Property Information

| Serial Number: 35:538:0005 |

Serial Life: 2008... |

|

|

Total Photos: 1

|

| |

|

|

| Property Address: 1536 N 500 EAST - PLEASANT GROVE |

|

| Mailing Address: 1585 N MURDOCK DR PLEASANT GROVE, UT 84062-8079 |

|

| Acreage: 0.376 |

|

| Last Document:

10227-2007

|

|

| Subdivision Map Filing |

|

| Legal Description:

LOT 5, PLAT B, BIG SPRINGS RANCH SUBDV. AREA 0.376 AC. |

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

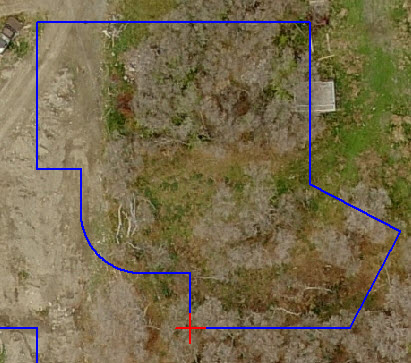

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$0 |

$65,800 |

$65,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$65,800 |

| 2023 |

$0 |

$0 |

$59,800 |

$59,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$59,800 |

| 2022 |

$0 |

$0 |

$62,900 |

$62,900 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$62,900 |

| 2021 |

$0 |

$0 |

$33,100 |

$33,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$33,100 |

| 2020 |

$0 |

$0 |

$30,100 |

$30,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$30,100 |

| 2019 |

$0 |

$0 |

$30,100 |

$30,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$30,100 |

| 2018 |

$0 |

$0 |

$30,100 |

$30,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$30,100 |

| 2017 |

$0 |

$0 |

$30,100 |

$30,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$30,100 |

| 2016 |

$0 |

$0 |

$22,600 |

$22,600 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$22,600 |

| 2015 |

$0 |

$0 |

$22,600 |

$22,600 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$22,600 |

| 2014 |

$0 |

$0 |

$18,800 |

$18,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$18,800 |

| 2013 |

$0 |

$0 |

$22,600 |

$22,600 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$22,600 |

| 2012 |

$0 |

$49,400 |

$0 |

$49,400 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$49,400 |

| 2011 |

$0 |

$49,400 |

$0 |

$49,400 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$49,400 |

| 2010 |

$0 |

$71,780 |

$0 |

$71,780 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$71,780 |

| 2009 |

$0 |

$83,900 |

$0 |

$83,900 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$83,900 |

| 2008 |

$0 |

$89,300 |

$0 |

$89,300 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$89,300 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2024 |

$563.84 |

$0.00 |

$563.84 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2023 |

$489.46 |

($11.36) |

$478.10 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2022 |

$517.42 |

$0.00 |

$517.42 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2021 |

$325.14 |

$0.00 |

$325.14 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2020 |

$301.60 |

$0.00 |

$301.60 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2019 |

$291.64 |

$0.00 |

$291.64 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2018 |

$308.43 |

$0.00 |

$308.43 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2017 |

$318.64 |

$0.00 |

$318.64 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2016 |

$247.81 |

$0.00 |

$247.81 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2015 |

$261.69 |

$0.00 |

$261.69 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2014 |

$219.75 |

$0.00 |

$219.75 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2013 |

$286.32 |

$0.00 |

$286.32 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2012 |

$639.78 |

$0.00 |

$639.78 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2011 |

$635.98 |

$0.00 |

$635.98 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2010 |

$864.66 |

$0.00 |

$864.66 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2009 |

$932.21 |

$0.00 |

$932.21 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2008 |

$917.65 |

$0.00 |

$917.65 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

|

*The visual representation is a sum of taxes for the year(s) selected and is for reference only and no liability is assumed for any inaccuracies, incorrect data or variations.

|

|

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 27947-2015 |

03/10/2015 |

04/06/2015 |

REC |

BANK OF AMERICAN FORK TEE |

BINGHAM, ROBERT I & RONNIE JEANNE |

| 82321-2013 |

08/14/2013 |

08/27/2013 |

REC |

BANK OF AMERICAN FORK TEE |

BINGHAM, ROBERT I & RONNIE JEANNE |

| 112864-2009 |

10/26/2009 |

10/28/2009 |

REC |

BANK OF AMERICAN FORK TEE |

BINGHAM, ROBERT I & RONNIE JEANNE |

| 97833-2008 |

09/03/2008 |

09/03/2008 |

REC |

TITLE WEST TITLE COMPANY TEE |

BINGHAM, ROBERT I & RONNIE JEANNE |

| 71927-2007 |

05/15/2007 |

05/15/2007 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 46386-2007 |

03/26/2007 |

03/30/2007 |

PRO COV |

BINGHAM, ROBERT |

WHOM OF INTEREST |

| 36555-2007 |

03/12/2007 |

03/13/2007 |

D TR |

BINGHAM, ROBERT I & RONNIE JEANNE (ET AL) |

BANK OF AMERICAN FORK |

| 10227-2007 |

10/03/2006 |

01/22/2007 |

S PLAT |

D SCOTT NUTTALL CONSTRUCTION (ET AL) |

BIG SPRINGS RANCH PLAT B |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/22/2024 7:14:47 AM |