Property Valuation Information

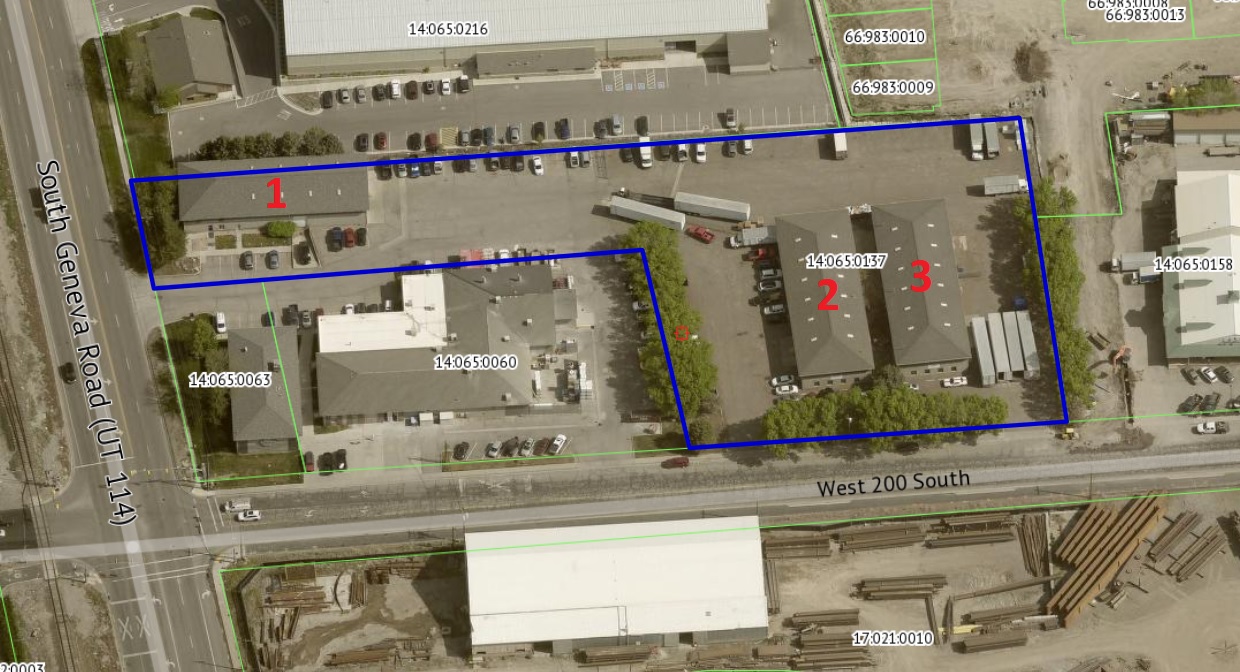

- Serial Number : 140650137

- Tax Year : 2024

- Owner Names : GALE INDUSTRIES INC

- Property Address : 175 S GENEVA RD - LINDON

- Tax District : 080 - LINDON CITY

- Acreage : 2.514951

- Property Classification : C - COMMERCIAL

- Legal Description : COM N 0 DEG 4' 13" W 32.97 FT & W 509.35 FT FR SE COR. SEC. 32, T5S, R2E, SLB&M.; W 262.56 FT; N 7 DEG 22' 24" W 179.31 FT; N 89 DEG 39' 23" W 342.2 FT; N 7 DEG 27' 50" W 100.04 FT; S 89 DEG 39' 23" E 627.66 FT; S 2 DEG 43' 32" E 275.62 FT TO BEG. AREA 2.515 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $2,400,600 |

$2,616,300 |

|||||||

| Total Property Market Value | $2,400,600 | $2,616,300 | |||||||