Property Information

mobile view

| Serial Number: 46:834:0001 |

Serial Life: 2014... |

|

|

Total Photos: 38

Total Photos: 38

|

| |

|

|

| Property Address: 452 W 1260 NORTH - OREM |

|

| Mailing Address: 452 W 1260 N OREM, UT 84057-2941 |

|

| Acreage: 5.310063 |

|

| Last Document:

29372-2013

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 1, PLAT B, MOXTEK SUB AREA 5.310 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

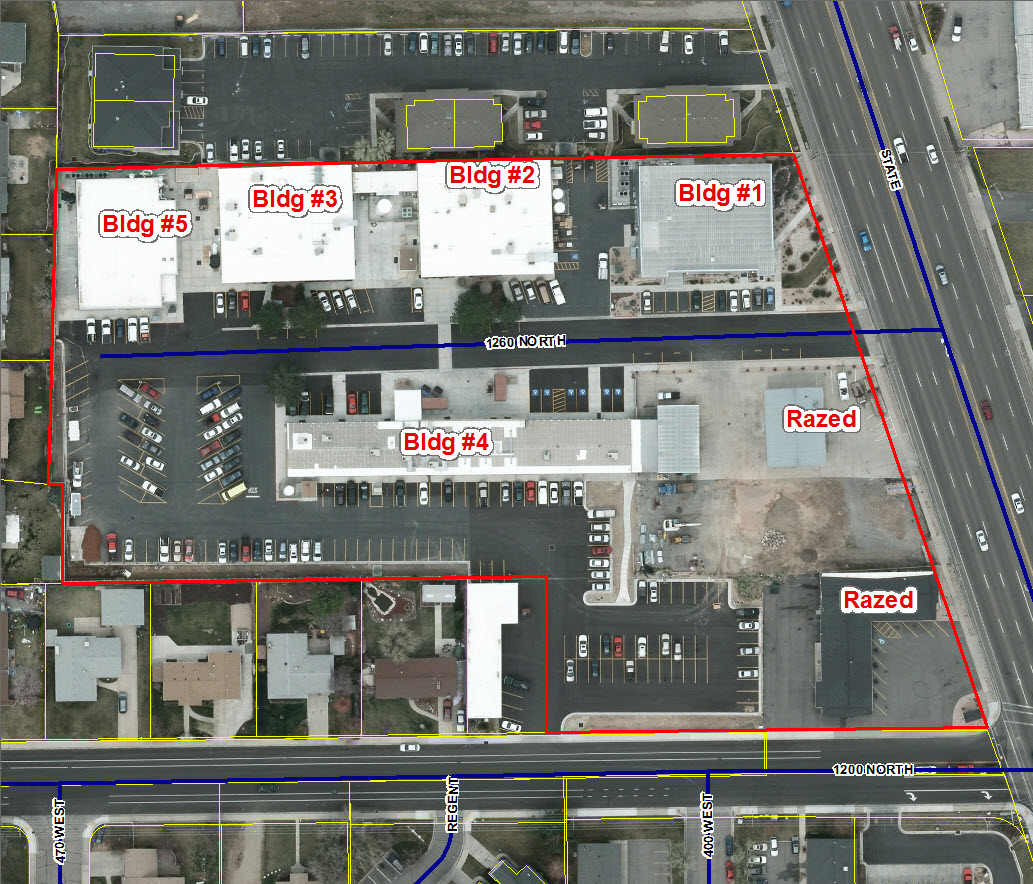

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$3,225,500 |

$0 |

$0 |

$3,225,500 |

$13,698,100 |

$0 |

$0 |

$13,698,100 |

$0 |

$0 |

$0 |

$16,923,600 |

| 2023 |

$3,075,000 |

$0 |

$0 |

$3,075,000 |

$14,145,800 |

$0 |

$0 |

$14,145,800 |

$0 |

$0 |

$0 |

$17,220,800 |

| 2022 |

$3,010,500 |

$0 |

$0 |

$3,010,500 |

$12,275,900 |

$0 |

$0 |

$12,275,900 |

$0 |

$0 |

$0 |

$15,286,400 |

| 2021 |

$2,499,400 |

$0 |

$0 |

$2,499,400 |

$10,065,200 |

$0 |

$0 |

$10,065,200 |

$0 |

$0 |

$0 |

$12,564,600 |

| 2020 |

$2,499,400 |

$0 |

$0 |

$2,499,400 |

$10,065,200 |

$0 |

$0 |

$10,065,200 |

$0 |

$0 |

$0 |

$12,564,600 |

| 2019 |

$2,173,400 |

$0 |

$0 |

$2,173,400 |

$10,099,100 |

$0 |

$0 |

$10,099,100 |

$0 |

$0 |

$0 |

$12,272,500 |

| 2018 |

$2,070,700 |

$0 |

$0 |

$2,070,700 |

$8,825,400 |

$0 |

$0 |

$8,825,400 |

$0 |

$0 |

$0 |

$10,896,100 |

| 2017 |

$2,408,700 |

$0 |

$0 |

$2,408,700 |

$8,307,400 |

$0 |

$0 |

$8,307,400 |

$0 |

$0 |

$0 |

$10,716,100 |

| 2016 |

$2,262,200 |

$0 |

$0 |

$2,262,200 |

$7,511,500 |

$0 |

$0 |

$7,511,500 |

$0 |

$0 |

$0 |

$9,773,700 |

| 2015 |

$2,185,800 |

$0 |

$0 |

$2,185,800 |

$6,602,600 |

$0 |

$0 |

$6,602,600 |

$0 |

$0 |

$0 |

$8,788,400 |

| 2014 |

$2,081,800 |

$0 |

$0 |

$2,081,800 |

$4,341,200 |

$0 |

$0 |

$4,341,200 |

$0 |

$0 |

$0 |

$6,423,000 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2024 |

$138,401.20 |

$0.00 |

$138,401.20 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2023 |

$131,033.07 |

$0.00 |

$131,033.07 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2022 |

$120,059.39 |

$0.00 |

$120,059.39 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2021 |

$118,459.05 |

$0.00 |

$118,459.05 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2020 |

$120,532.21 |

$0.00 |

$120,532.21 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2019 |

$113,213.81 |

$0.00 |

$113,213.81 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2018 |

$105,201.85 |

$0.00 |

$105,201.85 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2017 |

$106,228.70 |

$0.00 |

$106,228.70 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2016 |

$105,067.28 |

$0.00 |

$105,067.28 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2015 |

$99,897.74 |

$0.00 |

$99,897.74 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2014 |

$73,344.24 |

$0.00 |

$73,344.24 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 22480-2014 |

04/01/2014 |

04/04/2014 |

N |

PACIFICORP |

WHOM OF INTEREST |

| 110227-2013 |

10/29/2013 |

12/02/2013 |

R/W EAS |

MOXTEK INC |

PACIFI CORP DBA (ET AL) |

| 29372-2013 |

02/01/2013 |

03/27/2013 |

S PLAT |

MOXTEK INC |

MOXTEK PLAT B |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 1/26/2025 5:14:44 AM |