Property Information

mobile view

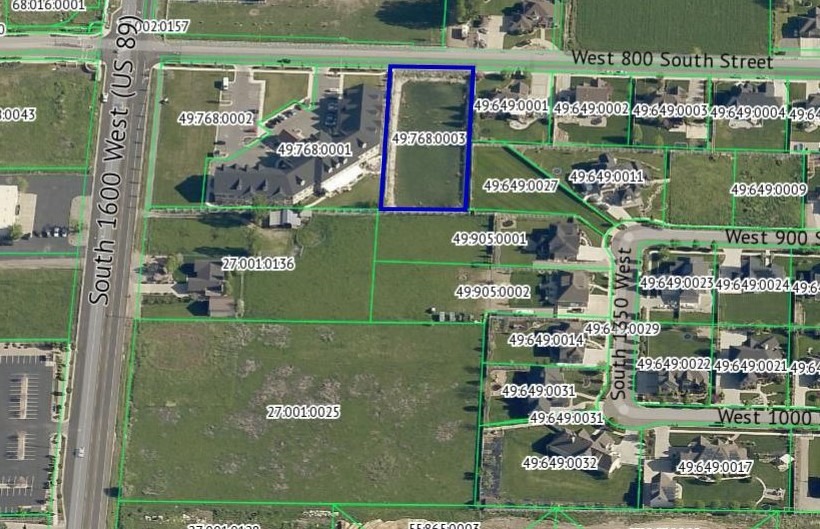

| Serial Number: 49:768:0003 |

Serial Life: 2015... |

|

|

Total Photos: 5

Total Photos: 5

|

| |

|

|

| Property Address: MAPLETON |

|

| Mailing Address: 229 S 950 W SPRINGVILLE, UT 84663 |

|

| Acreage: 1.030141 |

|

| Last Document:

32739-2014

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 3 (RETENTION BASIN), PLAT B, PHEASANT VIEW SUB AREA 1.030 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$36,600 |

$0 |

$0 |

$36,600 |

$34,400 |

$0 |

$0 |

$34,400 |

$0 |

$0 |

$0 |

$71,000 |

| 2023 |

$29,500 |

$0 |

$0 |

$29,500 |

$33,400 |

$0 |

$0 |

$33,400 |

$0 |

$0 |

$0 |

$62,900 |

| 2022 |

$29,500 |

$0 |

$0 |

$29,500 |

$52,400 |

$0 |

$0 |

$52,400 |

$0 |

$0 |

$0 |

$81,900 |

| 2021 |

$26,100 |

$0 |

$0 |

$26,100 |

$2,600 |

$0 |

$0 |

$2,600 |

$0 |

$0 |

$0 |

$28,700 |

| 2020 |

$26,100 |

$0 |

$0 |

$26,100 |

$2,600 |

$0 |

$0 |

$2,600 |

$0 |

$0 |

$0 |

$28,700 |

| 2019 |

$21,800 |

$0 |

$0 |

$21,800 |

$2,800 |

$0 |

$0 |

$2,800 |

$0 |

$0 |

$0 |

$24,600 |

| 2018 |

$20,700 |

$0 |

$0 |

$20,700 |

$2,900 |

$0 |

$0 |

$2,900 |

$0 |

$0 |

$0 |

$23,600 |

| 2017 |

$20,700 |

$0 |

$0 |

$20,700 |

$2,000 |

$0 |

$0 |

$2,000 |

$0 |

$0 |

$0 |

$22,700 |

| 2016 |

$21,100 |

$0 |

$0 |

$21,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$21,100 |

| 2015 |

$21,100 |

$0 |

$0 |

$21,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$21,100 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

140 - MAPLETON CITY |

| 2024 |

$724.77 |

$0.00 |

$724.77 |

$0.00 |

|

$0.00

|

$0.00 |

140 - MAPLETON CITY |

| 2023 |

$638.06 |

$0.00 |

$638.06 |

$0.00 |

|

$0.00

|

$0.00 |

140 - MAPLETON CITY |

| 2022 |

$840.21 |

$0.00 |

$840.21 |

$0.00 |

|

$0.00

|

$0.00 |

140 - MAPLETON CITY |

| 2021 |

$348.68 |

$0.00 |

$348.68 |

$0.00 |

|

$0.00

|

$0.00 |

140 - MAPLETON CITY |

| 2020 |

$360.47 |

$0.00 |

$360.47 |

$0.00 |

|

$0.00

|

$0.00 |

140 - MAPLETON CITY |

| 2019 |

$302.70 |

$0.00 |

$302.70 |

$0.00 |

|

$0.00

|

$0.00 |

140 - MAPLETON CITY |

| 2018 |

$305.05 |

$0.00 |

$305.05 |

$0.00 |

|

$0.00

|

$0.00 |

140 - MAPLETON CITY |

| 2017 |

$1,213.68 |

($909.59) |

$304.09 |

$0.00 |

|

$0.00

|

$0.00 |

140 - MAPLETON CITY |

| 2016 |

$284.34 |

$0.00 |

$284.34 |

$0.00 |

|

$0.00

|

$0.00 |

140 - MAPLETON CITY |

| 2015 |

$1,144.30 |

($858.23) |

$286.07 |

$0.00 |

|

$0.00

|

$0.00 |

140 - MAPLETON CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 11190-2024 |

02/13/2024 |

02/23/2024 |

RDECCOV |

PHEASANT VIEW HOME OWNERS ASSOCIATION INC (ET AL) |

WHOM OF INTEREST |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 32739-2014 |

05/12/2014 |

05/15/2014 |

S PLAT |

THATCHER, DEVAR S & CHARLOTTE (ET AL) |

PHEASANT VIEW PLAT B |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/22/2024 6:02:39 PM |