Property Information

mobile view

| Serial Number: 53:163:0018 |

Serial Life: 1996... |

|

|

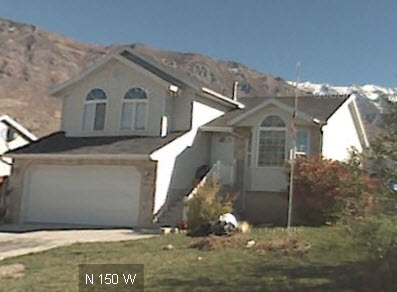

Total Photos: 2

|

| |

|

|

| Property Address: 1194 N 150 WEST - PLEASANT GROVE |

|

| Mailing Address: 790 W STATE RD LEHI, UT 84043 |

|

| Acreage: 0.221 |

|

| Last Document:

84194-1995

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 18, PLAT B, TIMPANOGOS MEADOW SUB AREA 0.221 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$231,600 |

$0 |

$231,600 |

$0 |

$241,800 |

$0 |

$241,800 |

$0 |

$0 |

$0 |

$473,400 |

| 2023 |

$0 |

$231,600 |

$0 |

$231,600 |

$0 |

$247,200 |

$0 |

$247,200 |

$0 |

$0 |

$0 |

$478,800 |

| 2022 |

$0 |

$244,300 |

$0 |

$244,300 |

$0 |

$249,400 |

$0 |

$249,400 |

$0 |

$0 |

$0 |

$493,700 |

| 2021 |

$0 |

$152,700 |

$0 |

$152,700 |

$0 |

$197,900 |

$0 |

$197,900 |

$0 |

$0 |

$0 |

$350,600 |

| 2020 |

$0 |

$136,300 |

$0 |

$136,300 |

$0 |

$183,200 |

$0 |

$183,200 |

$0 |

$0 |

$0 |

$319,500 |

| 2019 |

$0 |

$129,100 |

$0 |

$129,100 |

$0 |

$159,300 |

$0 |

$159,300 |

$0 |

$0 |

$0 |

$288,400 |

| 2018 |

$0 |

$121,900 |

$0 |

$121,900 |

$0 |

$138,500 |

$0 |

$138,500 |

$0 |

$0 |

$0 |

$260,400 |

| 2017 |

$0 |

$107,600 |

$0 |

$107,600 |

$0 |

$126,000 |

$0 |

$126,000 |

$0 |

$0 |

$0 |

$233,600 |

| 2016 |

$0 |

$68,100 |

$0 |

$68,100 |

$0 |

$140,000 |

$0 |

$140,000 |

$0 |

$0 |

$0 |

$208,100 |

| 2015 |

$0 |

$68,100 |

$0 |

$68,100 |

$0 |

$121,700 |

$0 |

$121,700 |

$0 |

$0 |

$0 |

$189,800 |

| 2014 |

$0 |

$66,700 |

$0 |

$66,700 |

$0 |

$105,800 |

$0 |

$105,800 |

$0 |

$0 |

$0 |

$172,500 |

| 2013 |

$0 |

$50,800 |

$0 |

$50,800 |

$0 |

$92,000 |

$0 |

$92,000 |

$0 |

$0 |

$0 |

$142,800 |

| 2012 |

$0 |

$73,800 |

$0 |

$73,800 |

$0 |

$83,600 |

$0 |

$83,600 |

$0 |

$0 |

$0 |

$157,400 |

| 2011 |

$0 |

$45,000 |

$0 |

$45,000 |

$0 |

$116,300 |

$0 |

$116,300 |

$0 |

$0 |

$0 |

$161,300 |

| 2010 |

$0 |

$53,696 |

$0 |

$53,696 |

$0 |

$121,304 |

$0 |

$121,304 |

$0 |

$0 |

$0 |

$175,000 |

| 2009 |

$0 |

$76,500 |

$0 |

$76,500 |

$0 |

$102,900 |

$0 |

$102,900 |

$0 |

$0 |

$0 |

$179,400 |

| 2008 |

$0 |

$86,700 |

$0 |

$86,700 |

$0 |

$116,800 |

$0 |

$116,800 |

$0 |

$0 |

$0 |

$203,500 |

| 2007 |

$0 |

$86,700 |

$0 |

$86,700 |

$0 |

$116,800 |

$0 |

$116,800 |

$0 |

$0 |

$0 |

$203,500 |

| 2006 |

$0 |

$43,100 |

$0 |

$43,100 |

$0 |

$138,800 |

$0 |

$138,800 |

$0 |

$0 |

$0 |

$181,900 |

| 2005 |

$0 |

$43,145 |

$0 |

$43,145 |

$0 |

$101,959 |

$0 |

$101,959 |

$0 |

$0 |

$0 |

$145,104 |

| 2004 |

$0 |

$43,145 |

$0 |

$43,145 |

$0 |

$101,959 |

$0 |

$101,959 |

$0 |

$0 |

$0 |

$145,104 |

| 2003 |

$0 |

$43,145 |

$0 |

$43,145 |

$0 |

$101,959 |

$0 |

$101,959 |

$0 |

$0 |

$0 |

$145,104 |

| 2002 |

$0 |

$43,145 |

$0 |

$43,145 |

$0 |

$101,959 |

$0 |

$101,959 |

$0 |

$0 |

$0 |

$145,104 |

| 2001 |

$0 |

$43,145 |

$0 |

$43,145 |

$0 |

$101,959 |

$0 |

$101,959 |

$0 |

$0 |

$0 |

$145,104 |

| 2000 |

$0 |

$40,322 |

$0 |

$40,322 |

$0 |

$89,840 |

$0 |

$89,840 |

$0 |

$0 |

$0 |

$130,162 |

| 1999 |

$0 |

$40,322 |

$0 |

$40,322 |

$0 |

$89,840 |

$0 |

$89,840 |

$0 |

$0 |

$0 |

$130,162 |

| 1998 |

$0 |

$35,683 |

$0 |

$35,683 |

$0 |

$79,504 |

$0 |

$79,504 |

$0 |

$0 |

$0 |

$115,187 |

| 1997 |

$0 |

$35,683 |

$0 |

$35,683 |

$0 |

$79,504 |

$0 |

$79,504 |

$0 |

$0 |

$0 |

$115,187 |

| 1996 |

$0 |

$35,000 |

$0 |

$35,000 |

$0 |

$27,750 |

$0 |

$27,750 |

$0 |

$0 |

$0 |

$62,750 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2024 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

($50.04)

|

($50.04) |

070 - PLEASANT GROVE CITY |

| 2023 |

$2,155.44 |

($50.04) |

$2,105.40 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2022 |

$2,233.65 |

$0.00 |

$2,233.65 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2021 |

$1,894.17 |

$0.00 |

$1,894.17 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2020 |

$1,760.76 |

$0.00 |

$1,760.76 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2019 |

$1,536.87 |

$0.00 |

$1,536.87 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2018 |

$1,467.58 |

$0.00 |

$1,467.58 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2017 |

$1,360.09 |

$0.00 |

$1,360.09 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2016 |

$1,255.00 |

$0.00 |

$1,255.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2015 |

$1,208.73 |

$0.00 |

$1,208.73 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2014 |

$1,108.99 |

$0.00 |

$1,108.99 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2013 |

$995.02 |

$0.00 |

$995.02 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2012 |

$1,121.17 |

$0.00 |

$1,121.17 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2011 |

$1,142.12 |

$0.00 |

$1,142.12 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2010 |

$1,159.43 |

$0.00 |

$1,159.43 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2009 |

$1,126.88 |

($30.56) |

$1,096.32 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2008 |

$1,150.14 |

$0.00 |

$1,150.14 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2007 |

$1,104.59 |

$0.00 |

$1,104.59 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2006 |

$1,056.78 |

$0.00 |

$1,056.78 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2005 |

$978.03 |

$0.00 |

$978.03 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2004 |

$990.33 |

$0.00 |

$990.33 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2003 |

$982.10 |

$0.00 |

$982.10 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2002 |

$907.17 |

$0.00 |

$907.17 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2001 |

$895.35 |

$0.00 |

$895.35 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2000 |

$834.30 |

$0.00 |

$834.30 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1999 |

$843.46 |

$0.00 |

$843.46 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1998 |

$731.85 |

$0.00 |

$731.85 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1997 |

$705.44 |

$0.00 |

$705.44 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1996 |

$379.71 |

$0.00 |

$379.71 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 32661-2020 |

02/28/2020 |

03/13/2020 |

RSUBTEE |

MERS (ET AL) |

MAAG, KEVIN |

| 55731-2017 |

06/09/2017 |

06/09/2017 |

SP WD |

MAAG, KEVIN |

CARMAA HOLDINGS LLC SERIES 2 |

| 55730-2017 |

06/09/2017 |

06/09/2017 |

D TR |

MAAG, KEVIN |

UNITED WHOLESALE MORTGAGE |

| 55729-2017 |

06/09/2017 |

06/09/2017 |

SP WD |

CARMAA HOLDINGS LLC SERIES 2 |

MAAG, KEVIN |

| 26303-2013 |

03/07/2013 |

03/20/2013 |

REC |

BANK OF AMERICAN FORK TEE |

MAAG, KEVIN T & KARYN F |

| 82643-2009 |

06/30/2009 |

07/29/2009 |

WD |

MAAG, KEVIN T & KARYN F |

CARMAA HOLDINGS LLC SERIES 2 |

| 145902-2003 |

08/22/2003 |

09/04/2003 |

REC |

RIVERS, ROD TEE |

MAAG, TROY & ANNALISA |

| 145901-2003 |

07/31/2003 |

09/04/2003 |

SUB TEE |

GMAC MORTGAGE CORPORATION |

RIVERS, ROD SUCTEE |

| 138706-2003 |

08/19/2003 |

08/25/2003 |

D TR |

MAAG, KEVIN T & KARYN F |

BANK OF AMERICAN FORK |

| 138705-2003 |

08/19/2003 |

08/25/2003 |

WD |

MAAG, KEVIN & KARYN |

MAAG, KEVIN T & KARYN F |

| 98214-2003 |

06/25/2003 |

06/30/2003 |

WD |

MAAG, TROY & ANNALISA |

MAAG, KEVIN & KARYN |

| 26354-2001 |

03/16/2001 |

03/22/2001 |

REC |

FIRST AMERICAN TITLE CO SUCTEE |

MAAG, TROY & ANNALISA |

| 26353-2001 |

02/28/2001 |

03/22/2001 |

SUB TEE |

UTAH HOUSING FINANCE AGENCY |

FIRST AMERICAN TITLE CO SUCTEE |

| 7154-2001 |

01/24/2001 |

01/29/2001 |

D TR |

MAAG, TROY & ANNALISA |

GMAC MORTGAGE CORPORATION |

| 7627-1997 |

01/24/1997 |

01/31/1997 |

REC |

PROVO LAND TITLE COMPANY TEE |

LEGACY PROPERTIES AND INVESTMENTS LC |

| 78929-1996 |

08/28/1996 |

09/25/1996 |

AS |

FIRST SECURITY BANK OF UTAH |

UTAH HOUSING FINANCE AGENCY |

| 60270-1996 |

07/23/1996 |

07/23/1996 |

REC |

PROVO LAND TITLE COMPANY TEE |

LEGACY PROPERTIES AND INVESTMENTS LC |

| 50475-1996 |

06/17/1996 |

06/18/1996 |

REC |

PROVO LAND TITLE COMPANY TEE |

ALL AMERICAN AND DEVELOPMENT CONSTRUCTION LC |

| 48421-1996 |

06/11/1996 |

06/11/1996 |

P REC |

PROVO LAND TITLE COMPANY TEE |

LEGACY PROPERTEIS AND INVESTMENTS LC |

| 46191-1996 |

05/31/1996 |

06/03/1996 |

D TR |

MAAG, TROY & ANNALISA |

FIRST SECURITY BANK OF UTAH |

| 46190-1996 |

05/31/1996 |

06/03/1996 |

WD |

ALL AMERICAN DEVELOPMENT AND CONSTRUCTION LC |

MAAG, TROY & ANNALISA |

| 33144-1996 |

04/22/1996 |

04/22/1996 |

P REC |

PROVO LAND TITLE COMPANY TEE |

LEGACY PROPERTIES AND INVESTMENTS LC |

| 10341-1996 |

01/30/1996 |

02/06/1996 |

D TR |

ALL AMERICAN DEVELOPMENT AND CONSTRUCTION LC |

UNITED SAVINGS BANK |

| 84285-1995 |

12/04/1995 |

12/06/1995 |

P REC |

PROVO LAND TITLE COMPANY TEE |

LEGACY PROPERTIES |

| 84194-1995 |

11/29/1995 |

12/05/1995 |

QCD |

LEGACY PROPERTIES AND INVESTMENTS LC |

ALL AMERICAN DEVELOPMENT AND CONSTRUCTION LC |

| 76846-1995 |

11/06/1995 |

11/08/1995 |

RESOL |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 70587-1995 |

07/18/1995 |

10/18/1995 |

S PLAT |

LEGACY PROPERTIES AND INVESTMENTS LC (ET AL) |

TIMPANOGOS MEADOW PLAT B |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 7/14/2024 2:08:39 PM |