Property Information

| Serial Number: 52:473:0022 |

Serial Life: 1995... |

|

|

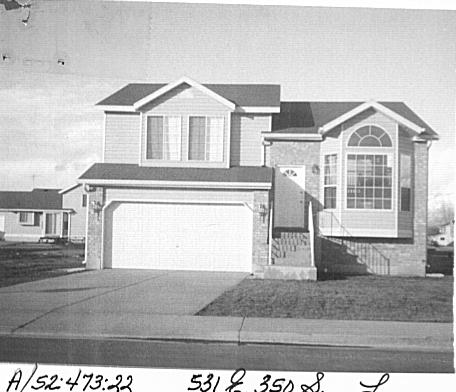

Total Photos: 1

|

| |

|

|

| Property Address: 531 E 350 SOUTH - LEHI |

|

| Mailing Address: 531 E 350 S LEHI, UT 84043-2270 |

|

| Acreage: 0.187 |

|

| Last Document:

70481-1994

|

|

| Subdivision Map Filing |

|

| Legal Description:

LOT 22, PLAT C, SOUTHTOWNE ESTATES SUBDV. AREA 0.187 AC. |

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$168,800 |

$0 |

$168,800 |

$0 |

$223,800 |

$0 |

$223,800 |

$0 |

$0 |

$0 |

$392,600 |

| 2023 |

$0 |

$163,900 |

$0 |

$163,900 |

$0 |

$255,300 |

$0 |

$255,300 |

$0 |

$0 |

$0 |

$419,200 |

| 2022 |

$0 |

$167,200 |

$0 |

$167,200 |

$0 |

$261,700 |

$0 |

$261,700 |

$0 |

$0 |

$0 |

$428,900 |

| 2021 |

$0 |

$104,500 |

$0 |

$104,500 |

$0 |

$213,300 |

$0 |

$213,300 |

$0 |

$0 |

$0 |

$317,800 |

| 2020 |

$0 |

$96,800 |

$0 |

$96,800 |

$0 |

$199,300 |

$0 |

$199,300 |

$0 |

$0 |

$0 |

$296,100 |

| 2019 |

$0 |

$96,800 |

$0 |

$96,800 |

$0 |

$173,300 |

$0 |

$173,300 |

$0 |

$0 |

$0 |

$270,100 |

| 2018 |

$0 |

$96,800 |

$0 |

$96,800 |

$0 |

$150,700 |

$0 |

$150,700 |

$0 |

$0 |

$0 |

$247,500 |

| 2017 |

$0 |

$72,600 |

$0 |

$72,600 |

$0 |

$150,700 |

$0 |

$150,700 |

$0 |

$0 |

$0 |

$223,300 |

| 2016 |

$0 |

$55,900 |

$0 |

$55,900 |

$0 |

$149,600 |

$0 |

$149,600 |

$0 |

$0 |

$0 |

$205,500 |

| 2015 |

$0 |

$49,300 |

$0 |

$49,300 |

$0 |

$147,300 |

$0 |

$147,300 |

$0 |

$0 |

$0 |

$196,600 |

| 2014 |

$0 |

$46,500 |

$0 |

$46,500 |

$0 |

$135,400 |

$0 |

$135,400 |

$0 |

$0 |

$0 |

$181,900 |

| 2013 |

$0 |

$41,400 |

$0 |

$41,400 |

$0 |

$117,700 |

$0 |

$117,700 |

$0 |

$0 |

$0 |

$159,100 |

| 2012 |

$0 |

$33,300 |

$0 |

$33,300 |

$0 |

$127,900 |

$0 |

$127,900 |

$0 |

$0 |

$0 |

$161,200 |

| 2011 |

$0 |

$30,200 |

$0 |

$30,200 |

$0 |

$132,600 |

$0 |

$132,600 |

$0 |

$0 |

$0 |

$162,800 |

| 2010 |

$0 |

$30,000 |

$0 |

$30,000 |

$0 |

$146,616 |

$0 |

$146,616 |

$0 |

$0 |

$0 |

$176,616 |

| 2009 |

$0 |

$66,400 |

$0 |

$66,400 |

$0 |

$119,200 |

$0 |

$119,200 |

$0 |

$0 |

$0 |

$185,600 |

| 2008 |

$0 |

$79,100 |

$0 |

$79,100 |

$0 |

$109,900 |

$0 |

$109,900 |

$0 |

$0 |

$0 |

$189,000 |

| 2007 |

$0 |

$81,500 |

$0 |

$81,500 |

$0 |

$113,300 |

$0 |

$113,300 |

$0 |

$0 |

$0 |

$194,800 |

| 2006 |

$0 |

$51,900 |

$0 |

$51,900 |

$0 |

$105,500 |

$0 |

$105,500 |

$0 |

$0 |

$0 |

$157,400 |

| 2005 |

$0 |

$49,000 |

$0 |

$49,000 |

$0 |

$99,500 |

$0 |

$99,500 |

$0 |

$0 |

$0 |

$148,500 |

| 2004 |

$0 |

$27,327 |

$0 |

$27,327 |

$0 |

$101,957 |

$0 |

$101,957 |

$0 |

$0 |

$0 |

$129,284 |

| 2003 |

$0 |

$27,327 |

$0 |

$27,327 |

$0 |

$101,957 |

$0 |

$101,957 |

$0 |

$0 |

$0 |

$129,284 |

| 2002 |

$0 |

$27,327 |

$0 |

$27,327 |

$0 |

$101,957 |

$0 |

$101,957 |

$0 |

$0 |

$0 |

$129,284 |

| 2001 |

$0 |

$27,327 |

$0 |

$27,327 |

$0 |

$101,957 |

$0 |

$101,957 |

$0 |

$0 |

$0 |

$129,284 |

| 2000 |

$0 |

$25,539 |

$0 |

$25,539 |

$0 |

$92,764 |

$0 |

$92,764 |

$0 |

$0 |

$0 |

$118,303 |

| 1999 |

$0 |

$25,539 |

$0 |

$25,539 |

$0 |

$92,764 |

$0 |

$92,764 |

$0 |

$0 |

$0 |

$118,303 |

| 1998 |

$0 |

$22,601 |

$0 |

$22,601 |

$0 |

$82,092 |

$0 |

$82,092 |

$0 |

$0 |

$0 |

$104,693 |

| 1997 |

$0 |

$22,601 |

$0 |

$22,601 |

$0 |

$82,092 |

$0 |

$82,092 |

$0 |

$0 |

$0 |

$104,693 |

| 1996 |

$0 |

$22,000 |

$0 |

$22,000 |

$0 |

$79,910 |

$0 |

$79,910 |

$0 |

$0 |

$0 |

$101,910 |

| 1995 |

$0 |

$20,000 |

$0 |

$20,000 |

$0 |

$79,910 |

$0 |

$79,910 |

$0 |

$0 |

$0 |

$99,910 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2024 |

$1,845.12 |

$0.00 |

$1,845.12 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2023 |

$1,814.51 |

$0.00 |

$1,814.51 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2022 |

$1,915.00 |

$0.00 |

$1,915.00 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2021 |

$1,706.47 |

$0.00 |

$1,706.47 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2020 |

$1,608.52 |

$0.00 |

$1,608.52 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2019 |

$1,411.42 |

$0.00 |

$1,411.42 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2018 |

$1,368.06 |

$0.00 |

$1,368.06 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2017 |

$1,276.91 |

$0.00 |

$1,276.91 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2016 |

$1,266.56 |

$0.00 |

$1,266.56 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2015 |

$1,276.47 |

$0.00 |

$1,276.47 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2014 |

$1,188.03 |

$0.00 |

$1,188.03 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2013 |

$1,126.71 |

$0.00 |

$1,126.71 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2012 |

$1,173.33 |

$0.00 |

$1,173.33 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2011 |

$1,177.45 |

$0.00 |

$1,177.45 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2010 |

$1,198.99 |

$0.00 |

$1,198.99 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2009 |

$1,119.41 |

$0.00 |

$1,119.41 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2008 |

$1,078.90 |

$0.00 |

$1,078.90 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2007 |

$1,082.44 |

$0.00 |

$1,082.44 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2006 |

$964.82 |

$0.00 |

$964.82 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2005 |

$1,027.47 |

$0.00 |

$1,027.47 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2004 |

$882.00 |

$0.00 |

$882.00 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2003 |

$870.55 |

$0.00 |

$870.55 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2002 |

$795.96 |

$0.00 |

$795.96 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2001 |

$792.41 |

$0.00 |

$792.41 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2000 |

$735.70 |

$0.00 |

$735.70 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1999 |

$708.18 |

$0.00 |

$708.18 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1998 |

$602.54 |

$0.00 |

$602.54 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1997 |

$596.84 |

$0.00 |

$596.84 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1996 |

$545.32 |

$0.00 |

$545.32 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1995 |

$597.26 |

$0.00 |

$597.26 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

|

*The visual representation is a sum of taxes for the year(s) selected and is for reference only and no liability is assumed for any inaccuracies, incorrect data or variations.

|

|

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 58443-2022 |

05/11/2022 |

05/12/2022 |

RSUBTEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC (ET AL) |

MCGRAW, RYAN |

| 52148-2022 |

04/22/2022 |

04/27/2022 |

D TR |

MCGRAW, RYAN |

FIRST COLONY MORTGAGE CORPORATION |

| 94672-2021 |

05/07/2021 |

05/20/2021 |

REC |

FIRST AMERICAN TITLE INSURANCE COMPANY TEE |

MCGRAW, RYAN |

| 94671-2021 |

05/07/2021 |

05/20/2021 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

FIRST AMERICAN TITLE INSURANCE COMPANY SUBTEE |

| 83872-2021 |

04/27/2021 |

05/03/2021 |

D TR |

MCGRAW, RYAN |

FIRST COLONY MORTGAGE CORPORATION |

| 42954-2020 |

04/02/2020 |

04/03/2020 |

RSUBTEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC (ET AL) |

MCGRAW, RYAN |

| 32816-2020 |

03/09/2020 |

03/13/2020 |

D TR |

MCGRAW, RYAN |

FIRST COLONY MORTGAGE CORPORATION |

| 21567-2018 |

02/22/2018 |

03/06/2018 |

REC |

WELLS FARGO FINANCIAL NATIONAL BANK TEE |

PHILLIPS, DAWN D & DAVID |

| 21566-2018 |

02/22/2018 |

03/06/2018 |

REC |

WELLS FARGO BANK |

WELLS FARGO FINANCIAL NATIONAL BANK SUCTEE |

| 19824-2018 |

02/14/2018 |

03/01/2018 |

RSUBTEE |

UTAH FIRST FEDERAL CREDIT UNION (ET AL) |

PHILLIPS, DAWN D & DAVID |

| 13995-2018 |

02/08/2018 |

02/12/2018 |

D TR |

MCGRAW, RYAN |

FIRST COLONY MORTGAGE CORPORATION |

| 13994-2018 |

02/08/2017 |

02/12/2018 |

WD |

PHILLIPS, DAWN D & DAVID |

MCGRAW, RYAN |

| 45906-2017 |

05/08/2017 |

05/12/2017 |

TR D |

PHILLIPS, DAVID & DAWN D |

UTAH FIRST FEDERAL CREDIT UNION |

| 5374-2016 |

01/21/2016 |

01/21/2016 |

REC |

WELLS FARGO FINANCIAL NATIONAL BANK TEE |

PHILLIPS, DAVID R & DAWN DEIDRICH |

| 5373-2016 |

01/21/2016 |

01/21/2016 |

SUB TEE |

WELLS FARGO BANK |

WELLS FARGO FINANCIAL NATIONAL BANK SUCTEE |

| 4963-2016 |

01/12/2016 |

01/20/2016 |

RSUBTEE |

UTAH FIRST FEDERAL CREDIT UNION (ET AL) |

PHILLIPS, DAVID R & DAWN DIEDERICH |

| 446-2016 |

12/30/2015 |

01/05/2016 |

D TR |

PHILLIPS, DAWN D & DAVID |

WELLS FARGO BANK |

| 445-2016 |

12/30/2015 |

01/05/2016 |

WD |

PHILLIPS, DAVID R & DAWN DIEDERICH |

PHILLIPS, DAWN D & DAVID |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 85000-2008 |

07/28/2008 |

07/29/2008 |

D TR |

PHILLIPS, DAVID R & DAWN DIEDERICH |

UTAH FIRST FEDERAL CREDIT UNION |

| 17788-2006 |

01/31/2006 |

02/14/2006 |

RSUBTEE |

UTAH HOUSING CORPORATION (ET AL) |

PHILLIPS, DAVID R & DAWN DIEDERICH |

| 149136-2005 |

12/21/2005 |

12/27/2005 |

REC |

U S BANK TRUST COMPANY |

PHILLIPS, DAVID R & DAWN DIEDRICH (ET AL) |

| 137336-2005 |

11/22/2005 |

11/29/2005 |

D TR |

PHILLIPS, DAVID R & DAWN DIEDERICH |

WELLS FARGO BANK |

| 9402-1999 |

11/20/1998 |

01/27/1999 |

D TR |

PHILLIPS, DAVID R & DAWN D |

US BANK NATIONAL ASSOCIATION |

| 136141-1998 |

12/10/1998 |

12/29/1998 |

REC |

LUNDBERG, J SCOTT TEE |

PHILLIPS, DAWN DIEDERICH & DAVID R |

| 136140-1998 |

07/24/1998 |

12/29/1998 |

SUB TEE |

FIRST UNION NATIONAL BANK FKA (ET AL) |

LUNDBERG, SCOTT SUCTEE |

| 59427-1998 |

04/29/1998 |

06/15/1998 |

REC |

RESIDENTIAL FUNDING CORPORATION SUCTEE |

PHILLIPS, DAVID R & DAWN DIEDERICH |

| 59426-1998 |

04/29/1998 |

06/15/1998 |

SUB TEE |

RESIDENTIAL FUNDING CORPORATION |

RESIDENTIAL FUNDING CORPORATION SUCTEE |

| 59425-1998 |

11/21/1996 |

06/15/1998 |

AS |

COM UNITY LENDING INCORPORATED |

RESIDENTIAL FUNDING CORPORATION |

| 54971-1997 |

07/07/1997 |

07/21/1997 |

REC |

ZIONS FIRST NATIONAL BANK TEE |

PHILLIPS, DAVID R & DAWN DIEDERICH |

| 54812-1997 |

07/15/1997 |

07/21/1997 |

D TR |

PHILLIPS, DAWN DIEDERICH & DAVID R |

SIGNET BANK |

| 97667-1996 |

11/22/1996 |

12/04/1996 |

D TR |

PHILLIPS, DAVID R & DAWN DIEDERICH |

COM UNITY LENDING INC |

| 76846-1995 |

11/06/1995 |

11/08/1995 |

RESOL |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 46052-1995 |

07/17/1995 |

07/18/1995 |

RC |

ZIONS FIRST NATIONAL BANK |

WHOM OF INTEREST |

| 46051-1995 |

07/17/1995 |

07/18/1995 |

D TR |

PHILLIPS, DAVID R & DAWN DIEDERICH |

ZIONS FIRST NATIONAL BANK |

| 16591-1995 |

03/13/1991 |

03/20/1995 |

QCD |

WILLES, MARIE T & CASSEL S TEE (ET AL) |

WILLES, MARIE T TEE |

| 16590-1995 |

03/13/1991 |

03/20/1995 |

AF DC |

WILLES, CASSEL S DEC |

WILLES, MARIE T TEE |

| 95614-1994 |

09/20/1994 |

12/20/1994 |

AS |

FIRST SECURITY BANK OF UTAH |

UTAH HOUSING FINANCE AGENCY |

| 95613-1994 |

09/01/1994 |

12/20/1994 |

D TR |

PHILLIPS, DAVID H & DAWN DIEDERICH |

FIRST SECURITY BANK OF UTAH |

| 80152-1994 |

10/12/1994 |

10/14/1994 |

REC |

GUARDIAN TITLE COMPANY TEE |

IVORY HOMES |

| 70482-1994 |

09/01/1994 |

09/02/1994 |

D TR |

PHILLIPS, DAVID R & DAWN DIEDERICH |

FIRST SECURITY BANK OF UTAH |

| 70481-1994 |

09/01/1994 |

09/02/1994 |

SP WD |

IVORY HOMES BY (ET AL) |

PHILLIPS, DAVID R & DAWN DIEDERICH |

| 49280-1994 |

06/08/1994 |

06/13/1994 |

D TR |

IVORY, ELLIS R G PTNR (ET AL) |

FIRST SECURITY BANK OF UTAH |

| 49279-1994 |

06/13/1994 |

06/13/1994 |

WD |

HADFIELD, JOHN L |

IVORY HOMES |

| 26452-1994 |

03/28/1994 |

03/30/1994 |

WD |

HADFIELD FAMILY LIMITED PARTNERSHIP BY (ET AL) |

HADFIELD, JOHN L |

| 6970-1994 |

01/18/1994 |

01/26/1994 |

REC |

GUARDIAN TITLE COMPANY OF UTAH COUNTY TEE |

HADFIELD, JOHN L |

| 1844-1994 |

08/10/1993 |

01/06/1994 |

S PLAT |

HADFIELD, JOHN L |

SOUTHTOWNE ESTATES PLAT C |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/20/2024 5:40:21 AM |