Property Information

| Serial Number: 35:196:0023 |

Serial Life: 1994... |

|

|

Total Photos: 1

|

| |

|

|

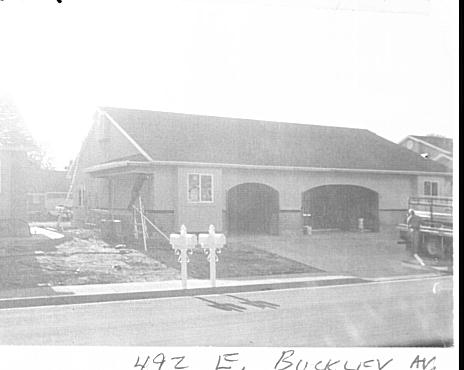

| Property Address: 492 E BUCKLEY AVE - SPRINGVILLE |

|

| Mailing Address: 492 BUCKLEY AVE SPRINGVILLE, UT 84663 |

|

| Acreage: 0.031 |

|

| Last Document:

62317-2001

|

|

| Subdivision Map Filing |

|

| Legal Description:

UNIT 23, BROOK COURT PUD AMENDED SUBDV. AREA 0.031 AC. |

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| 2022... |

|

MCEWAN, JANE W |

|

| 2022... |

|

WILLIAMS, DEBORAH |

|

| 2022NV |

|

MCEWAN, JANE W |

|

| 2018-2021 |

|

MCEWAN, JANE W |

|

| 2018-2021 |

|

WILLIAMS, DEBORAH |

|

| 2018NV |

|

MCEWAN, JANE H |

|

| 2018NV |

|

FALLICK, JUDITH R |

|

| 2018NV |

|

RIDD, CRAIG M |

|

| 2018NV |

|

ZENDA RIDD REVOCABLE TRUST 02-04-2010 |

|

| 2011-2017 |

|

RIDD, ZENDA O |

|

| 2004-2010 |

|

RIDD, ZENDA O |

|

| 2002-2003 |

|

RIDD, ZENDA O |

|

| 2001 |

|

SKALET, MARY L |

|

| 1998-2000 |

|

SKALET, MARY L |

|

| 1997 |

|

SKALET, MARY L |

|

| 1995-1996 |

|

HOAGLAND, DENNIS R |

|

| 1995NV |

|

HENRICHSEN, ELDON R |

|

| 1995NV |

|

HENRICHSEN, JOYCE H |

|

| 1994 |

|

BROOK CORPORATION |

|

| 1994NV |

|

BROOK COURT INC |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$76,400 |

$0 |

$76,400 |

$0 |

$276,700 |

$0 |

$276,700 |

$0 |

$0 |

$0 |

$353,100 |

| 2023 |

$0 |

$63,700 |

$0 |

$63,700 |

$0 |

$290,000 |

$0 |

$290,000 |

$0 |

$0 |

$0 |

$353,700 |

| 2022 |

$0 |

$65,000 |

$0 |

$65,000 |

$0 |

$276,900 |

$0 |

$276,900 |

$0 |

$0 |

$0 |

$341,900 |

| 2021 |

$0 |

$65,000 |

$0 |

$65,000 |

$0 |

$199,000 |

$0 |

$199,000 |

$0 |

$0 |

$0 |

$264,000 |

| 2020 |

$0 |

$65,000 |

$0 |

$65,000 |

$0 |

$166,600 |

$0 |

$166,600 |

$0 |

$0 |

$0 |

$231,600 |

| 2019 |

$0 |

$65,000 |

$0 |

$65,000 |

$0 |

$150,600 |

$0 |

$150,600 |

$0 |

$0 |

$0 |

$215,600 |

| 2018 |

$0 |

$65,000 |

$0 |

$65,000 |

$0 |

$146,200 |

$0 |

$146,200 |

$0 |

$0 |

$0 |

$211,200 |

| 2017 |

$0 |

$55,000 |

$0 |

$55,000 |

$0 |

$146,200 |

$0 |

$146,200 |

$0 |

$0 |

$0 |

$201,200 |

| 2016 |

$0 |

$45,000 |

$0 |

$45,000 |

$0 |

$127,100 |

$0 |

$127,100 |

$0 |

$0 |

$0 |

$172,100 |

| 2015 |

$0 |

$45,000 |

$0 |

$45,000 |

$0 |

$121,000 |

$0 |

$121,000 |

$0 |

$0 |

$0 |

$166,000 |

| 2014 |

$0 |

$40,000 |

$0 |

$40,000 |

$0 |

$88,000 |

$0 |

$88,000 |

$0 |

$0 |

$0 |

$128,000 |

| 2013 |

$0 |

$35,000 |

$0 |

$35,000 |

$0 |

$93,000 |

$0 |

$93,000 |

$0 |

$0 |

$0 |

$128,000 |

| 2012 |

$0 |

$35,000 |

$0 |

$35,000 |

$0 |

$93,000 |

$0 |

$93,000 |

$0 |

$0 |

$0 |

$128,000 |

| 2011 |

$0 |

$55,000 |

$0 |

$55,000 |

$0 |

$80,000 |

$0 |

$80,000 |

$0 |

$0 |

$0 |

$135,000 |

| 2010 |

$0 |

$66,000 |

$0 |

$66,000 |

$0 |

$102,400 |

$0 |

$102,400 |

$0 |

$0 |

$0 |

$168,400 |

| 2009 |

$0 |

$66,000 |

$0 |

$66,000 |

$0 |

$102,400 |

$0 |

$102,400 |

$0 |

$0 |

$0 |

$168,400 |

| 2008 |

$0 |

$66,000 |

$0 |

$66,000 |

$0 |

$105,600 |

$0 |

$105,600 |

$0 |

$0 |

$0 |

$171,600 |

| 2007 |

$0 |

$66,000 |

$0 |

$66,000 |

$0 |

$105,600 |

$0 |

$105,600 |

$0 |

$0 |

$0 |

$171,600 |

| 2006 |

$0 |

$9,163 |

$0 |

$9,163 |

$0 |

$105,585 |

$0 |

$105,585 |

$0 |

$0 |

$0 |

$114,748 |

| 2005 |

$0 |

$9,163 |

$0 |

$9,163 |

$0 |

$105,585 |

$0 |

$105,585 |

$0 |

$0 |

$0 |

$114,748 |

| 2004 |

$0 |

$9,163 |

$0 |

$9,163 |

$0 |

$105,585 |

$0 |

$105,585 |

$0 |

$0 |

$0 |

$114,748 |

| 2003 |

$0 |

$9,163 |

$0 |

$9,163 |

$0 |

$105,585 |

$0 |

$105,585 |

$0 |

$0 |

$0 |

$114,748 |

| 2002 |

$0 |

$9,163 |

$0 |

$9,163 |

$0 |

$105,585 |

$0 |

$105,585 |

$0 |

$0 |

$0 |

$114,748 |

| 2001 |

$0 |

$10,181 |

$0 |

$10,181 |

$0 |

$91,495 |

$0 |

$91,495 |

$0 |

$0 |

$0 |

$101,676 |

| 2000 |

$0 |

$9,515 |

$0 |

$9,515 |

$0 |

$83,245 |

$0 |

$83,245 |

$0 |

$0 |

$0 |

$92,760 |

| 1999 |

$0 |

$9,515 |

$0 |

$9,515 |

$0 |

$83,245 |

$0 |

$83,245 |

$0 |

$0 |

$0 |

$92,760 |

| 1998 |

$0 |

$9,515 |

$0 |

$9,515 |

$0 |

$83,245 |

$0 |

$83,245 |

$0 |

$0 |

$0 |

$92,760 |

| 1997 |

$0 |

$9,515 |

$0 |

$9,515 |

$0 |

$83,245 |

$0 |

$83,245 |

$0 |

$0 |

$0 |

$92,760 |

| 1996 |

$0 |

$9,227 |

$0 |

$9,227 |

$0 |

$80,726 |

$0 |

$80,726 |

$0 |

$0 |

$0 |

$89,953 |

| 1995 |

$0 |

$8,388 |

$0 |

$8,388 |

$0 |

$80,726 |

$0 |

$80,726 |

$0 |

$0 |

$0 |

$89,114 |

| 1994 |

$0 |

$4,905 |

$0 |

$4,905 |

$0 |

$65,102 |

$0 |

$65,102 |

$0 |

$0 |

$0 |

$70,007 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2024 |

$1,895.64 |

$0.00 |

$1,895.64 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2023 |

$1,896.91 |

$0.00 |

$1,896.91 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2022 |

$1,867.10 |

$0.00 |

$1,867.10 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2021 |

$1,684.03 |

$0.00 |

$1,684.03 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2020 |

$1,523.85 |

$0.00 |

$1,523.85 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2019 |

$1,393.43 |

$0.00 |

$1,393.43 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2018 |

$1,430.74 |

$0.00 |

$1,430.74 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2017 |

$1,411.36 |

$0.00 |

$1,411.36 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2016 |

$1,231.37 |

$0.00 |

$1,231.37 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2015 |

$1,161.79 |

$0.00 |

$1,161.79 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2014 |

$901.68 |

$0.00 |

$901.68 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2013 |

$942.66 |

$0.00 |

$942.66 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2012 |

$956.31 |

$0.00 |

$956.31 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2011 |

$983.89 |

$0.00 |

$983.89 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2010 |

$1,213.41 |

$0.00 |

$1,213.41 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2009 |

$1,096.81 |

$0.00 |

$1,096.81 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2008 |

$1,033.84 |

$0.00 |

$1,033.84 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2007 |

$1,024.68 |

$0.00 |

$1,024.68 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2006 |

$766.31 |

$0.00 |

$766.31 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2005 |

$814.08 |

$0.00 |

$814.08 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2004 |

$812.31 |

$0.00 |

$812.31 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2003 |

$736.14 |

$0.00 |

$736.14 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2002 |

$719.10 |

$0.00 |

$719.10 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2001 |

$652.27 |

$0.00 |

$652.27 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2000 |

$588.29 |

$0.00 |

$588.29 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1999 |

$559.36 |

$0.00 |

$559.36 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1998 |

$547.12 |

$0.00 |

$547.12 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1997 |

$608.34 |

$0.00 |

$608.34 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1996 |

$582.51 |

$0.00 |

$582.51 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1995 |

$573.78 |

$0.00 |

$573.78 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1994 |

$689.16 |

$0.00 |

$689.16 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

|

*The visual representation is a sum of taxes for the year(s) selected and is for reference only and no liability is assumed for any inaccuracies, incorrect data or variations.

|

|

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 138379-2021 |

08/05/2021 |

08/09/2021 |

REC |

MORAN, KEVIN P TEE |

MCEWAN, JANE W |

| 138378-2021 |

07/15/2021 |

08/09/2021 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

MORAN, KEVIN P SUBTEE |

| 119166-2021 |

06/29/2021 |

07/06/2021 |

WD |

MCEWAN, JANE W |

MCEWAN, JANE W (ET AL) |

| 119165-2021 |

06/29/2021 |

07/06/2021 |

D TR |

MCEWAN, JANE W |

UTAH COMMUNITY FEDERAL CREDIT UNION |

| 119164-2021 |

06/29/2021 |

07/06/2021 |

WD |

MCEWAN, JANE W (ET AL) |

MCEWAN, JANE W |

| 92909-2021 |

05/14/2021 |

05/18/2021 |

DECLCOV |

BROOKCOURT HOME OWNERS ASSOCIATION |

WHOM OF INTEREST |

| 95442-2017 |

09/25/2017 |

09/27/2017 |

WD |

MCEWAN, JANE W |

MCEWAN, JANE W (ET AL) |

| 66002-2017 |

07/07/2017 |

07/07/2017 |

D TR |

MCEWAN, JANE W |

UTAH COMMUNITY FEDERAL CREDIT UNION |

| 65998-2017 |

06/12/2017 |

07/07/2017 |

WD |

FALLICK, JUDITH R SUCTEE (ET AL) |

MCEWAN, JANE H |

| 65997-2017 |

06/12/2017 |

07/07/2017 |

AF DC |

RIDD, ZENDA O & ZENDA ORR AKA (ET AL) |

FALLICK, JUDITH R SUCTEE (ET AL) |

| 131106-2016 |

12/28/2016 |

12/29/2016 |

RESOL |

BROOKCOURT HOMEOWNERS ASSOCIATION |

WHOM OF INTEREST |

| 10645-2016 |

07/16/2015 |

02/09/2016 |

RESOL |

BROOKCOURT HOME OWNERS ASSOCIATIONS |

WHOM OF INTEREST |

| 100114-2015 |

11/05/2015 |

11/04/2015 |

BY LAWS |

BROOKCOURT HOA |

WHOM OF INTEREST |

| 48671-2015 |

05/30/2015 |

06/04/2015 |

RESOL |

BROOKCOURT HOME OWNERS ASSOCIATION |

WHOM OF INTEREST |

| 48670-2015 |

05/29/2015 |

06/04/2015 |

RDECCOV |

BROOKCOURT HOME OWNERS ASSOCIATION |

WHOM OF INTEREST |

| 67436-2013 |

07/09/2013 |

07/12/2013 |

BY LAWS |

BROOKCOURT HOMEOWNERS ASSOCIATION |

WHOM OF INTEREST |

| 11532-2010 |

02/04/2010 |

02/09/2010 |

QCD |

RIDD, ZENDA O |

RIDD, ZENDA O TEE |

| 62317-2001 |

06/22/2001 |

06/26/2001 |

WD |

GRIFFEL, SALLY JO TEE (ET AL) |

RIDD, ZENDA O |

| 62316-2001 |

06/22/2001 |

06/26/2001 |

SUC TEE |

GRIFFEL, SALLY JO (ET AL) |

GRIFFEL, SALLY JO TEE |

| 21899-2000 |

03/20/2000 |

03/20/2000 |

SP WD |

SKALET, MARY L |

SKALET, MARY L TEE |

| 35466-1996 |

04/24/1996 |

04/29/1996 |

WD |

HOAGLAND, DENNIS R TEE (ET AL) |

SKALET, MARY L |

| 36257-1994 |

04/06/1994 |

05/02/1994 |

WD |

HENRICHSEN, ELDON R & JOYCE H TEE (ET AL) |

HOAGLAND, DENNIS R TEE |

| 24899-1994 |

07/06/1993 |

03/25/1994 |

WD |

BROOK CORPORATION |

HENRICHSEN, ELDON R & JOYCE H TEE |

| 94303-1993 |

12/22/1993 |

12/27/1993 |

QCD |

BROOK CORPORATION AKA (ET AL) |

BROOK CORPORATION |

| 35561-1993 |

04/20/1993 |

06/03/1993 |

P PLAT |

HENRICHSEN, JOHN L (ET AL) |

BROOK COURT PUD AMD |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/15/2024 9:51:10 AM |