Property Valuation Information

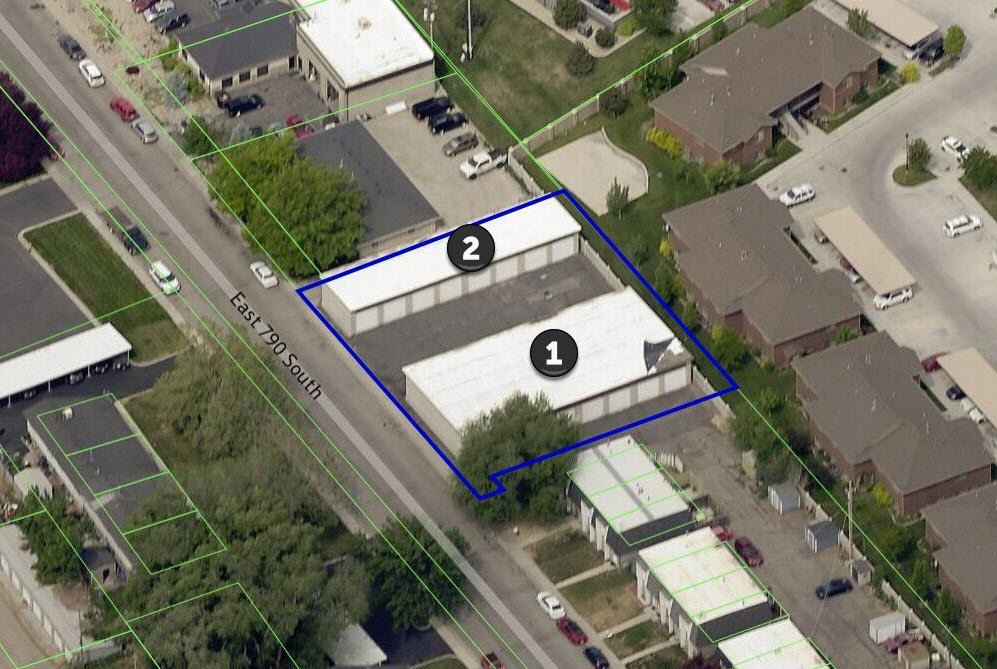

- Serial Number : 140460006

- Tax Year : 2024

- Owner Names : J&M BOUNOUS STORAGE LLC

- Property Address : 391 E 790 SOUTH - PLEASANT GROVE

- Tax District : 070 - PLEASANT GROVE CITY

- Acreage : 0.38

- Property Classification : C - COMMERCIAL

- Legal Description : COM S 21'34"E 192.97 FT & E 253.78 FT FR W 1/4 COR SEC 28, T5S, R2E, SLM; N 63 DEG 11'E 136.25 FT; S 26 DEG 19'57"E 106.44 FT; N 63 DEG 13'24"E 9.65 FT; S 26 DEG 49'E 10.31 FT; S 62 DEG 53'W 145 FT; N 26 DEG 49'W 117.51 FT TO BEG. AREA .37 ACRE. ALSO: COM S 21'34"E ALONG SEC LINE 264.16 FT & E 112.50 FT & N 63 DEG 11'E 153 FT FR W1/4 COR SD SEC 28; N 63 DEG 11'E 5.2 FT; S 26 DEG 49'E 117.51 FT; S 62 DEG 53'W 4.06 FT; N 27 DEG 22'31"W 117.53 FT TO BEG. AREA .01 ACRE. TOTAL .38 ACRE

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $482,200 |

$491,800 |

|||||||

| Total Property Market Value | $482,200 | $491,800 | |||||||