Property Information

| Serial Number: 52:429:0011 |

Serial Life: 1994... |

|

|

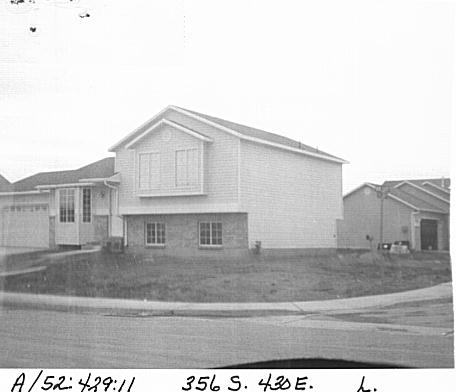

Total Photos: 1

|

| |

|

|

| Property Address: 356 S 430 EAST - LEHI |

|

| Mailing Address: 356 S 430 E LEHI, UT 84043-2268 |

|

| Acreage: 0.187 |

|

| Last Document:

8909-1994

|

|

| Subdivision Map Filing |

|

| Legal Description:

LOT 11, PLAT A, SOUTHTOWNE ESTATES. AREA 0.187 AC. |

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$168,800 |

$0 |

$168,800 |

$0 |

$232,300 |

$0 |

$232,300 |

$0 |

$0 |

$0 |

$401,100 |

| 2023 |

$0 |

$163,900 |

$0 |

$163,900 |

$0 |

$234,700 |

$0 |

$234,700 |

$0 |

$0 |

$0 |

$398,600 |

| 2022 |

$0 |

$167,200 |

$0 |

$167,200 |

$0 |

$245,400 |

$0 |

$245,400 |

$0 |

$0 |

$0 |

$412,600 |

| 2021 |

$0 |

$104,500 |

$0 |

$104,500 |

$0 |

$200,000 |

$0 |

$200,000 |

$0 |

$0 |

$0 |

$304,500 |

| 2020 |

$0 |

$96,800 |

$0 |

$96,800 |

$0 |

$186,900 |

$0 |

$186,900 |

$0 |

$0 |

$0 |

$283,700 |

| 2019 |

$0 |

$96,800 |

$0 |

$96,800 |

$0 |

$166,400 |

$0 |

$166,400 |

$0 |

$0 |

$0 |

$263,200 |

| 2018 |

$0 |

$96,800 |

$0 |

$96,800 |

$0 |

$144,700 |

$0 |

$144,700 |

$0 |

$0 |

$0 |

$241,500 |

| 2017 |

$0 |

$72,600 |

$0 |

$72,600 |

$0 |

$143,500 |

$0 |

$143,500 |

$0 |

$0 |

$0 |

$216,100 |

| 2016 |

$0 |

$55,900 |

$0 |

$55,900 |

$0 |

$143,500 |

$0 |

$143,500 |

$0 |

$0 |

$0 |

$199,400 |

| 2015 |

$0 |

$49,300 |

$0 |

$49,300 |

$0 |

$142,800 |

$0 |

$142,800 |

$0 |

$0 |

$0 |

$192,100 |

| 2014 |

$0 |

$46,500 |

$0 |

$46,500 |

$0 |

$127,400 |

$0 |

$127,400 |

$0 |

$0 |

$0 |

$173,900 |

| 2013 |

$0 |

$41,400 |

$0 |

$41,400 |

$0 |

$110,800 |

$0 |

$110,800 |

$0 |

$0 |

$0 |

$152,200 |

| 2012 |

$0 |

$33,300 |

$0 |

$33,300 |

$0 |

$120,400 |

$0 |

$120,400 |

$0 |

$0 |

$0 |

$153,700 |

| 2011 |

$0 |

$30,200 |

$0 |

$30,200 |

$0 |

$124,900 |

$0 |

$124,900 |

$0 |

$0 |

$0 |

$155,100 |

| 2010 |

$0 |

$30,000 |

$0 |

$30,000 |

$0 |

$138,215 |

$0 |

$138,215 |

$0 |

$0 |

$0 |

$168,215 |

| 2009 |

$0 |

$66,400 |

$0 |

$66,400 |

$0 |

$111,300 |

$0 |

$111,300 |

$0 |

$0 |

$0 |

$177,700 |

| 2008 |

$0 |

$79,100 |

$0 |

$79,100 |

$0 |

$105,300 |

$0 |

$105,300 |

$0 |

$0 |

$0 |

$184,400 |

| 2007 |

$0 |

$81,500 |

$0 |

$81,500 |

$0 |

$108,600 |

$0 |

$108,600 |

$0 |

$0 |

$0 |

$190,100 |

| 2006 |

$0 |

$51,900 |

$0 |

$51,900 |

$0 |

$107,800 |

$0 |

$107,800 |

$0 |

$0 |

$0 |

$159,700 |

| 2005 |

$0 |

$49,000 |

$0 |

$49,000 |

$0 |

$101,700 |

$0 |

$101,700 |

$0 |

$0 |

$0 |

$150,700 |

| 2004 |

$0 |

$35,000 |

$0 |

$35,000 |

$0 |

$108,000 |

$0 |

$108,000 |

$0 |

$0 |

$0 |

$143,000 |

| 2003 |

$0 |

$35,000 |

$0 |

$35,000 |

$0 |

$108,000 |

$0 |

$108,000 |

$0 |

$0 |

$0 |

$143,000 |

| 2002 |

$0 |

$35,000 |

$0 |

$35,000 |

$0 |

$108,000 |

$0 |

$108,000 |

$0 |

$0 |

$0 |

$143,000 |

| 2001 |

$0 |

$35,000 |

$0 |

$35,000 |

$0 |

$108,000 |

$0 |

$108,000 |

$0 |

$0 |

$0 |

$143,000 |

| 2000 |

$0 |

$34,937 |

$0 |

$34,937 |

$0 |

$108,330 |

$0 |

$108,330 |

$0 |

$0 |

$0 |

$143,267 |

| 1999 |

$0 |

$34,937 |

$0 |

$34,937 |

$0 |

$108,330 |

$0 |

$108,330 |

$0 |

$0 |

$0 |

$143,267 |

| 1998 |

$0 |

$30,918 |

$0 |

$30,918 |

$0 |

$95,867 |

$0 |

$95,867 |

$0 |

$0 |

$0 |

$126,785 |

| 1997 |

$0 |

$30,918 |

$0 |

$30,918 |

$0 |

$95,867 |

$0 |

$95,867 |

$0 |

$0 |

$0 |

$126,785 |

| 1996 |

$0 |

$30,096 |

$0 |

$30,096 |

$0 |

$93,319 |

$0 |

$93,319 |

$0 |

$0 |

$0 |

$123,415 |

| 1995 |

$0 |

$27,360 |

$0 |

$27,360 |

$0 |

$93,319 |

$0 |

$93,319 |

$0 |

$0 |

$0 |

$120,679 |

| 1994 |

$0 |

$16,000 |

$0 |

$16,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$16,000 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2024 |

$1,885.07 |

$0.00 |

$1,885.07 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2023 |

$1,725.34 |

$0.00 |

$1,725.34 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2022 |

$1,842.22 |

$0.00 |

$1,842.22 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2021 |

$1,635.06 |

$0.00 |

$1,635.06 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2020 |

$1,541.16 |

$0.00 |

$1,541.16 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2019 |

$1,375.36 |

$0.00 |

$1,375.36 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2018 |

$1,334.89 |

$0.00 |

$1,334.89 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2017 |

$1,235.74 |

$0.00 |

$1,235.74 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2016 |

$1,228.96 |

$0.00 |

$1,228.96 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2015 |

$1,247.26 |

$0.00 |

$1,247.26 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2014 |

$1,135.78 |

$0.00 |

$1,135.78 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2013 |

$1,077.85 |

$0.00 |

$1,077.85 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2012 |

$1,118.74 |

$0.00 |

$1,118.74 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2011 |

$1,121.76 |

$0.00 |

$1,121.76 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2010 |

$1,141.95 |

$0.00 |

$1,141.95 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2009 |

$1,071.76 |

$0.00 |

$1,071.76 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2008 |

$1,052.64 |

$0.00 |

$1,052.64 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2007 |

$1,056.32 |

$0.00 |

$1,056.32 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2006 |

$978.92 |

$0.00 |

$978.92 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2005 |

$1,042.69 |

$0.00 |

$1,042.69 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2004 |

$975.57 |

$0.00 |

$975.57 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2003 |

$962.91 |

$0.00 |

$962.91 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2002 |

$880.41 |

$0.00 |

$880.41 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2001 |

$876.48 |

$0.00 |

$876.48 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2000 |

$890.96 |

$0.00 |

$890.96 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1999 |

$857.63 |

$0.00 |

$857.63 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1998 |

$729.68 |

$0.00 |

$729.68 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1997 |

$722.77 |

$0.00 |

$722.77 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1996 |

$660.39 |

$0.00 |

$660.39 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1995 |

$721.41 |

$0.00 |

$721.41 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1994 |

$224.67 |

$0.00 |

$224.67 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

|

*The visual representation is a sum of taxes for the year(s) selected and is for reference only and no liability is assumed for any inaccuracies, incorrect data or variations.

|

|

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 51468-2012 |

06/01/2012 |

06/21/2012 |

RSUBTEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC (ET AL) |

BROADHEAD, JOHN WESTON & HOLLY DAWN |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 43937-2004 |

04/07/2004 |

04/19/2004 |

RSUBTEE |

WASHINGTON MUTUAL BANK (ET AL) |

BROADHEAD, JOHN WESTON & HOLLY DAWN |

| 12564-2004 |

01/29/2004 |

02/04/2004 |

D TR |

BROADHEAD, JOHN WESTON & HOLLY DAWN |

HOME LOAN CORPORATION |

| 80705-1996 |

07/03/1996 |

10/02/1996 |

AS |

ACCUBANC MORTGAGE CORPORATION DBA (ET AL) |

GREAT WESTERN BANK |

| 67998-1996 |

08/19/1996 |

08/20/1996 |

REC |

VTC INVESTMENTS INC DBA (ET AL) |

BROADHEAD, JOHN WESTON & HOLLY DAWN |

| 67997-1996 |

07/29/1996 |

08/20/1996 |

SUB TEE |

CHASE MORTGAGE SERVICES INC FKA (ET AL) |

WHOM OF INTEREST |

| 54889-1996 |

06/27/1996 |

07/02/1996 |

D TR |

BROADHEAD, JOHN WESTON & HOLLY DAWN |

ACCUBANC MORTGAGE CORPORATION DBA (ET AL) |

| 76846-1995 |

11/06/1995 |

11/08/1995 |

RESOL |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 43295-1995 |

06/01/1995 |

07/07/1995 |

QCD |

CARSON, KAYE W TEE (ET AL) |

CARSON, KAYE W (ET AL) |

| 33554-1995 |

03/20/1995 |

05/30/1995 |

AF DC |

WHOM OF INTEREST |

WILLES, MARIE T & MARIE THRASHER AKA |

| 16591-1995 |

03/13/1991 |

03/20/1995 |

QCD |

WILLES, MARIE T & CASSEL S TEE (ET AL) |

WILLES, MARIE T TEE |

| 16590-1995 |

03/13/1991 |

03/20/1995 |

AF DC |

WILLES, CASSEL S DEC |

WILLES, MARIE T TEE |

| 92121-1994 |

12/02/1994 |

12/06/1994 |

REC |

WESTERN COMMUNITY BANK TEE |

PATTERSON, RAND |

| 91111-1994 |

11/28/1994 |

11/30/1994 |

D TR |

BROADHEAD, JOHN WESTON & HOLLY DAWN |

CHASE MANHATTAN MORTGAGE CORPORATION |

| 91110-1994 |

11/28/1994 |

11/30/1994 |

WD |

PATTERSON, RAND |

BROADHEAD, JOHN WESTON & HOLLY DAWN |

| 83728-1994 |

10/29/1994 |

10/31/1994 |

REC |

PROVO ABSTRACT COMPANY TEE |

HARGRAVES, MICHAEL J & HOLLY D |

| 8910-1994 |

01/28/1994 |

01/31/1994 |

D TR |

PATTERSON, RAND |

WESTERN COMMUNITY BANK |

| 8909-1994 |

|

01/31/1994 |

WD |

HADFIELD, JOHN L |

PATTERSON, RAND |

| 55793-1993 |

06/24/1993 |

08/17/1993 |

REC |

GUARDIAN TITLE COMPANY OF UTAH COUNTY TEE (ET AL) |

HADFIELD, JOHN L |

| 39554-1993 |

05/20/1993 |

06/17/1993 |

DECLCOV |

HADFIELD, JOHN TEE |

WHOM OF INTEREST |

| 27017-1993 |

04/13/1993 |

04/30/1993 |

S PLAT |

HADFIELD, JOHN L |

SOUTHTOWNE ESTATES PLAT A |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/2/2024 5:45:16 PM |