Property Valuation Information

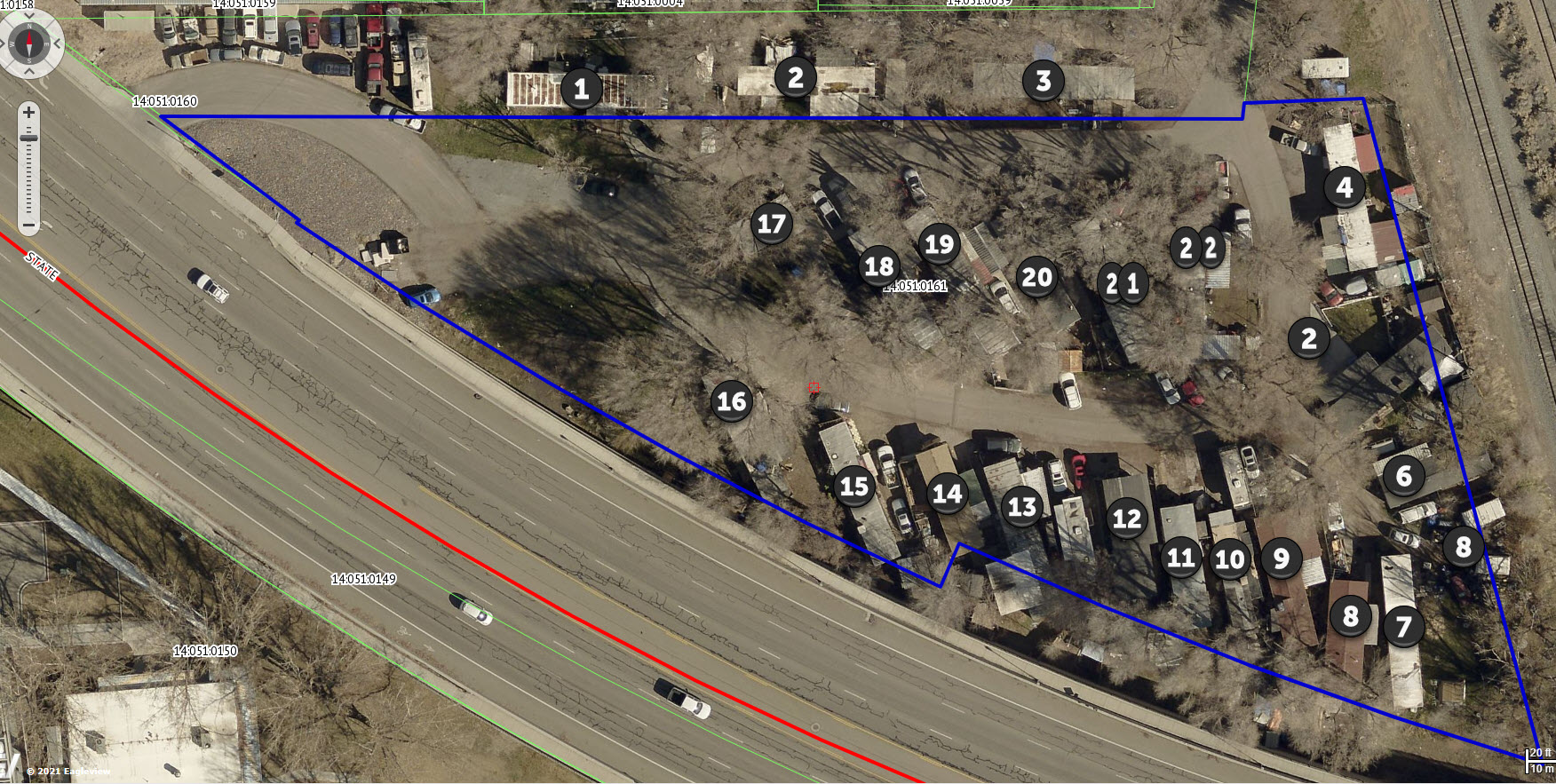

- Serial Number : 140510161

- Tax Year : 2024

- Owner Names : HUTCHINGS, ROSE MARY WEST

- Property Address : PLEASANT GROVE

- Tax District : 070 - PLEASANT GROVE CITY

- Acreage : 2.510758

- Property Classification : HP - M/H COMMUNITY

- Legal Description : COM S 590.9 FT & W 89.6 FT FR N 1/4 COR. SEC. 29, T5S, R2E, SLB&M.; N 89 DEG 3' 0" W 40.4 FT; S 8 DEG 48' 1" W 85.2 FT; N 89 DEG 17' 0" W 140.66 FT; S 0 DEG 3' 20" E 2.78 FT; S 89 DEG 38' 16" W 140.36 FT; N 0 DEG 16' 49" W 5.43 FT; N 89 DEG 17' 0" W 203.95 FT; ALONG A CURVE TO L (CHORD BEARS: S 50 DEG 12' 46" E 14.32 FT, RADIUS = 1460.84 FT); N 89 DEG 38' 23" E 2.79 FT; S 52 DEG 56' 24" E 68.45 FT; S 89 DEG 43' 0" E 453.78 FT; N 7 DEG 5' 58" E 6.6 FT; N 7 DEG 6' 0" E 124.5 FT TO BEG. AREA 0.607 AC. ALSO COM S 712.71 FT & W 55.14 FT FR N 1/4 COR. SEC. 29, T5S, R2E, SLB&M.; S 88 DEG 0' 0" W 49.88 FT; S 7 DEG 5' 58" W 6.6 FT; N 89 DEG 43' 0" W 453.78 FT; S 52 DEG 56' 23" E 72.47 FT; S 37 DEG 3' 14" W 1.79 FT; ALONG A CURVE TO L (CHORD BEARS: S 60 DEG 21' 56" E 310.18 FT, RADIUS = 1851.02 FT); N 23 DEG 41' 58" E 20 FT; ALONG A CURVE TO L (CHORD BEARS: S 69 DEG 5' 0" E 262 FT, RADIUS = 1860.1 FT); N 14 DEG 57' 0" W 289.55 FT TO BEG. AREA 1.904 AC. TOTAL AREA 2.511 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $1,061,500 |

$979,100 |

|||||||

| Total Property Market Value | $1,061,500 | $979,100 | |||||||