL HOUSING DEVELOPMENT CORPORATION |

ANDERSON, DAVID KENT & KRISTY RENEE |

| 112532-2001 |

10/29/2001 |

11/01/2001 |

S TR D |

RURAL HOUSING DEVELOPMENT CORPORATION |

UTAH VALLEY CONSORTIUM OF CITES (SIC) AND COUNTIES |

| 112531-2001 |

10/29/2001 |

11/01/2001 |

TR D |

RURAL HOUSING DEVELOPMENT CORPORATION INC |

HOUSING ASSISTANCE COUNCIL |

| 110456-2001 |

10/04/2001 |

10/29/2001 |

WD |

BART SMITH FAMILY INVESTMENTS LLC |

RURAL HOUSING DEVELOPMENT CORPORATION |

| 54175-2001 |

05/30/2001 |

06/04/2001 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 52163-2001 |

05/17/2001 |

05/30/2001 |

PRO COV |

BART SMITH FAMILY INVESTMENTS LLC |

WHOM OF INTEREST |

| 52162-2001 |

05/17/2001 |

05/30/2001 |

AGR |

BART K SMITH FAMILY LLC |

PAYSON CITY |

| 52161-2001 |

08/18/1999 |

05/30/2001 |

S PLAT |

BART SMITH FAMILY INVESTMENTS LLC |

EAST HILL ESTATES PLAT B |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 1/11/2025 2:03:56 AM |