Property Valuation Information

- Serial Number : 071010016

- Tax Year : 2024

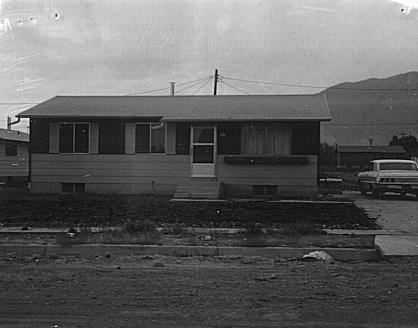

- Owner Names : MUNIZ, KAROLEE

- Property Address : 584 N 400 EAST - SPANISH FORK

- Tax District : 150 - SPANISH FORK CITY

- Acreage : 0.13

- Property Classification : RP - RES PRIMARY

- Legal Description : COM AT PT 78 FT S OF NW COR BLK 101, PLAT A, SPANISH FORK CITY SUR; S 6/ FT E 99 FT; N 39 FT TO PT 99 FT S OF N LINE OF SD BLK; N 45 W 29.70 FT TO PT 78 FT S & 78 FT E OF NW COR OF SD BLK; W 78 FT TO POINT OF BEG.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $352,800 |

$344,200 |

|||||||

| Total Property Market Value | $352,800 | $344,200 | |||||||