Property Information

mobile view

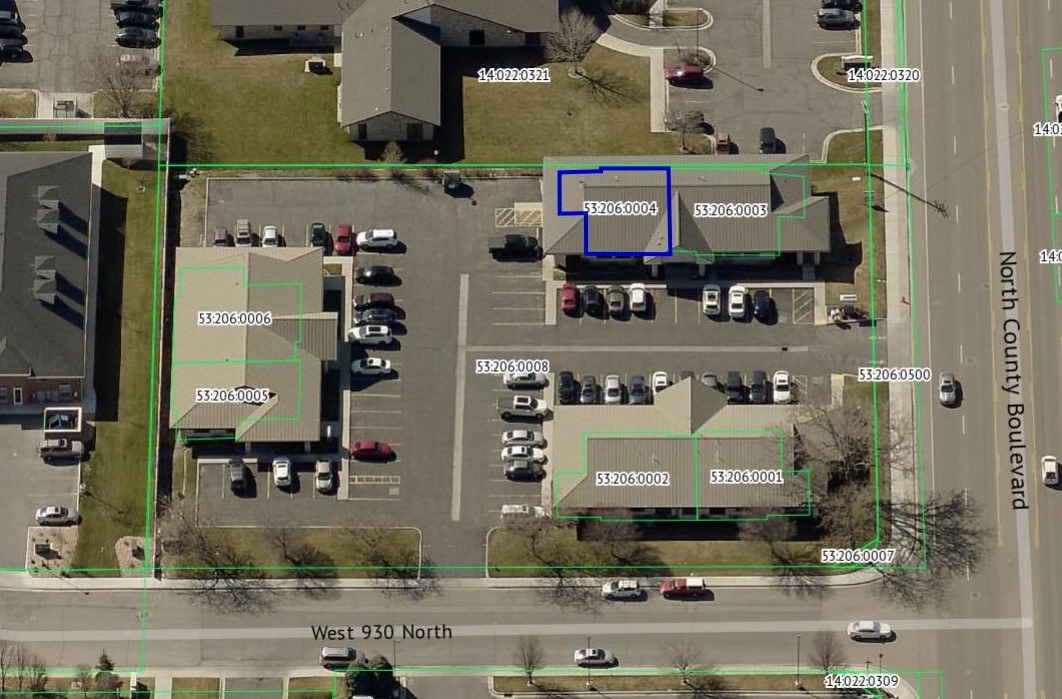

| Serial Number: 53:206:0004 |

Serial Life: 1999... |

|

|

Total Photos: 8

Total Photos: 8

|

| |

|

|

| Property Address: 886 N 2000 WEST - PLEASANT GROVE |

|

| Mailing Address: 12974 NEW RIVER DR DRAPER, UT 84020 |

|

| Acreage: 0.04 |

|

| Last Document:

135250-2004

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 4, PLAT A, TIMP MEDICAL CENTER SUBDV. AREA 0.040 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$118,600 |

$0 |

$0 |

$118,600 |

$505,100 |

$0 |

$0 |

$505,100 |

$0 |

$0 |

$0 |

$623,700 |

| 2023 |

$116,300 |

$0 |

$0 |

$116,300 |

$495,200 |

$0 |

$0 |

$495,200 |

$0 |

$0 |

$0 |

$611,500 |

| 2022 |

$116,300 |

$0 |

$0 |

$116,300 |

$386,800 |

$0 |

$0 |

$386,800 |

$0 |

$0 |

$0 |

$503,100 |

| 2021 |

$116,300 |

$0 |

$0 |

$116,300 |

$386,800 |

$0 |

$0 |

$386,800 |

$0 |

$0 |

$0 |

$503,100 |

| 2020 |

$116,300 |

$0 |

$0 |

$116,300 |

$386,800 |

$0 |

$0 |

$386,800 |

$0 |

$0 |

$0 |

$503,100 |

| 2019 |

$116,300 |

$0 |

$0 |

$116,300 |

$386,800 |

$0 |

$0 |

$386,800 |

$0 |

$0 |

$0 |

$503,100 |

| 2018 |

$116,300 |

$0 |

$0 |

$116,300 |

$355,300 |

$0 |

$0 |

$355,300 |

$0 |

$0 |

$0 |

$471,600 |

| 2017 |

$116,300 |

$0 |

$0 |

$116,300 |

$355,300 |

$0 |

$0 |

$355,300 |

$0 |

$0 |

$0 |

$471,600 |

| 2016 |

$116,300 |

$0 |

$0 |

$116,300 |

$355,300 |

$0 |

$0 |

$355,300 |

$0 |

$0 |

$0 |

$471,600 |

| 2015 |

$116,300 |

$0 |

$0 |

$116,300 |

$355,300 |

$0 |

$0 |

$355,300 |

$0 |

$0 |

$0 |

$471,600 |

| 2014 |

$77,600 |

$0 |

$0 |

$77,600 |

$299,800 |

$0 |

$0 |

$299,800 |

$0 |

$0 |

$0 |

$377,400 |

| 2013 |

$77,600 |

$0 |

$0 |

$77,600 |

$299,800 |

$0 |

$0 |

$299,800 |

$0 |

$0 |

$0 |

$377,400 |

| 2012 |

$77,600 |

$0 |

$0 |

$77,600 |

$299,800 |

$0 |

$0 |

$299,800 |

$0 |

$0 |

$0 |

$377,400 |

| 2011 |

$82,700 |

$0 |

$0 |

$82,700 |

$287,800 |

$0 |

$0 |

$287,800 |

$0 |

$0 |

$0 |

$370,500 |

| 2010 |

$89,866 |

$0 |

$0 |

$89,866 |

$302,901 |

$0 |

$0 |

$302,901 |

$0 |

$0 |

$0 |

$392,767 |

| 2009 |

$91,700 |

$0 |

$0 |

$91,700 |

$325,700 |

$0 |

$0 |

$325,700 |

$0 |

$0 |

$0 |

$417,400 |

| 2008 |

$91,700 |

$0 |

$0 |

$91,700 |

$325,700 |

$0 |

$0 |

$325,700 |

$0 |

$0 |

$0 |

$417,400 |

| 2007 |

$87,300 |

$0 |

$0 |

$87,300 |

$310,200 |

$0 |

$0 |

$310,200 |

$0 |

$0 |

$0 |

$397,500 |

| 2006 |

$54,000 |

$0 |

$0 |

$54,000 |

$184,140 |

$0 |

$0 |

$184,140 |

$0 |

$0 |

$0 |

$238,140 |

| 2005 |

$54,000 |

$0 |

$0 |

$54,000 |

$184,140 |

$0 |

$0 |

$184,140 |

$0 |

$0 |

$0 |

$238,140 |

| 2004 |

$18,165 |

$0 |

$0 |

$18,165 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$18,165 |

| 2003 |

$18,165 |

$0 |

$0 |

$18,165 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$18,165 |

| 2002 |

$18,165 |

$0 |

$0 |

$18,165 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$18,165 |

| 2001 |

$15,579 |

$0 |

$0 |

$15,579 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$15,579 |

| 2000 |

$14,560 |

$0 |

$0 |

$14,560 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$14,560 |

| 1999 |

$14,560 |

$0 |

$0 |

$14,560 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$14,560 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2024 |

$5,344.49 |

$0.00 |

$5,344.49 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2023 |

$5,005.13 |

($116.19) |

$4,888.94 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2022 |

$4,138.50 |

$0.00 |

$4,138.50 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2021 |

$4,941.95 |

$0.00 |

$4,941.95 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2020 |

$5,041.06 |

$0.00 |

$5,041.06 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2019 |

$5,483.97 |

($609.43) |

$4,874.54 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2018 |

$4,832.49 |

$0.00 |

$4,832.49 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2017 |

$4,992.36 |

$0.00 |

$4,992.36 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2016 |

$5,171.09 |

$0.00 |

$5,171.09 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2015 |

$5,460.66 |

$0.00 |

$5,460.66 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2014 |

$4,411.43 |

$0.00 |

$4,411.43 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2013 |

$4,781.28 |

$0.00 |

$4,781.28 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2012 |

$4,887.71 |

$0.00 |

$4,887.71 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2011 |

$4,769.82 |

$0.00 |

$4,769.82 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2010 |

$4,731.27 |

$0.00 |

$4,731.27 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2009 |

$4,637.73 |

$0.00 |

$4,637.73 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2008 |

$4,289.20 |

$0.00 |

$4,289.20 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2007 |

$3,922.93 |

$0.00 |

$3,922.93 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2006 |

$2,515.47 |

$0.00 |

$2,515.47 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2005 |

$2,918.41 |

$0.00 |

$2,918.41 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2004 |

$225.41 |

$0.00 |

$225.41 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2003 |

$223.54 |

$0.00 |

$223.54 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2002 |

$206.48 |

$0.00 |

$206.48 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2001 |

$174.78 |

$0.00 |

$174.78 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2000 |

$169.68 |

$0.00 |

$169.68 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1999 |

$171.55 |

$0.00 |

$171.55 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 105726-2018 |

11/01/2018 |

11/02/2018 |

D TR |

DAYNES PROPERTY MANAGMENT LLC |

UTAH COMMUNITY FEDERAL CREDIT UNION |

| 105725-2018 |

11/01/2018 |

11/02/2018 |

WD |

SCS INVESTMETNS LLC |

DAYNES PROPERTY MANAGMENT LLC |

| 105724-2018 |

10/25/2018 |

11/02/2018 |

PA |

SMITH, STEVEN C |

SMITH, TODD B |

| 33340-2012 |

04/23/2012 |

04/24/2012 |

WD |

TIMPVIEW PROFESSIONAL PLAZA CONDOMINIUMS ASSOCIATION |

UTAH COUNTY |

| 33339-2012 |

10/21/2011 |

04/24/2012 |

QCD |

LAO, EDWARD D & MARILOU B TEE (ET AL) |

UTAH COUNTY |

| 33338-2012 |

10/18/2011 |

04/24/2012 |

QCD |

SCS INVESTMENTS LLC BY (ET AL) |

UTAH COUNTY |

| 33337-2012 |

10/18/2011 |

04/24/2012 |

QCD |

HEINZ E AND IRMGARD S GERSTLE LLC |

UTAH COUNTY |

| 33336-2012 |

12/16/2011 |

04/24/2012 |

QCD |

BLACKHURST TEETH LLC |

UTAH COUNTY |

| 145731-2005 |

11/18/2005 |

12/16/2005 |

SUB AGR |

TOTAL NUTRITION INC |

COLUMBIAN LIFE INSURANCE COMPANY |

| 145730-2005 |

12/13/2005 |

12/16/2005 |

D TR |

SCS INVESTMENTS LLC BY (ET AL) |

COLUMBIAN LIFE INSURANCE COMPANY |

| 138117-2005 |

11/15/2005 |

11/30/2005 |

REC |

FIRST NATIONAL BANK OF ARIZONA |

UTAZ INVESTMENTS LC |

| 130081-2005 |

11/08/2005 |

11/14/2005 |

SP WD |

SMITH, STEVEN C |

SCS INVESTMENTS LLC |

| 130080-2005 |

11/08/2005 |

11/14/2005 |

QCD |

SMITH, REBECCA B |

SMITH, STEVEN C |

| 130079-2005 |

06/07/2004 |

11/14/2005 |

PA |

SMITH, REBECCA B |

CHRISTENSEN, KENNETH B |

| 130078-2005 |

06/03/2004 |

11/14/2005 |

PA |

SMITH, STEVEN C |

PHILLIPS, ROBERT L |

| 135250-2004 |

11/23/2004 |

12/02/2004 |

SP WD |

UTAZ INVESTMENTS LC |

SMITH, STEVEN C |

| 131003-2004 |

11/19/2004 |

11/19/2004 |

P REC |

PRO-TITLE AND ESCROW INC TEE |

UTAZ INVESTMENTS LC |

| 130869-2004 |

11/17/2004 |

11/19/2004 |

ADECCOV |

UTAZ INVESTMENTS LC |

WHOM OF INTEREST |

| 107704-2004 |

09/17/2004 |

09/21/2004 |

REC |

CENTRAL BANK TEE |

UTAZ INVESTMENTS LC |

| 105563-2004 |

09/13/2004 |

09/15/2004 |

SUB TEE |

CLOWARD, BURKE J |

UTAZ INVESTMENTS LC SUBTEE |

| 105562-2004 |

09/10/2004 |

09/15/2004 |

D TR |

UTAZ INVESTMENTS LC |

FIRST NATIONAL BANK OF ARIZONA |

| 66882-2000 |

08/24/2000 |

08/25/2000 |

REC |

CENTRAL BANK TEE |

UTAZ INVESTMENTS LC |

| 66881-2000 |

08/24/2000 |

08/25/2000 |

REC |

CENTRAL BANK TEE |

UTAZ INVESTMENTS LC |

| 65355-2000 |

08/21/2000 |

08/21/2000 |

SUB AGR |

CLOWARD, BURKE J |

CENTRAL BANK |

| 65354-2000 |

08/16/2000 |

08/21/2000 |

D TR |

CHESAPEAK INVESTMENT LC (ET AL) |

CENTRAL BANK |

| 17577-1999 |

07/07/1998 |

02/12/1999 |

SUB TEE |

COOK, CAROLEE B PERREP (ET AL) |

BACKMAN-STEWART TITLE SERVICES LTD SUBTEE |

| 6157-1999 |

01/13/1999 |

01/20/1999 |

REC |

CENTRAL BANK TEE |

UTAZ INVESTMENTS LC |

| 75614-1998 |

07/02/1998 |

07/29/1998 |

DECLCON |

UT AZ INVESTMENT LC |

WHOM OF INTEREST |

| 75613-1998 |

06/09/1998 |

07/29/1998 |

C PLAT |

UTAZ INVESTMENTS LC (ET AL) |

TIMP MEDICAL CENTER CONDO PLAT A |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/25/2024 7:14:54 PM |