Property Information

| Serial Number: 55:511:0002 |

Serial Life: 2002... |

|

|

Total Photos: 1

|

| |

|

|

| Property Address: 829 N 530 EAST - OREM |

|

| Mailing Address: 829 N 530 E OREM, UT 84097-3301 |

|

| Acreage: 0.394 |

|

| Last Document:

104009-2007

|

|

| Subdivision Map Filing |

|

| Legal Description:

LOT 2, PLAT A, WHITE HORSE ACRES SUBDV. AREA 0.394 AC. |

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

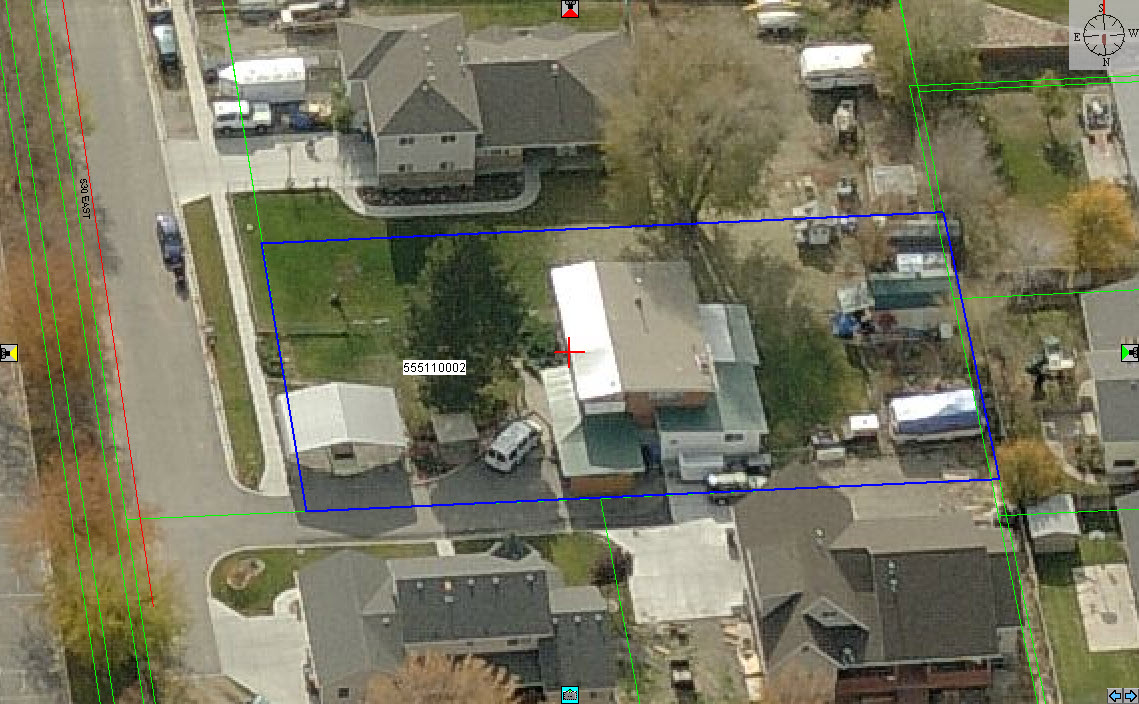

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$259,900 |

$0 |

$259,900 |

$0 |

$370,600 |

$0 |

$370,600 |

$0 |

$0 |

$0 |

$630,500 |

| 2023 |

$0 |

$259,900 |

$0 |

$259,900 |

$0 |

$378,100 |

$0 |

$378,100 |

$0 |

$0 |

$0 |

$638,000 |

| 2022 |

$0 |

$277,100 |

$0 |

$277,100 |

$0 |

$322,200 |

$0 |

$322,200 |

$0 |

$0 |

$0 |

$599,300 |

| 2021 |

$0 |

$163,000 |

$0 |

$163,000 |

$0 |

$266,300 |

$0 |

$266,300 |

$0 |

$0 |

$0 |

$429,300 |

| 2020 |

$0 |

$130,400 |

$0 |

$130,400 |

$0 |

$261,100 |

$0 |

$261,100 |

$0 |

$0 |

$0 |

$391,500 |

| 2019 |

$0 |

$118,100 |

$0 |

$118,100 |

$0 |

$234,800 |

$0 |

$234,800 |

$0 |

$0 |

$0 |

$352,900 |

| 2018 |

$0 |

$114,100 |

$0 |

$114,100 |

$0 |

$217,500 |

$0 |

$217,500 |

$0 |

$0 |

$0 |

$331,600 |

| 2017 |

$0 |

$105,900 |

$0 |

$105,900 |

$0 |

$201,500 |

$0 |

$201,500 |

$0 |

$0 |

$0 |

$307,400 |

| 2016 |

$0 |

$77,400 |

$0 |

$77,400 |

$0 |

$197,200 |

$0 |

$197,200 |

$0 |

$0 |

$0 |

$274,600 |

| 2015 |

$0 |

$70,100 |

$0 |

$70,100 |

$0 |

$174,200 |

$0 |

$174,200 |

$0 |

$0 |

$0 |

$244,300 |

| 2014 |

$0 |

$69,300 |

$0 |

$69,300 |

$0 |

$160,900 |

$0 |

$160,900 |

$0 |

$0 |

$0 |

$230,200 |

| 2013 |

$0 |

$56,700 |

$0 |

$56,700 |

$0 |

$160,900 |

$0 |

$160,900 |

$0 |

$0 |

$0 |

$217,600 |

| 2012 |

$0 |

$70,600 |

$0 |

$70,600 |

$0 |

$184,900 |

$0 |

$184,900 |

$0 |

$0 |

$0 |

$255,500 |

| 2011 |

$0 |

$77,600 |

$0 |

$77,600 |

$0 |

$108,500 |

$0 |

$108,500 |

$0 |

$0 |

$0 |

$186,100 |

| 2010 |

$0 |

$87,516 |

$0 |

$87,516 |

$0 |

$110,385 |

$0 |

$110,385 |

$0 |

$0 |

$0 |

$197,901 |

| 2009 |

$0 |

$108,500 |

$0 |

$108,500 |

$0 |

$91,400 |

$0 |

$91,400 |

$0 |

$0 |

$0 |

$199,900 |

| 2008 |

$0 |

$108,500 |

$0 |

$108,500 |

$0 |

$135,300 |

$0 |

$135,300 |

$0 |

$0 |

$0 |

$243,800 |

| 2007 |

$0 |

$113,000 |

$0 |

$113,000 |

$0 |

$140,900 |

$0 |

$140,900 |

$0 |

$0 |

$0 |

$253,900 |

| 2006 |

$0 |

$51,500 |

$0 |

$51,500 |

$0 |

$61,200 |

$0 |

$61,200 |

$0 |

$0 |

$0 |

$112,700 |

| 2005 |

$0 |

$49,000 |

$0 |

$49,000 |

$0 |

$58,240 |

$0 |

$58,240 |

$0 |

$0 |

$0 |

$107,240 |

| 2004 |

$0 |

$49,000 |

$0 |

$49,000 |

$0 |

$58,240 |

$0 |

$58,240 |

$0 |

$0 |

$0 |

$107,240 |

| 2003 |

$0 |

$49,000 |

$0 |

$49,000 |

$0 |

$58,240 |

$0 |

$58,240 |

$0 |

$0 |

$0 |

$107,240 |

| 2002 |

$0 |

$49,000 |

$0 |

$49,000 |

$0 |

$58,240 |

$0 |

$58,240 |

$0 |

$0 |

$0 |

$107,240 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2024 |

$2,835.93 |

$0.00 |

$2,835.93 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2023 |

$2,670.00 |

$0.00 |

$2,670.00 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2022 |

$2,588.80 |

$0.00 |

$2,588.80 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2021 |

$2,226.09 |

$0.00 |

$2,226.09 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2020 |

$2,065.61 |

$0.00 |

$2,065.61 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2019 |

$1,790.53 |

$0.00 |

$1,790.53 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2018 |

$1,760.88 |

$0.00 |

$1,760.88 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2017 |

$1,675.99 |

$0.00 |

$1,675.99 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2016 |

$1,623.57 |

$0.00 |

$1,623.57 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2015 |

$1,527.33 |

$0.00 |

$1,527.33 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2014 |

$1,445.76 |

$0.00 |

$1,445.76 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2013 |

$1,473.74 |

$0.00 |

$1,473.74 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2012 |

$1,766.12 |

$0.00 |

$1,766.12 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2011 |

$1,280.26 |

$0.00 |

$1,280.26 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2010 |

$1,274.59 |

$0.00 |

$1,274.59 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2009 |

$1,193.45 |

$0.00 |

$1,193.45 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2008 |

$1,348.81 |

$0.00 |

$1,348.81 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2007 |

$1,388.63 |

$0.00 |

$1,388.63 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2006 |

$656.36 |

$0.00 |

$656.36 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2005 |

$704.95 |

$0.00 |

$704.95 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2004 |

$692.45 |

$0.00 |

$692.45 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2003 |

$671.92 |

$0.00 |

$671.92 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2002 |

$614.06 |

$0.00 |

$614.06 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

|

*The visual representation is a sum of taxes for the year(s) selected and is for reference only and no liability is assumed for any inaccuracies, incorrect data or variations.

|

|

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 3175-2013 |

12/20/2012 |

01/10/2013 |

RSUBTEE |

WELLS FARGO BANK (ET AL) |

KARR, DONALD V & BARBARA J |

| 112291-2012 |

12/20/2012 |

12/20/2012 |

WD |

KARR, DONALD V & BARBARA J |

KARR, DONALD VERLE TEE |

| 108831-2012 |

11/21/2012 |

12/10/2012 |

D TR |

KARR, DONALD V & BARBARA J |

WELLS FARGO BANK |

| 91996-2012 |

10/23/2012 |

10/23/2012 |

WD |

KARR, DONALD VERLE TEE (ET AL) |

KARR, DONALD V & BARBARA J |

| 104009-2007 |

07/18/2007 |

07/18/2007 |

QCD |

KARR, DONALD VERLE & BARBARA JEAN |

KARR, DONALD VERLE TEE |

| 139473-2004 |

11/24/2004 |

12/13/2004 |

REC |

REAL ESTATE REPRESENTATIVE |

KARR, DONALD VERLE & ELIZABETH ANNETTE |

| 180961-2003 |

09/09/2003 |

11/14/2003 |

AS |

UTAH COMMUNITY FEDERAL CREDIT UNION |

WELLS FARGO HOME MORTGAGE INC |

| 171935-2003 |

10/07/2003 |

10/27/2003 |

REC |

HALLIDAY, PAUL M TEE |

KARR, DONALD V & BARBARA J |

| 171934-2003 |

10/07/2003 |

10/27/2003 |

SUB TEE |

CUNA MUTUAL MORTGAGE CORP FKA (ET AL) |

HALLIDAY, PAUL M TEE |

| 148237-2003 |

09/04/2003 |

09/09/2003 |

D TR |

KARR, DONALD V & BARBARA J |

UTAH COMMUNITY FEDERAL CREDIT UNION |

| 152110-2002 |

12/16/2002 |

12/16/2002 |

R LN |

CHRISTENSEN BROTHERS CONSTRUCTION INC |

WHOM OF INTEREST |

| 63338-2002 |

06/05/2002 |

06/05/2002 |

R LN |

GENEVA ROCK PRODUCTS INC |

WHOM OF INTEREST |

| 56533-2002 |

05/17/2002 |

05/17/2002 |

PR LN |

CHRISTENSEN BROTHERS CONSTRUCTION INC |

WHOM OF INTEREST |

| 40330-2002 |

02/06/2002 |

04/10/2002 |

SUB TEE |

PRINCIPAL WHOLESALE MORTGAGE INC |

PRINCIPAL LIFE INSURANCE COMPANY SUCTEE |

| 40329-2002 |

04/09/2002 |

04/10/2002 |

SUB AGR |

ROCKY MOUNTAIN ATV INC (ET AL) |

ZIONS FIRST NATIONAL BANK |

| 31729-2002 |

01/28/2002 |

03/20/2002 |

AS |

UTAH COMMUNITY FEDERAL CREDIT UNION |

CUNA MUTUAL MORTGAGE CORPORATION |

| 28782-2002 |

03/13/2002 |

03/13/2002 |

N LN |

KARR, DONALD & BARBARA |

GENEVA ROCK INC |

| 18046-2002 |

02/13/2002 |

02/13/2002 |

N LN |

KARR, DON |

CHRISTENSEN BROTHERS CONSTRUCTION INC |

| 13616-2002 |

01/23/2001 |

02/04/2002 |

REC |

UNIVERSAL CAMPUS FEDERAL CREDIT UNION |

KARR, DONALD VERLE & ELIZABETH ANNETTE |

| 13615-2002 |

01/23/2002 |

02/04/2002 |

SUB TEE |

UNIVERSAL CAMPUS FEDERAL CREDIT UNION |

UNIVERSAL CAMPUS FEDERAL CREDIT UNION SUBTEE |

| 10365-2002 |

01/23/2002 |

01/28/2002 |

D TR |

KARR, DONALD V & BARBARA J |

UTAH COMMUNITY FEDERAL CREDIT UNION |

| 32645-2001 |

03/30/2001 |

04/09/2001 |

S PLAT |

KARR, DONALD V & DONALD VERLE AKA (ET AL) |

WHITE HORSE ACRES PLAT A |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 1/12/2025 4:31:21 AM |