Property Information

mobile view

| Serial Number: 52:940:0005 |

Serial Life: 2003... |

|

|

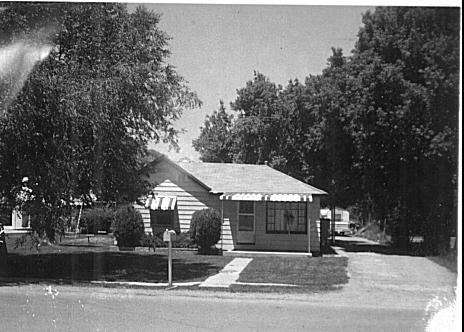

Total Photos: 1

Total Photos: 1

|

| |

|

|

| Property Address: 1760 W 600 SOUTH - PROVO |

|

| Mailing Address: 1760 W 600 S PROVO, UT 84601-3812 |

|

| Acreage: 0.219 |

|

| Last Document:

112852-2012

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 5, PLAT C, SUNSET MANOR SUBDV. AREA 0.219 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$152,900 |

$0 |

$152,900 |

$0 |

$165,100 |

$0 |

$165,100 |

$0 |

$0 |

$0 |

$318,000 |

| 2023 |

$0 |

$152,800 |

$0 |

$152,800 |

$0 |

$149,700 |

$0 |

$149,700 |

$0 |

$0 |

$0 |

$302,500 |

| 2022 |

$0 |

$162,900 |

$0 |

$162,900 |

$0 |

$161,500 |

$0 |

$161,500 |

$0 |

$0 |

$0 |

$324,400 |

| 2021 |

$0 |

$90,500 |

$0 |

$90,500 |

$0 |

$144,200 |

$0 |

$144,200 |

$0 |

$0 |

$0 |

$234,700 |

| 2020 |

$0 |

$82,300 |

$0 |

$82,300 |

$0 |

$131,100 |

$0 |

$131,100 |

$0 |

$0 |

$0 |

$213,400 |

| 2019 |

$0 |

$82,300 |

$0 |

$82,300 |

$0 |

$128,500 |

$0 |

$128,500 |

$0 |

$0 |

$0 |

$210,800 |

| 2018 |

$0 |

$75,200 |

$0 |

$75,200 |

$0 |

$111,700 |

$0 |

$111,700 |

$0 |

$0 |

$0 |

$186,900 |

| 2017 |

$0 |

$64,400 |

$0 |

$64,400 |

$0 |

$97,100 |

$0 |

$97,100 |

$0 |

$0 |

$0 |

$161,500 |

| 2016 |

$0 |

$50,100 |

$0 |

$50,100 |

$0 |

$84,400 |

$0 |

$84,400 |

$0 |

$0 |

$0 |

$134,500 |

| 2015 |

$0 |

$50,100 |

$0 |

$50,100 |

$0 |

$78,300 |

$0 |

$78,300 |

$0 |

$0 |

$0 |

$128,400 |

| 2014 |

$0 |

$46,500 |

$0 |

$46,500 |

$0 |

$76,500 |

$0 |

$76,500 |

$0 |

$0 |

$0 |

$123,000 |

| 2013 |

$0 |

$41,200 |

$0 |

$41,200 |

$0 |

$69,700 |

$0 |

$69,700 |

$0 |

$0 |

$0 |

$110,900 |

| 2012 |

$0 |

$34,900 |

$0 |

$34,900 |

$0 |

$70,800 |

$0 |

$70,800 |

$0 |

$0 |

$0 |

$105,700 |

| 2011 |

$0 |

$33,600 |

$0 |

$33,600 |

$0 |

$76,400 |

$0 |

$76,400 |

$0 |

$0 |

$0 |

$110,000 |

| 2010 |

$0 |

$37,101 |

$0 |

$37,101 |

$0 |

$82,159 |

$0 |

$82,159 |

$0 |

$0 |

$0 |

$119,260 |

| 2009 |

$0 |

$67,800 |

$0 |

$67,800 |

$0 |

$64,600 |

$0 |

$64,600 |

$0 |

$0 |

$0 |

$132,400 |

| 2008 |

$0 |

$80,700 |

$0 |

$80,700 |

$0 |

$53,700 |

$0 |

$53,700 |

$0 |

$0 |

$0 |

$134,400 |

| 2007 |

$0 |

$83,200 |

$0 |

$83,200 |

$0 |

$55,400 |

$0 |

$55,400 |

$0 |

$0 |

$0 |

$138,600 |

| 2006 |

$0 |

$44,100 |

$0 |

$44,100 |

$0 |

$74,200 |

$0 |

$74,200 |

$0 |

$0 |

$0 |

$118,300 |

| 2005 |

$0 |

$42,000 |

$0 |

$42,000 |

$0 |

$70,628 |

$0 |

$70,628 |

$0 |

$0 |

$0 |

$112,628 |

| 2004 |

$0 |

$42,000 |

$0 |

$42,000 |

$0 |

$70,628 |

$0 |

$70,628 |

$0 |

$0 |

$0 |

$112,628 |

| 2003 |

$0 |

$42,000 |

$0 |

$42,000 |

$0 |

$70,628 |

$0 |

$70,628 |

$0 |

$0 |

$0 |

$112,628 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2024 |

$1,776.81 |

$0.00 |

$1,776.81 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2023 |

$1,714.49 |

$0.00 |

$1,714.49 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2022 |

$1,823.45 |

$0.00 |

$1,823.45 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2021 |

$1,375.27 |

$0.00 |

$1,375.27 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2020 |

$1,333.91 |

$0.00 |

$1,333.91 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2019 |

$1,266.99 |

$0.00 |

$1,266.99 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2018 |

$1,107.62 |

$0.00 |

$1,107.62 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2017 |

$957.98 |

$0.00 |

$957.98 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2016 |

$855.96 |

$0.00 |

$855.96 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2015 |

$808.46 |

$0.00 |

$808.46 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2014 |

$742.93 |

$0.00 |

$742.93 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2013 |

$717.00 |

$0.00 |

$717.00 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2012 |

$705.18 |

$0.00 |

$705.18 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2011 |

$712.33 |

$0.00 |

$712.33 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2010 |

$709.39 |

$0.00 |

$709.39 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2009 |

$768.18 |

$0.00 |

$768.18 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2008 |

$719.02 |

$0.00 |

$719.02 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2007 |

$669.07 |

$0.00 |

$669.07 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2006 |

$682.40 |

$0.00 |

$682.40 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2005 |

$669.38 |

$0.00 |

$669.38 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2004 |

$674.27 |

$0.00 |

$674.27 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

| 2003 |

$657.61 |

$0.00 |

$657.61 |

$0.00 |

|

$0.00

|

$0.00 |

110 - PROVO CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 69283-2021 |

04/12/2021 |

04/13/2021 |

RSUBTEE |

WELLS FARGO BANK (ET AL) |

RUELAS, GERMAN U |

| 9016-2013 |

01/10/2013 |

01/29/2013 |

RSUBTEE |

WELLS FARGO BANK (ET AL) |

RUELAS, GERMAN URIBE |

| 112853-2012 |

12/17/2012 |

12/21/2012 |

D TR |

RUELAS, GERMAN U |

WELLS FARGO BANK |

| 112852-2012 |

12/17/2012 |

12/21/2012 |

SP WD |

RUELAS, GERMAN URIBE |

RUELAS, GERMAN U |

| 34181-2007 |

01/26/2007 |

03/08/2007 |

RSUBTEE |

US BANK NATIONAL ASSOCIATION (ET AL) |

URIBE, GERMAN |

| 175492-2006 |

12/22/2006 |

12/28/2006 |

D TR |

RUELAS, GERMAN URIBE |

WELLS FARGO BANK |

| 175491-2006 |

12/22/2006 |

12/28/2006 |

WD |

URIBE, GERMAN |

RUELAS, GERMAN URIBE |

| 39807-2005 |

04/04/2005 |

04/15/2005 |

REC |

FIDELITY NATIONAL TITLE INSURANCE COMANY TEE |

RUELAS, CARMEN |

| 39806-2005 |

03/23/2005 |

04/15/2005 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

FIDELITY NATIONAL TITLE INSURANCE COMANY SUCTEE |

| 146486-2004 |

12/29/2004 |

12/30/2004 |

D TR |

URIBE, GERMAN |

FIRST FRANKLIN FINANCIAL CORPORATION |

| 146485-2004 |

12/29/2004 |

12/30/2004 |

WD |

RUELAS, CARMEN |

URIBE, GERMAN |

| 6056-2004 |

01/15/2004 |

01/16/2004 |

QCD |

CARTER, RICHARD D |

RUELAS, CARMEN |

| 77172-2003 |

05/08/2003 |

05/22/2003 |

REL |

CENTRAL BANK AND TRUST COMPANY |

HAWS, MARK S & NORMA C |

| 138341-2002 |

11/14/2002 |

11/18/2002 |

WD |

CARTER, RICHARD D TEE (ET AL) |

RUELAS, CARMEN |

| 102322-2002 |

08/27/2002 |

09/04/2002 |

S PLAT |

WRIGHT, DENNIS R (ET AL) |

SUNSET MANOR PLAT C |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 1/4/2025 2:41:26 AM |