Property Information

mobile view

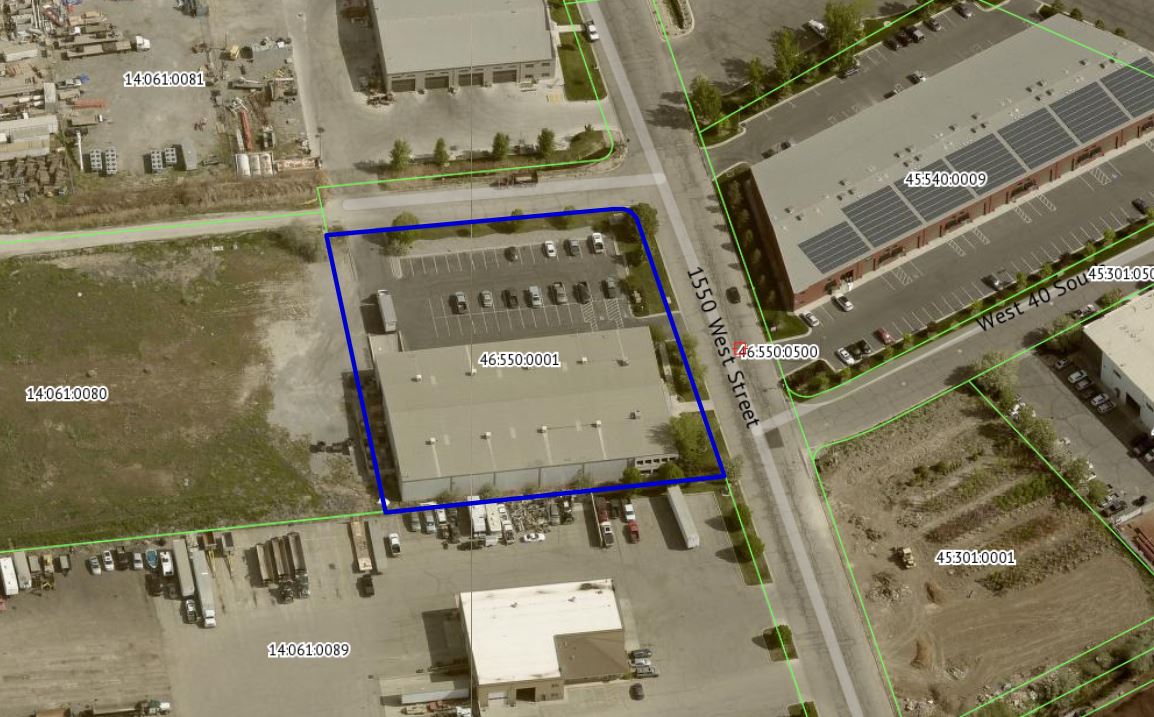

| Serial Number: 46:550:0001 |

Serial Life: 2001... |

|

|

Total Photos: 8

Total Photos: 8

|

| |

|

|

| Property Address: 28 S 1550 WEST - LINDON |

|

| Mailing Address: 8150 LEHIGH MORTON GROVE, IL 60053 |

|

| Acreage: 1.5 |

|

| Last Document:

30458-2000

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 1, PLAT A, MILLER INDUSTRIAL PARK SUBDV. AREA 1.500 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$704,300 |

$0 |

$0 |

$704,300 |

$2,343,300 |

$0 |

$0 |

$2,343,300 |

$0 |

$0 |

$0 |

$3,047,600 |

| 2023 |

$653,100 |

$0 |

$0 |

$653,100 |

$2,047,200 |

$0 |

$0 |

$2,047,200 |

$0 |

$0 |

$0 |

$2,700,300 |

| 2022 |

$518,600 |

$0 |

$0 |

$518,600 |

$1,968,300 |

$0 |

$0 |

$1,968,300 |

$0 |

$0 |

$0 |

$2,486,900 |

| 2021 |

$518,600 |

$0 |

$0 |

$518,600 |

$1,857,800 |

$0 |

$0 |

$1,857,800 |

$0 |

$0 |

$0 |

$2,376,400 |

| 2020 |

$518,600 |

$0 |

$0 |

$518,600 |

$1,766,400 |

$0 |

$0 |

$1,766,400 |

$0 |

$0 |

$0 |

$2,285,000 |

| 2019 |

$480,200 |

$0 |

$0 |

$480,200 |

$1,766,400 |

$0 |

$0 |

$1,766,400 |

$0 |

$0 |

$0 |

$2,246,600 |

| 2018 |

$407,100 |

$0 |

$0 |

$407,100 |

$1,605,800 |

$0 |

$0 |

$1,605,800 |

$0 |

$0 |

$0 |

$2,012,900 |

| 2017 |

$388,100 |

$0 |

$0 |

$388,100 |

$1,604,000 |

$0 |

$0 |

$1,604,000 |

$0 |

$0 |

$0 |

$1,992,100 |

| 2016 |

$369,800 |

$0 |

$0 |

$369,800 |

$1,333,700 |

$0 |

$0 |

$1,333,700 |

$0 |

$0 |

$0 |

$1,703,500 |

| 2015 |

$336,500 |

$0 |

$0 |

$336,500 |

$1,159,700 |

$0 |

$0 |

$1,159,700 |

$0 |

$0 |

$0 |

$1,496,200 |

| 2014 |

$320,800 |

$0 |

$0 |

$320,800 |

$1,008,400 |

$0 |

$0 |

$1,008,400 |

$0 |

$0 |

$0 |

$1,329,200 |

| 2013 |

$291,600 |

$0 |

$0 |

$291,600 |

$1,008,400 |

$0 |

$0 |

$1,008,400 |

$0 |

$0 |

$0 |

$1,300,000 |

| 2012 |

$291,600 |

$0 |

$0 |

$291,600 |

$1,008,400 |

$0 |

$0 |

$1,008,400 |

$0 |

$0 |

$0 |

$1,300,000 |

| 2011 |

$291,600 |

$0 |

$0 |

$291,600 |

$1,008,400 |

$0 |

$0 |

$1,008,400 |

$0 |

$0 |

$0 |

$1,300,000 |

| 2010 |

$316,932 |

$0 |

$0 |

$316,932 |

$1,612,620 |

$0 |

$0 |

$1,612,620 |

$0 |

$0 |

$0 |

$1,929,552 |

| 2009 |

$323,400 |

$0 |

$0 |

$323,400 |

$1,734,000 |

$0 |

$0 |

$1,734,000 |

$0 |

$0 |

$0 |

$2,057,400 |

| 2008 |

$235,300 |

$0 |

$0 |

$235,300 |

$1,200,500 |

$0 |

$0 |

$1,200,500 |

$0 |

$0 |

$0 |

$1,435,800 |

| 2007 |

$224,100 |

$0 |

$0 |

$224,100 |

$1,143,300 |

$0 |

$0 |

$1,143,300 |

$0 |

$0 |

$0 |

$1,367,400 |

| 2006 |

$186,769 |

$0 |

$0 |

$186,769 |

$1,039,320 |

$0 |

$0 |

$1,039,320 |

$0 |

$0 |

$0 |

$1,226,089 |

| 2005 |

$186,769 |

$0 |

$0 |

$186,769 |

$1,039,320 |

$0 |

$0 |

$1,039,320 |

$0 |

$0 |

$0 |

$1,226,089 |

| 2004 |

$186,769 |

$0 |

$0 |

$186,769 |

$1,039,320 |

$0 |

$0 |

$1,039,320 |

$0 |

$0 |

$0 |

$1,226,089 |

| 2003 |

$186,769 |

$0 |

$0 |

$186,769 |

$1,039,320 |

$0 |

$0 |

$1,039,320 |

$0 |

$0 |

$0 |

$1,226,089 |

| 2002 |

$186,769 |

$0 |

$0 |

$186,769 |

$1,039,320 |

$0 |

$0 |

$1,039,320 |

$0 |

$0 |

$0 |

$1,226,089 |

| 2001 |

$160,179 |

$0 |

$0 |

$160,179 |

$834,254 |

$0 |

$0 |

$834,254 |

$0 |

$0 |

$0 |

$994,433 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2024 |

$24,758.70 |

$0.00 |

$24,758.70 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2023 |

$20,425.07 |

$0.00 |

$20,425.07 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2022 |

$19,472.43 |

$0.00 |

$19,472.43 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2021 |

$22,437.97 |

$0.00 |

$22,437.97 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2020 |

$21,917.72 |

$0.00 |

$21,917.72 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2019 |

$20,659.73 |

$0.00 |

$20,659.73 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2018 |

$19,635.84 |

$0.00 |

$19,635.84 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2017 |

$19,936.94 |

$0.00 |

$19,936.94 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2016 |

$18,431.87 |

$0.00 |

$18,431.87 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2015 |

$17,124.01 |

$0.00 |

$17,124.01 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2014 |

$15,357.58 |

$0.00 |

$15,357.58 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2013 |

$16,217.50 |

$0.00 |

$16,217.50 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2012 |

$16,565.90 |

$0.00 |

$16,565.90 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2011 |

$23,156.07 |

($6,648.67) |

$16,507.40 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2010 |

$22,834.32 |

$0.00 |

$22,834.32 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2009 |

$22,331.02 |

$0.00 |

$22,331.02 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2008 |

$14,022.02 |

$0.00 |

$14,022.02 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2007 |

$13,196.78 |

$0.00 |

$13,196.78 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2006 |

$12,545.34 |

$0.00 |

$12,545.34 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2005 |

$14,428.62 |

$0.00 |

$14,428.62 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2004 |

$14,429.84 |

$0.00 |

$14,429.84 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2003 |

$14,177.27 |

$0.00 |

$14,177.27 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2002 |

$13,007.58 |

$0.00 |

$13,007.58 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

| 2001 |

$10,538.01 |

$0.00 |

$10,538.01 |

$0.00 |

|

$0.00

|

$0.00 |

085 - LINDON CITY W/WATER CONS |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 112238-2020 |

07/30/2020 |

08/03/2020 |

ASSIGN |

FEIGER FAMILY PROPERTIES LLC |

FIRST MIDWEST BANK |

| 112237-2020 |

07/30/2020 |

08/03/2020 |

D TR |

FEIGER FAMILY PROPERTIES LLC |

FIRST MIDWEST BANK |

| 112236-2020 |

07/31/2020 |

08/03/2020 |

WD |

FUSION DEVELOPMENT LLC |

FEIGER FAMILY PROPERTIES LLC |

| 87786-2020 |

06/05/2020 |

06/24/2020 |

REC |

BANK OF UTAH TEE |

R & T MILLER LLC |

| 7425-2020 |

01/21/2020 |

01/21/2020 |

REC |

ZIONS BANCORPORATION TEE |

R&T MILLER LLC |

| 37993-2011 |

05/09/2011 |

05/20/2011 |

SP WD |

R & T MILLER LLC |

FUSION DEVELOPMENT LLC |

| 125003-2005 |

10/21/2005 |

11/01/2005 |

AS |

R&T MILLER LLC |

ZIONS FIRST NATIONAL BANK |

| 125002-2005 |

10/20/2005 |

11/01/2005 |

D TR |

R & T MILLER LLC |

ZIONS FIRST NATIONAL BANK |

| 114779-2005 |

10/03/2005 |

10/11/2005 |

REC |

U S BANK NATIONAL ASSOCIATION TEE |

R & T MILLER LLC |

| 114778-2005 |

10/03/2005 |

10/11/2005 |

REC |

U S BANK NATIONAL ASSOCIATION TEE |

R & T MILLER LLC |

| 114777-2005 |

10/03/2005 |

10/11/2005 |

R AS |

U S BANK NATIONAL ASSOCIATION |

R & T MILLER LLC |

| 114776-2005 |

10/03/2005 |

10/11/2005 |

R AS |

U S BANK NATIONAL ASSOCIATION |

R & T MILLER LLC |

| 98719-2005 |

09/02/2005 |

09/02/2005 |

D TR |

R & T MILLER LLC (ET AL) |

AMERICAN BANK OF COMMERCE |

| 90612-2001 |

09/05/2001 |

09/07/2001 |

REC |

PROVO LAND TITLE COMPANY TEE |

JARRETT, MICHAEL T & MARCIA T |

| 72038-2000 |

09/11/2000 |

09/13/2000 |

MOD AGR |

R&T MILLER LLC |

US BANK NATIONAL ASSOCIATION |

| 55420-2000 |

07/10/2000 |

07/17/2000 |

AS |

R&T MILLER LLC |

US BANK NATIONAL ASSOCIATION |

| 55419-2000 |

07/10/2000 |

07/17/2000 |

D TR |

R&T MILLER LLC |

US BANK NATIONAL ASSOCIATION |

| 32493-2000 |

09/28/1999 |

04/26/2000 |

REC |

FIRST AMERICAN TITLE INSURANCE COMPANY - UTAH DIVISION SUC TO (ET AL) |

HADLEY, JACK L & EVAJEAN C |

| 30458-2000 |

09/21/1999 |

04/18/2000 |

S PLAT |

STEPHEN W PHELON LTD PARTNERSHIP (ET AL) |

MILLER INDUSTRIAL PARK PLAT A |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 1/3/2025 9:11:06 AM |