Property Information

mobile view

| Serial Number: 09:054:0021 |

Serial Life: 2017... |

|

|

Total Photos: 17

Total Photos: 17

|

| |

|

|

| Property Address: 305 N SR 198 - SALEM |

|

| Mailing Address: 1265 S 1000 E MAPLETON, UT 84664-5022 |

|

| Acreage: 1.013849 |

|

| Last Document:

59388-2020

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 0 DEG 32' 51" E 1714.86 FT & E 605.31 FT FR W 1/4 COR. SEC. 1, T9S, R2E, SLB&M.; S 89 DEG 16' 16" E 381.43 FT; ALONG A CURVE TO L (CHORD BEARS: N 28 DEG 33' 44" E 113.08 FT, RADIUS = 668.8 FT); N 89 DEG 16' 16" W 78.88 FT; N 0 DEG 23' 4" E 4.41 FT; N 88 DEG 36' 7" W 103 FT; N 0 DEG 23' 4" E 3.5 FT; N 88 DEG 36' 7" W 253 FT; S 0 DEG 23' 4" W 112.07 FT TO BEG. AREA 1.014 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

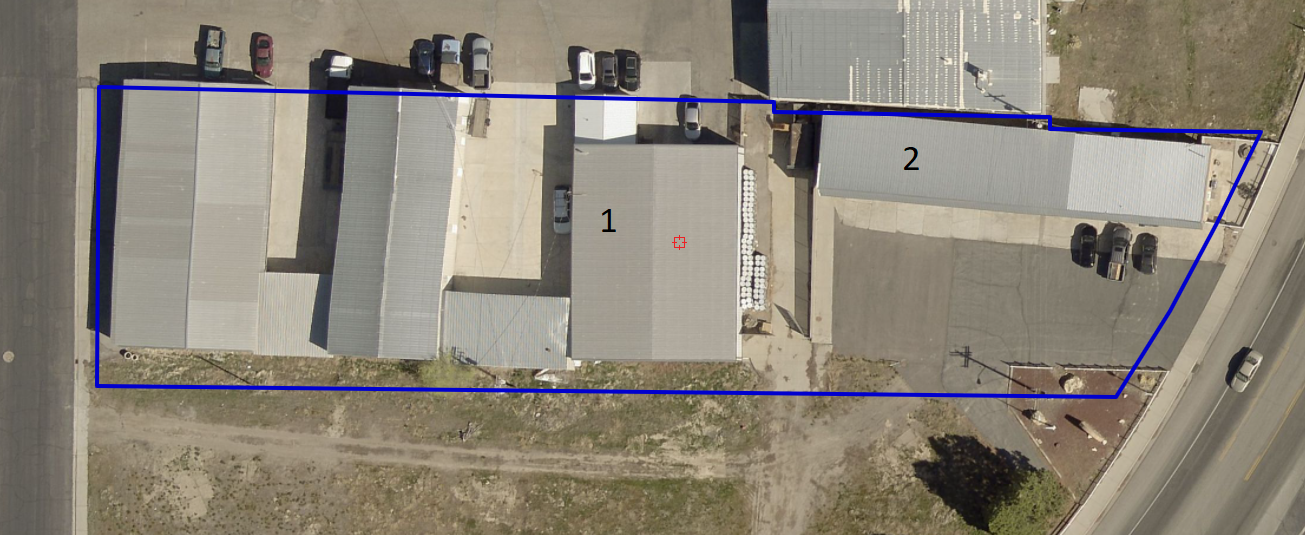

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$434,300 |

$0 |

$0 |

$434,300 |

$427,700 |

$0 |

$0 |

$427,700 |

$0 |

$0 |

$0 |

$862,000 |

| 2023 |

$354,500 |

$0 |

$0 |

$354,500 |

$409,800 |

$0 |

$0 |

$409,800 |

$0 |

$0 |

$0 |

$764,300 |

| 2022 |

$354,500 |

$0 |

$0 |

$354,500 |

$434,700 |

$0 |

$0 |

$434,700 |

$0 |

$0 |

$0 |

$789,200 |

| 2021 |

$307,300 |

$0 |

$0 |

$307,300 |

$302,100 |

$0 |

$0 |

$302,100 |

$0 |

$0 |

$0 |

$609,400 |

| 2020 |

$253,100 |

$0 |

$0 |

$253,100 |

$338,500 |

$0 |

$0 |

$338,500 |

$0 |

$0 |

$0 |

$591,600 |

| 2019 |

$221,300 |

$0 |

$0 |

$221,300 |

$337,200 |

$0 |

$0 |

$337,200 |

$0 |

$0 |

$0 |

$558,500 |

| 2018 |

$211,100 |

$0 |

$0 |

$211,100 |

$315,100 |

$0 |

$0 |

$315,100 |

$0 |

$0 |

$0 |

$526,200 |

| 2017 |

$203,200 |

$0 |

$0 |

$203,200 |

$315,100 |

$0 |

$0 |

$315,100 |

$0 |

$0 |

$0 |

$518,300 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

180 - SALEM CITY |

| 2024 |

$8,499.32 |

$0.00 |

$8,499.32 |

$0.00 |

|

$0.00

|

$0.00 |

180 - SALEM CITY |

| 2023 |

$7,523.00 |

$0.00 |

$7,523.00 |

$0.00 |

|

$0.00

|

$0.00 |

180 - SALEM CITY |

| 2022 |

$7,889.63 |

$0.00 |

$7,889.63 |

$0.00 |

|

$0.00

|

$0.00 |

180 - SALEM CITY |

| 2021 |

$6,903.28 |

$0.00 |

$6,903.28 |

$0.00 |

|

$0.00

|

$0.00 |

180 - SALEM CITY |

| 2020 |

$6,886.82 |

$0.00 |

$6,886.82 |

$0.00 |

|

$0.00

|

$0.00 |

180 - SALEM CITY |

| 2019 |

$6,366.34 |

$0.00 |

$6,366.34 |

$0.00 |

|

$0.00

|

$0.00 |

180 - SALEM CITY |

| 2018 |

$6,275.99 |

$0.00 |

$6,275.99 |

$0.00 |

|

$0.00

|

$0.00 |

180 - SALEM CITY |

| 2017 |

$6,375.09 |

$0.00 |

$6,375.09 |

$0.00 |

|

$0.00

|

$0.00 |

180 - SALEM CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 128698-2022 |

12/30/2022 |

12/30/2022 |

WD |

MAINGOT, RICHARD A & DENISE E TEE (ET AL) |

MT HOLDINGS LLC |

| 19033-2021 |

01/28/2021 |

02/01/2021 |

WD |

MAINGOT, RICHARD A & DENISE E |

MAINGOT, RICHARD A & DENISE E TEE (ET AL) |

| 85604-2020 |

06/22/2020 |

06/22/2020 |

REC |

MOUNTAIN AMERICA CREDIT UNION TEE |

MAINGOT, RICHARD & DENISE |

| 59389-2020 |

05/01/2020 |

05/04/2020 |

D TR |

MAINGOT, RICHARD A & DENISE E |

WELLS FARGO BANK |

| 59388-2020 |

05/01/2020 |

05/04/2020 |

WD |

MAINGOT, RICHARD & DENISE |

MAINGOT, RICHARD A & DENISE E |

| 9211-2018 |

01/29/2018 |

01/29/2018 |

D TR |

MAINGOT, RICHARD & DENISE |

MOUNTAIN AMERICA FEDERAL CREDIT UNION |

| 9149-2018 |

01/29/2018 |

01/29/2018 |

WD |

BUTLER, DIANE |

MAINGOT, RICHARD & DENISE |

| 103006-2017 |

10/16/2017 |

10/18/2017 |

SP WD |

B&M STORAGE LLC |

BUTLER, DIANE |

| 132353-2016 |

12/30/2016 |

12/30/2016 |

CORR AF |

BUTLER, DIANE N & DIANE |

WHOM OF INTEREST |

| 132352-2016 |

12/30/2016 |

12/30/2016 |

CORR AF |

BUTLER, JAY LEE & J LEE |

WHOM OF INTEREST |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/22/2024 5:16:52 PM |