Property Information

| Serial Number: 30:073:0216 |

Serial Life: 2008... |

|

|

Total Photos: 1

|

| |

|

|

| Property Address: 1698 S GOOSENEST DR - PAYSON |

|

| Mailing Address: 1698 GOOSENEST DR PAYSON, UT 84651-9502 |

|

| Acreage: 0.523416 |

|

| Last Document:

112019-2007

|

|

| Subdivision Map Filing |

|

| Legal Description:

COM S 0 DEG 31' 3" E 1033.041 FT & W 3057.978 FT FR E 1/4 COR. SEC. 22, T9S, R2E, SLB&M.; N 62 DEG 42' 32" W 212.28 FT; S 25 DEG 8' 55" W 104.79 FT; S 62 DEG 42' 32" E 175.63 FT; S 72 DEG 36' 4" E 51.05 FT; N 16 DEG 55' 15" E 97.53 FT TO BEG. AREA 0.523 AC. |

|

- Owner Names

- Value History

- Tax History

- Location

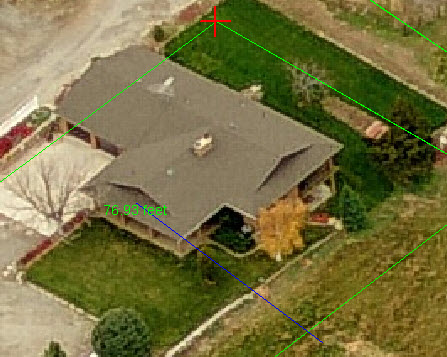

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$184,500 |

$0 |

$184,500 |

$0 |

$399,600 |

$0 |

$399,600 |

$0 |

$0 |

$0 |

$584,100 |

| 2023 |

$0 |

$184,500 |

$0 |

$184,500 |

$0 |

$399,200 |

$0 |

$399,200 |

$0 |

$0 |

$0 |

$583,700 |

| 2022 |

$0 |

$196,700 |

$0 |

$196,700 |

$0 |

$354,300 |

$0 |

$354,300 |

$0 |

$0 |

$0 |

$551,000 |

| 2021 |

$0 |

$140,500 |

$0 |

$140,500 |

$0 |

$266,400 |

$0 |

$266,400 |

$0 |

$0 |

$0 |

$406,900 |

| 2020 |

$0 |

$117,100 |

$0 |

$117,100 |

$0 |

$266,400 |

$0 |

$266,400 |

$0 |

$0 |

$0 |

$383,500 |

| 2019 |

$0 |

$95,400 |

$0 |

$95,400 |

$0 |

$242,200 |

$0 |

$242,200 |

$0 |

$0 |

$0 |

$337,600 |

| 2018 |

$0 |

$78,100 |

$0 |

$78,100 |

$0 |

$226,000 |

$0 |

$226,000 |

$0 |

$0 |

$0 |

$304,100 |

| 2017 |

$0 |

$65,000 |

$0 |

$65,000 |

$0 |

$226,000 |

$0 |

$226,000 |

$0 |

$0 |

$0 |

$291,000 |

| 2016 |

$0 |

$50,300 |

$0 |

$50,300 |

$0 |

$184,500 |

$0 |

$184,500 |

$0 |

$0 |

$0 |

$234,800 |

| 2015 |

$0 |

$45,100 |

$0 |

$45,100 |

$0 |

$174,100 |

$0 |

$174,100 |

$0 |

$0 |

$0 |

$219,200 |

| 2014 |

$0 |

$45,100 |

$0 |

$45,100 |

$0 |

$174,100 |

$0 |

$174,100 |

$0 |

$0 |

$0 |

$219,200 |

| 2013 |

$0 |

$39,700 |

$0 |

$39,700 |

$0 |

$174,100 |

$0 |

$174,100 |

$0 |

$0 |

$0 |

$213,800 |

| 2012 |

$0 |

$39,700 |

$0 |

$39,700 |

$0 |

$155,500 |

$0 |

$155,500 |

$0 |

$0 |

$0 |

$195,200 |

| 2011 |

$0 |

$40,700 |

$0 |

$40,700 |

$0 |

$165,700 |

$0 |

$165,700 |

$0 |

$0 |

$0 |

$206,400 |

| 2010 |

$0 |

$25,800 |

$0 |

$25,800 |

$0 |

$193,609 |

$0 |

$193,609 |

$0 |

$0 |

$0 |

$219,409 |

| 2009 |

$0 |

$25,800 |

$0 |

$25,800 |

$0 |

$199,200 |

$0 |

$199,200 |

$0 |

$0 |

$0 |

$225,000 |

| 2008 |

$0 |

$25,800 |

$0 |

$25,800 |

$0 |

$155,000 |

$0 |

$155,000 |

$0 |

$0 |

$0 |

$180,800 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2024 |

$3,156.65 |

$0.00 |

$3,156.65 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2023 |

$3,145.82 |

$0.00 |

$3,145.82 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2022 |

$3,019.29 |

$0.00 |

$3,019.29 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2021 |

$2,527.54 |

$0.00 |

$2,527.54 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2020 |

$2,434.92 |

$0.00 |

$2,434.92 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2019 |

$2,090.76 |

$0.00 |

$2,090.76 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2018 |

$1,954.04 |

$0.00 |

$1,954.04 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2017 |

$1,912.12 |

$0.00 |

$1,912.12 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2016 |

$1,553.04 |

$0.00 |

$1,553.04 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2015 |

$1,459.86 |

$0.00 |

$1,459.86 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2014 |

$1,449.37 |

$0.00 |

$1,449.37 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2013 |

$1,479.75 |

$0.00 |

$1,479.75 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2012 |

$1,371.42 |

$0.00 |

$1,371.42 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2011 |

$1,415.71 |

$0.00 |

$1,415.71 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2010 |

$1,467.41 |

$0.00 |

$1,467.41 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2009 |

$1,425.23 |

$0.00 |

$1,425.23 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2008 |

$1,065.30 |

$0.00 |

$1,065.30 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

|

*The visual representation is a sum of taxes for the year(s) selected and is for reference only and no liability is assumed for any inaccuracies, incorrect data or variations.

|

|

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 59992-2008 |

05/06/2008 |

05/21/2008 |

MOD AGR |

WILLIAMS, NATHAN D & NATHAN D (ET AL) |

USAA FEDERAL SAVINGS BANK |

| 25333-2008 |

03/04/2008 |

03/04/2008 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 132535-2007 |

08/30/2007 |

09/10/2007 |

D TR |

WILLIAMS, NATHAN D & NATHAN D (ET AL) |

USAA FEDERAL SAVINGS BANK |

| 124441-2007 |

08/24/2007 |

08/24/2007 |

R FARM |

UTAH COUNTY TREASURER |

STAHELI, MAX S & REETA B |

| 112019-2007 |

07/20/2007 |

08/02/2007 |

WD |

STAHELI, MAX S & REETA B |

WILLIAMS, MARYANNE W & NATHAN D TEE |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 1/5/2025 1:55:45 AM |