Property Information

mobile view

| Serial Number: 46:110:0003 |

Serial Life: 1981... |

|

|

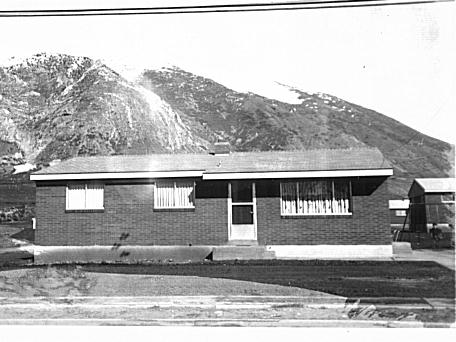

Total Photos: 1

Total Photos: 1

|

| |

|

|

| Property Address: 520 N 100 EAST - SPRINGVILLE |

|

| Mailing Address: 2915 E HALE ST MESA, AZ 85213 |

|

| Acreage: 0.19 |

|

| Last Document:

106567-2020

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM AT NE COR, LOT 3, MT VISTA SUBD, PLAT A; SPRINGVILLE; W 100 FT; S 1 11' W 80 FT; S 88 34'E 101.68 FT; N 82.55 FT TO BEG.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| 2021... |

|

KIENE LIVING TRUST 12-01-2008 |

|

| 2021... |

|

KIENE, BRUCE PAUL |

|

| 2021... |

|

KIENE, MARY PETERSON |

|

| 2019-2020 |

|

KIENE, BRUCE |

|

| 2019-2020 |

|

KIENE, MARY |

|

| 2019NV |

|

KIENE, BRUCE |

|

| 2016-2018 |

|

BRENT & JANIE JOHNSON FAMILY TRUST NOVEMBER 25 2015 |

|

| 2016-2018 |

|

JOHNSON, BRENT |

|

| 2016-2018 |

|

JOHNSON, JANIE |

|

| 1995-2015 |

|

JOHNSON, BRENT |

|

| 1995-2015 |

|

JOHNSON, LOIS JANIE |

|

| 1993-1994 |

|

JONES, PAULA O |

|

| 1993-1994 |

|

OLDROYD, GLENNA O |

|

| 1982-1992 |

|

PETT, DAVID M |

|

| 1982-1992 |

|

PETT, LOYAL L |

|

| 1981 |

|

PETT, DAVID M |

|

| 1981 |

|

PETT, LOYAL L |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$148,900 |

$0 |

$148,900 |

$0 |

$241,900 |

$0 |

$241,900 |

$0 |

$0 |

$0 |

$390,800 |

| 2023 |

$0 |

$148,900 |

$0 |

$148,900 |

$0 |

$226,500 |

$0 |

$226,500 |

$0 |

$0 |

$0 |

$375,400 |

| 2022 |

$0 |

$151,900 |

$0 |

$151,900 |

$0 |

$220,400 |

$0 |

$220,400 |

$0 |

$0 |

$0 |

$372,300 |

| 2021 |

$0 |

$112,500 |

$0 |

$112,500 |

$0 |

$169,500 |

$0 |

$169,500 |

$0 |

$0 |

$0 |

$282,000 |

| 2020 |

$0 |

$83,300 |

$0 |

$83,300 |

$0 |

$161,300 |

$0 |

$161,300 |

$0 |

$0 |

$0 |

$244,600 |

| 2019 |

$0 |

$69,400 |

$0 |

$69,400 |

$0 |

$158,700 |

$0 |

$158,700 |

$0 |

$0 |

$0 |

$228,100 |

| 2018 |

$0 |

$64,500 |

$0 |

$64,500 |

$0 |

$143,600 |

$0 |

$143,600 |

$0 |

$0 |

$0 |

$208,100 |

| 2017 |

$0 |

$57,600 |

$0 |

$57,600 |

$0 |

$124,900 |

$0 |

$124,900 |

$0 |

$0 |

$0 |

$182,500 |

| 2016 |

$0 |

$57,600 |

$0 |

$57,600 |

$0 |

$109,500 |

$0 |

$109,500 |

$0 |

$0 |

$0 |

$167,100 |

| 2015 |

$0 |

$57,600 |

$0 |

$57,600 |

$0 |

$107,200 |

$0 |

$107,200 |

$0 |

$0 |

$0 |

$164,800 |

| 2014 |

$0 |

$53,400 |

$0 |

$53,400 |

$0 |

$97,500 |

$0 |

$97,500 |

$0 |

$0 |

$0 |

$150,900 |

| 2013 |

$0 |

$39,600 |

$0 |

$39,600 |

$0 |

$97,500 |

$0 |

$97,500 |

$0 |

$0 |

$0 |

$137,100 |

| 2012 |

$0 |

$36,700 |

$0 |

$36,700 |

$0 |

$103,600 |

$0 |

$103,600 |

$0 |

$0 |

$0 |

$140,300 |

| 2011 |

$0 |

$36,700 |

$0 |

$36,700 |

$0 |

$111,700 |

$0 |

$111,700 |

$0 |

$0 |

$0 |

$148,400 |

| 2010 |

$0 |

$35,000 |

$0 |

$35,000 |

$0 |

$122,648 |

$0 |

$122,648 |

$0 |

$0 |

$0 |

$157,648 |

| 2009 |

$0 |

$41,400 |

$0 |

$41,400 |

$0 |

$119,400 |

$0 |

$119,400 |

$0 |

$0 |

$0 |

$160,800 |

| 2008 |

$0 |

$59,100 |

$0 |

$59,100 |

$0 |

$103,600 |

$0 |

$103,600 |

$0 |

$0 |

$0 |

$162,700 |

| 2007 |

$0 |

$61,600 |

$0 |

$61,600 |

$0 |

$107,900 |

$0 |

$107,900 |

$0 |

$0 |

$0 |

$169,500 |

| 2006 |

$0 |

$53,600 |

$0 |

$53,600 |

$0 |

$98,100 |

$0 |

$98,100 |

$0 |

$0 |

$0 |

$151,700 |

| 2005 |

$0 |

$52,000 |

$0 |

$52,000 |

$0 |

$95,200 |

$0 |

$95,200 |

$0 |

$0 |

$0 |

$147,200 |

| 2004 |

$0 |

$52,000 |

$0 |

$52,000 |

$0 |

$95,200 |

$0 |

$95,200 |

$0 |

$0 |

$0 |

$147,200 |

| 2003 |

$0 |

$35,965 |

$0 |

$35,965 |

$0 |

$69,504 |

$0 |

$69,504 |

$0 |

$0 |

$0 |

$105,469 |

| 2002 |

$0 |

$35,965 |

$0 |

$35,965 |

$0 |

$69,504 |

$0 |

$69,504 |

$0 |

$0 |

$0 |

$105,469 |

| 2001 |

$0 |

$39,961 |

$0 |

$39,961 |

$0 |

$60,229 |

$0 |

$60,229 |

$0 |

$0 |

$0 |

$100,190 |

| 2000 |

$0 |

$37,347 |

$0 |

$37,347 |

$0 |

$53,964 |

$0 |

$53,964 |

$0 |

$0 |

$0 |

$91,311 |

| 1999 |

$0 |

$37,347 |

$0 |

$37,347 |

$0 |

$53,964 |

$0 |

$53,964 |

$0 |

$0 |

$0 |

$91,311 |

| 1998 |

$0 |

$37,347 |

$0 |

$37,347 |

$0 |

$53,964 |

$0 |

$53,964 |

$0 |

$0 |

$0 |

$91,311 |

| 1997 |

$0 |

$37,347 |

$0 |

$37,347 |

$0 |

$53,964 |

$0 |

$53,964 |

$0 |

$0 |

$0 |

$91,311 |

| 1996 |

$0 |

$31,983 |

$0 |

$31,983 |

$0 |

$46,214 |

$0 |

$46,214 |

$0 |

$0 |

$0 |

$78,197 |

| 1995 |

$0 |

$29,075 |

$0 |

$29,075 |

$0 |

$46,214 |

$0 |

$46,214 |

$0 |

$0 |

$0 |

$75,289 |

| 1994 |

$0 |

$17,003 |

$0 |

$17,003 |

$0 |

$37,269 |

$0 |

$37,269 |

$0 |

$0 |

$0 |

$54,272 |

| 1993 |

$0 |

$17,003 |

$0 |

$17,003 |

$0 |

$37,269 |

$0 |

$37,269 |

$0 |

$0 |

$0 |

$54,272 |

| 1992 |

$0 |

$15,599 |

$0 |

$15,599 |

$0 |

$34,192 |

$0 |

$34,192 |

$0 |

$0 |

$0 |

$49,791 |

| 1991 |

$0 |

$13,683 |

$0 |

$13,683 |

$0 |

$36,890 |

$0 |

$36,890 |

$0 |

$0 |

$0 |

$50,573 |

| 1990 |

$0 |

$13,683 |

$0 |

$13,683 |

$0 |

$36,890 |

$0 |

$36,890 |

$0 |

$0 |

$0 |

$50,573 |

| 1989 |

$0 |

$13,683 |

$0 |

$13,683 |

$0 |

$36,890 |

$0 |

$36,890 |

$0 |

$0 |

$0 |

$50,573 |

| 1988 |

$0 |

$13,683 |

$0 |

$13,683 |

$0 |

$38,012 |

$0 |

$38,012 |

$0 |

$0 |

$0 |

$51,695 |

| 1987 |

$0 |

$13,683 |

$0 |

$13,683 |

$0 |

$39,442 |

$0 |

$39,442 |

$0 |

$0 |

$0 |

$53,125 |

| 1986 |

$0 |

$13,684 |

$0 |

$13,684 |

$0 |

$39,442 |

$0 |

$39,442 |

$0 |

$0 |

$0 |

$53,126 |

| 1985 |

$0 |

$13,683 |

$0 |

$13,683 |

$0 |

$39,442 |

$0 |

$39,442 |

$0 |

$0 |

$0 |

$53,125 |

| 1984 |

$0 |

$13,825 |

$0 |

$13,825 |

$0 |

$39,842 |

$0 |

$39,842 |

$0 |

$0 |

$0 |

$53,667 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2024 |

$2,098.03 |

$0.00 |

$2,098.03 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2023 |

$2,013.29 |

$0.00 |

$2,013.29 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2022 |

$2,033.11 |

$0.00 |

$2,033.11 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2021 |

$1,798.85 |

$0.00 |

$1,798.85 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2020 |

$1,609.38 |

$0.00 |

$1,609.38 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2019 |

$1,474.22 |

$0.00 |

$1,474.22 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2018 |

$1,409.74 |

$0.00 |

$1,409.74 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2017 |

$1,280.18 |

$0.00 |

$1,280.18 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2016 |

$1,195.59 |

$0.00 |

$1,195.59 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2015 |

$1,153.39 |

$0.00 |

$1,153.39 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2014 |

$1,063.00 |

$0.00 |

$1,063.00 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2013 |

$1,009.67 |

$0.00 |

$1,009.67 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2012 |

$1,048.21 |

$0.00 |

$1,048.21 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2011 |

$1,081.55 |

$0.00 |

$1,081.55 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2010 |

$1,135.94 |

$0.00 |

$1,135.94 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2009 |

$1,047.31 |

$0.00 |

$1,047.31 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2008 |

$980.22 |

$0.00 |

$980.22 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2007 |

$1,012.14 |

$0.00 |

$1,012.14 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2006 |

$1,013.07 |

$0.00 |

$1,013.07 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2005 |

$1,044.30 |

$0.00 |

$1,044.30 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2004 |

$1,042.04 |

$0.00 |

$1,042.04 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2003 |

$676.61 |

$0.00 |

$676.61 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2002 |

$660.94 |

$0.00 |

$660.94 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2001 |

$642.74 |

$0.00 |

$642.74 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2000 |

$579.10 |

$0.00 |

$579.10 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1999 |

$550.62 |

$0.00 |

$550.62 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1998 |

$538.57 |

$0.00 |

$538.57 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1997 |

$598.84 |

$0.00 |

$598.84 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1996 |

$506.39 |

$0.00 |

$506.39 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1995 |

$484.78 |

$0.00 |

$484.78 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1994 |

$534.27 |

$0.00 |

$534.27 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1993 |

$485.55 |

$0.00 |

$485.55 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1992 |

$434.54 |

$0.00 |

$434.54 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1991 |

$433.94 |

$0.00 |

$433.94 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1990 |

$427.70 |

$0.00 |

$427.70 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1989 |

$438.50 |

$0.00 |

$438.50 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1988 |

$445.87 |

$0.00 |

$445.87 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1987 |

$464.74 |

$0.00 |

$464.74 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1986 |

$445.04 |

$0.00 |

$445.04 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1985 |

$431.33 |

$0.00 |

$431.33 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1984 |

$426.26 |

$0.00 |

$426.26 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 106567-2020 |

07/03/2020 |

07/23/2020 |

WD |

KIENE, BRUCE & MARY |

KIENE, BRUCE PAUL & MARY PETERSON TEE (ET AL) |

| 15150-2019 |

01/07/2019 |

02/25/2019 |

REC |

E TITLE TEE |

JOHNSON, BRENT TEE (ET AL) |

| 15149-2019 |

12/14/2018 |

02/25/2019 |

SUB TEE |

SECURITY SERVICE FEDERAL CREDIT UNION |

E TITLE SUCTEE |

| 107231-2018 |

11/06/2018 |

11/08/2018 |

WD |

KIENE, BRUCE |

KIENE, BRUCE & MARY |

| 107230-2018 |

11/08/2018 |

11/08/2018 |

WD |

JOHNSON, BRENT & JANIE TEE (ET AL) |

KIENE, BRUCE |

| 52126-2016 |

05/26/2016 |

06/09/2016 |

REC |

CENTRAL BANK TEE |

JOHNSON, BRENT & LOIS JANIE |

| 48801-2016 |

05/20/2016 |

06/01/2016 |

D TR |

JOHNSON, BRENT & JANIE (ET AL) |

SECURITY SERVICE FEDERAL CREDIT UNION |

| 106906-2015 |

11/25/2015 |

11/30/2015 |

WD |

JOHNSON, BRENT & JANIE |

JOHNSON, BRENT & JANIE TEE (ET AL) |

| 17475-2012 |

02/28/2012 |

03/05/2012 |

N |

REDEVELOPMENT AGENCY OF PROVO CITY |

WHOM OF INTEREST |

| 108888-2003 |

07/11/2003 |

07/17/2003 |

REC |

CENTRAL BANK TEE |

JOHNSON, BRENT & LOIS JANIE |

| 108887-2003 |

07/11/2003 |

07/17/2003 |

D TR |

JOHNSON, BRENT & LOIS JANIE |

CENTRAL BANK |

| 6162-2002 |

01/11/2002 |

01/16/2002 |

REC |

CENTRAL BANK TEE |

JOHNSON, BRENT & LOIS JANIE |

| 6161-2002 |

01/11/2002 |

01/16/2002 |

D TR |

JOHNSON, BRENT & LOIS JANIE |

CENTRAL BANK |

| 9522-1998 |

01/27/1998 |

02/02/1998 |

REC |

CENTRAL BANK TEE |

JOHNSON, BRENT & LOIS JANIE |

| 9521-1998 |

01/27/1998 |

02/02/1998 |

D TR |

JOHNSON, BRENT & LOIS JANIE |

CENTRAL BANK |

| 52264-1995 |

07/07/1995 |

08/11/1995 |

REC |

ZIONS FIRST NATIONAL BANK TEE |

PETT, DAVID M & LOYAL L |

| 81559-1994 |

10/20/1994 |

10/21/1994 |

C WD |

JONES, PAULA O (ET AL) |

JOHNSON, BRENT & LOIS JANIE |

| 4686-1993 |

01/26/1993 |

01/27/1993 |

D TR |

JOHNSON, BRENT & LOIS JANIE |

CENTRAL BANK |

| 4685-1993 |

01/22/1993 |

01/27/1993 |

WD |

JONES, PAULA O (ET AL) |

JOHNSON, BRENT & LOIS JANIE |

| 28794-1992 |

05/04/1992 |

06/11/1992 |

WD |

PETT, DAVID M & LOYAL L |

JONES, PAULA O (ET AL) |

| 17497-1980 |

05/20/1980 |

05/20/1980 |

NI |

PETT, DAVID M & LOYAL L |

CHILD, LOIS C |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 3/30/2025 11:25:06 PM |