Property Information

| Serial Number: 14:038:0046 |

Serial Life: 1979... |

|

|

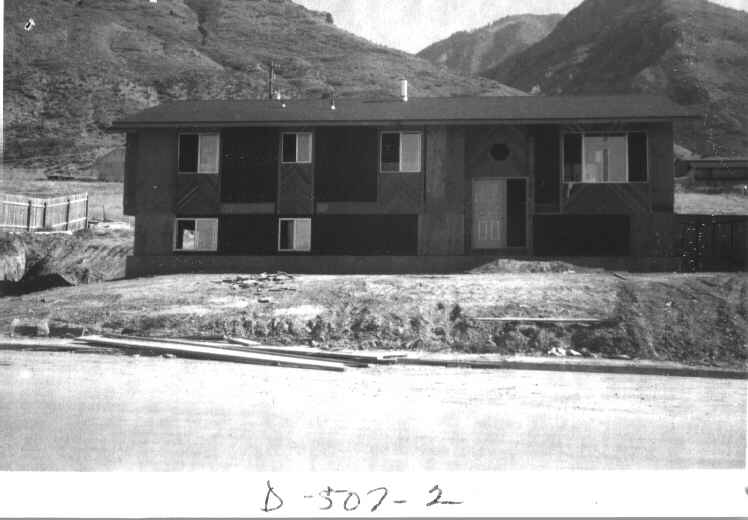

Total Photos: 1

|

| |

|

|

| Property Address: 230 N 1300 EAST - PLEASANT GROVE |

|

| Mailing Address: 230 N 1300 E PLEASANT GROVE, UT 84062-3022 |

|

| Acreage: 0.26 |

|

| Last Document:

62987-1995

|

|

| Subdivision Map Filing |

|

| Legal Description:

COM W 1097.69 FT & N 1094.77 FT FR S 1/4 COR SEC 22, T5S, R2E, SLM; N 3 02'W 95 FT; N 86 58'E 116.80 FT; S 3 02'E 25.92 FT; E 3.26 FT; S 3 02'E 68.91 FT; S 86 58'W 120 FT TO BEG. AREA .259 ACRES. |

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$252,600 |

$0 |

$252,600 |

$0 |

$248,000 |

$0 |

$248,000 |

$0 |

$0 |

$0 |

$500,600 |

| 2023 |

$0 |

$252,500 |

$0 |

$252,500 |

$0 |

$256,300 |

$0 |

$256,300 |

$0 |

$0 |

$0 |

$508,800 |

| 2022 |

$0 |

$266,400 |

$0 |

$266,400 |

$0 |

$224,600 |

$0 |

$224,600 |

$0 |

$0 |

$0 |

$491,000 |

| 2021 |

$0 |

$166,500 |

$0 |

$166,500 |

$0 |

$184,100 |

$0 |

$184,100 |

$0 |

$0 |

$0 |

$350,600 |

| 2020 |

$0 |

$148,700 |

$0 |

$148,700 |

$0 |

$165,900 |

$0 |

$165,900 |

$0 |

$0 |

$0 |

$314,600 |

| 2019 |

$0 |

$133,800 |

$0 |

$133,800 |

$0 |

$165,900 |

$0 |

$165,900 |

$0 |

$0 |

$0 |

$299,700 |

| 2018 |

$0 |

$122,700 |

$0 |

$122,700 |

$0 |

$144,300 |

$0 |

$144,300 |

$0 |

$0 |

$0 |

$267,000 |

| 2017 |

$0 |

$104,100 |

$0 |

$104,100 |

$0 |

$136,000 |

$0 |

$136,000 |

$0 |

$0 |

$0 |

$240,100 |

| 2016 |

$0 |

$70,600 |

$0 |

$70,600 |

$0 |

$140,400 |

$0 |

$140,400 |

$0 |

$0 |

$0 |

$211,000 |

| 2015 |

$0 |

$66,900 |

$0 |

$66,900 |

$0 |

$122,100 |

$0 |

$122,100 |

$0 |

$0 |

$0 |

$189,000 |

| 2014 |

$0 |

$63,200 |

$0 |

$63,200 |

$0 |

$114,800 |

$0 |

$114,800 |

$0 |

$0 |

$0 |

$178,000 |

| 2013 |

$0 |

$56,700 |

$0 |

$56,700 |

$0 |

$113,900 |

$0 |

$113,900 |

$0 |

$0 |

$0 |

$170,600 |

| 2012 |

$0 |

$55,400 |

$0 |

$55,400 |

$0 |

$125,200 |

$0 |

$125,200 |

$0 |

$0 |

$0 |

$180,600 |

| 2011 |

$0 |

$53,200 |

$0 |

$53,200 |

$0 |

$134,900 |

$0 |

$134,900 |

$0 |

$0 |

$0 |

$188,100 |

| 2010 |

$0 |

$58,678 |

$0 |

$58,678 |

$0 |

$145,390 |

$0 |

$145,390 |

$0 |

$0 |

$0 |

$204,068 |

| 2009 |

$0 |

$99,600 |

$0 |

$99,600 |

$0 |

$122,300 |

$0 |

$122,300 |

$0 |

$0 |

$0 |

$221,900 |

| 2008 |

$0 |

$126,100 |

$0 |

$126,100 |

$0 |

$101,900 |

$0 |

$101,900 |

$0 |

$0 |

$0 |

$228,000 |

| 2007 |

$0 |

$126,100 |

$0 |

$126,100 |

$0 |

$101,900 |

$0 |

$101,900 |

$0 |

$0 |

$0 |

$228,000 |

| 2006 |

$0 |

$58,800 |

$0 |

$58,800 |

$0 |

$125,700 |

$0 |

$125,700 |

$0 |

$0 |

$0 |

$184,500 |

| 2005 |

$0 |

$58,771 |

$0 |

$58,771 |

$0 |

$105,526 |

$0 |

$105,526 |

$0 |

$0 |

$0 |

$164,297 |

| 2004 |

$0 |

$58,771 |

$0 |

$58,771 |

$0 |

$105,526 |

$0 |

$105,526 |

$0 |

$0 |

$0 |

$164,297 |

| 2003 |

$0 |

$58,771 |

$0 |

$58,771 |

$0 |

$105,526 |

$0 |

$105,526 |

$0 |

$0 |

$0 |

$164,297 |

| 2002 |

$0 |

$58,771 |

$0 |

$58,771 |

$0 |

$105,526 |

$0 |

$105,526 |

$0 |

$0 |

$0 |

$164,297 |

| 2001 |

$0 |

$58,771 |

$0 |

$58,771 |

$0 |

$105,526 |

$0 |

$105,526 |

$0 |

$0 |

$0 |

$164,297 |

| 2000 |

$0 |

$54,926 |

$0 |

$54,926 |

$0 |

$98,669 |

$0 |

$98,669 |

$0 |

$0 |

$0 |

$153,595 |

| 1999 |

$0 |

$54,926 |

$0 |

$54,926 |

$0 |

$98,669 |

$0 |

$98,669 |

$0 |

$0 |

$0 |

$153,595 |

| 1998 |

$0 |

$48,607 |

$0 |

$48,607 |

$0 |

$87,318 |

$0 |

$87,318 |

$0 |

$0 |

$0 |

$135,925 |

| 1997 |

$0 |

$48,607 |

$0 |

$48,607 |

$0 |

$87,318 |

$0 |

$87,318 |

$0 |

$0 |

$0 |

$135,925 |

| 1996 |

$0 |

$44,447 |

$0 |

$44,447 |

$0 |

$79,845 |

$0 |

$79,845 |

$0 |

$0 |

$0 |

$124,292 |

| 1995 |

$0 |

$40,406 |

$0 |

$40,406 |

$0 |

$79,845 |

$0 |

$79,845 |

$0 |

$0 |

$0 |

$120,251 |

| 1994 |

$0 |

$23,629 |

$0 |

$23,629 |

$0 |

$64,391 |

$0 |

$64,391 |

$0 |

$0 |

$0 |

$88,020 |

| 1993 |

$0 |

$23,629 |

$0 |

$23,629 |

$0 |

$64,391 |

$0 |

$64,391 |

$0 |

$0 |

$0 |

$88,020 |

| 1992 |

$0 |

$21,678 |

$0 |

$21,678 |

$0 |

$59,074 |

$0 |

$59,074 |

$0 |

$0 |

$0 |

$80,752 |

| 1991 |

$0 |

$19,016 |

$0 |

$19,016 |

$0 |

$51,154 |

$0 |

$51,154 |

$0 |

$0 |

$0 |

$70,170 |

| 1990 |

$0 |

$19,016 |

$0 |

$19,016 |

$0 |

$51,154 |

$0 |

$51,154 |

$0 |

$0 |

$0 |

$70,170 |

| 1989 |

$0 |

$19,016 |

$0 |

$19,016 |

$0 |

$51,154 |

$0 |

$51,154 |

$0 |

$0 |

$0 |

$70,170 |

| 1988 |

$0 |

$19,017 |

$0 |

$19,017 |

$0 |

$50,718 |

$0 |

$50,718 |

$0 |

$0 |

$0 |

$69,735 |

| 1987 |

$0 |

$19,017 |

$0 |

$19,017 |

$0 |

$58,108 |

$0 |

$58,108 |

$0 |

$0 |

$0 |

$77,125 |

| 1986 |

$0 |

$19,017 |

$0 |

$19,017 |

$0 |

$58,109 |

$0 |

$58,109 |

$0 |

$0 |

$0 |

$77,126 |

| 1985 |

$0 |

$19,017 |

$0 |

$19,017 |

$0 |

$58,108 |

$0 |

$58,108 |

$0 |

$0 |

$0 |

$77,125 |

| 1984 |

$0 |

$19,208 |

$0 |

$19,208 |

$0 |

$58,692 |

$0 |

$58,692 |

$0 |

$0 |

$0 |

$77,900 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2024 |

$2,359.30 |

$0.00 |

$2,359.30 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2023 |

$2,290.49 |

($53.17) |

$2,237.32 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2022 |

$2,221.43 |

$0.00 |

$2,221.43 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2021 |

$1,894.17 |

$0.00 |

$1,894.17 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2020 |

$1,733.76 |

$0.00 |

$1,733.76 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2019 |

$1,597.09 |

$0.00 |

$1,597.09 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2018 |

$1,504.77 |

$0.00 |

$1,504.77 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2017 |

$1,397.93 |

$0.00 |

$1,397.93 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2016 |

$1,272.49 |

$0.00 |

$1,272.49 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2015 |

$1,203.64 |

$0.00 |

$1,203.64 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2014 |

$1,144.35 |

$0.00 |

$1,144.35 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2013 |

$1,188.73 |

$0.00 |

$1,188.73 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2012 |

$1,286.42 |

$0.00 |

$1,286.42 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2011 |

$1,331.88 |

$0.00 |

$1,331.88 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2010 |

$1,352.02 |

$0.00 |

$1,352.02 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2009 |

$1,356.04 |

$0.00 |

$1,356.04 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2008 |

$1,288.61 |

$0.00 |

$1,288.61 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2007 |

$1,237.57 |

$0.00 |

$1,237.57 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2006 |

$1,071.88 |

$0.00 |

$1,071.88 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2005 |

$1,107.40 |

$0.00 |

$1,107.40 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2004 |

$1,121.31 |

$0.00 |

$1,121.31 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2003 |

$1,112.01 |

$0.00 |

$1,112.01 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2002 |

$1,027.16 |

$0.00 |

$1,027.16 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2001 |

$1,013.78 |

$0.00 |

$1,013.78 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2000 |

$984.49 |

$0.00 |

$984.49 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1999 |

$995.31 |

$0.00 |

$995.31 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1998 |

$863.62 |

$0.00 |

$863.62 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1997 |

$832.44 |

$0.00 |

$832.44 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1996 |

$752.11 |

$0.00 |

$752.11 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1995 |

$818.59 |

$0.00 |

$818.59 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1994 |

$907.63 |

$0.00 |

$907.63 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1993 |

$775.10 |

$0.00 |

$775.10 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1992 |

$711.86 |

$0.00 |

$711.86 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1991 |

$654.36 |

$0.00 |

$654.36 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1990 |

$630.48 |

$0.00 |

$630.48 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1989 |

$640.08 |

$0.00 |

$640.08 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1988 |

$645.82 |

$0.00 |

$645.82 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1987 |

$704.40 |

$0.00 |

$704.40 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1986 |

$690.15 |

$0.00 |

$690.15 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1985 |

$696.16 |

$0.00 |

$696.16 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1984 |

$690.72 |

$0.00 |

$690.72 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

|

*The visual representation is a sum of taxes for the year(s) selected and is for reference only and no liability is assumed for any inaccuracies, incorrect data or variations.

|

|

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 163848-2020 |

10/13/2020 |

10/20/2020 |

REC |

MORAN, KEVIN P TEE |

JOHNSON, ROLAN M & SANDRA |

| 163847-2020 |

09/25/2020 |

10/20/2020 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

MORAN, KEVIN P SUBTEE |

| 118186-2017 |

11/29/2017 |

11/30/2017 |

RSUBTEE |

JPMORGAN CHASE BANK (ET AL) |

JOHNSON, ROLAN M & SANDRA |

| 111999-2017 |

11/07/2017 |

11/13/2017 |

D TR |

JOHNSON, ROLAN M & SANDRA |

SECURITY HOME MORTGAGE LLC |

| 27694-2012 |

03/21/2012 |

04/05/2012 |

RSUBTEE |

JPMORGAN CHASE BANK (ET AL) |

JOHNSON, ROLAN M & SANDRA |

| 22591-2012 |

02/27/2012 |

03/21/2012 |

RSUBTEE |

BANK OF AMERICA (ET AL) |

JOHNSON, ROLAN M & SANDRA |

| 19307-2012 |

03/05/2012 |

03/09/2012 |

D TR |

JOHNSON, ROLAN M & SANDRA |

JPMORGAN CHASE BANK |

| 75987-2008 |

06/24/2008 |

07/02/2008 |

REC |

RIVERS, ROD TEE |

JOHNSON, ROLAN M & SANDRA |

| 75986-2008 |

06/17/2008 |

07/02/2008 |

SUB TEE |

WASHINGTON MUTUAL BANK |

RIVERS, ROD SUCTEE |

| 72411-2008 |

06/17/2008 |

06/23/2008 |

REC |

FIDELITY NATIONAL TITLE INSURANCE COMPANY TEE |

DARR, JETTA |

| 72410-2008 |

06/17/2008 |

06/23/2008 |

SUB TEE |

USAA FEDERAL SAVINGS BANK |

JOHNSON, ROLAN M & SANDRA |

| 71391-2008 |

05/04/2008 |

06/20/2008 |

D TR |

JOHNSON, ROLAN M & SANDRA |

WASHINGTON MUTUAL BANK |

| 98160-2007 |

05/14/2007 |

07/06/2007 |

D TR |

JOHNSON, ROLAN M & SANDRA |

WASHINGTON MUTUAL BANK |

| 91534-2007 |

06/14/2007 |

06/22/2007 |

REC |

RIVERS, ROD TEE |

JOHNSON, ROLAN M & SANDRA |

| 91533-2007 |

06/12/2007 |

06/22/2007 |

SUB TEE |

WASHINGTON MUTUAL BANK |

RIVERS, ROD SUCTEE |

| 59009-2005 |

05/09/2005 |

06/02/2005 |

D TR |

JOHNSON, ROLAN M & SANDRA |

USAA FEDERAL SAVINGS BANK |

| 56123-2000 |

07/14/2000 |

07/19/2000 |

D TR |

JOHNSON, ROLAN M & SANDRA |

FLEET NATIONAL BANK |

| 49468-1998 |

04/27/1998 |

05/18/1998 |

REC |

RIVERS, ROD TEE |

JOHNSON, ROLAN M & SANDRA |

| 49467-1998 |

03/23/1998 |

05/18/1998 |

SUB TEE |

CHASE MORTGAGE SERVICES INC FKA (ET AL) |

RIVERS, ROD SUBTEE |

| 99974-1997 |

12/11/1997 |

12/16/1997 |

D TR |

JOHNSON, ROLAN M & SANDRA |

FLEET MORTGAGE CORP |

| 91277-1995 |

11/01/1995 |

12/29/1995 |

REC |

ZIONS FIRST NATIONAL BANK TEE |

CHRISTENSEN, CRAIG R & SUSAN P |

| 76846-1995 |

11/06/1995 |

11/08/1995 |

RESOL |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 66758-1995 |

09/27/1995 |

10/03/1995 |

D TR |

JOHNSON, ROLAN M & SANDRA |

CHASE MANHATTAN MORTGAGE CORPORATION |

| 66757-1995 |

09/27/1995 |

10/03/1995 |

WD |

JOHNSON, ROLAN & SANDRA |

JOHNSON, ROLAN M & SANDRA |

| 62987-1995 |

09/18/1995 |

09/21/1995 |

WD |

WILSON, KARL & MELANIE |

JOHNSON, ROLAN & SANDRA |

| 62986-1995 |

09/15/1995 |

09/21/1995 |

WD |

CHRISTENSEN, CRAIG R & SUSAN P |

WILSON, KARL & MELANIE |

| 39442-1980 |

11/12/1980 |

11/13/1980 |

NI |

WILSON, KARL & MELANIE |

JOHNSON, ROLAN & SANDRA |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 1/15/2025 9:19:14 PM |