Property Valuation Information

- Serial Number : 190470150

- Tax Year : 2024

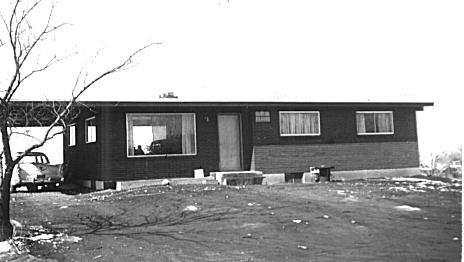

- Owner Names : ROSKELLEY, CHESTER M & LINDA D

- Property Address : 1475 N 2100 WEST - PROVO

- Tax District : 110 - PROVO CITY

- Acreage : 0.523082

- Property Classification : RP - RES PRIMARY

- Legal Description : COM N 0 DEG 0' 6" W 59.5 FT FR E 1/4 COR. SEC. 34, T6S, R2E, SLB&M.; W 185 FT; N 0 DEG 0' 6" W 93.15 FT; E 185 FT; S 0 DEG 0' 6" E 93.15 FT TO BEG. AREA 0.396 AC. ALSO COM N 59.02 FT & W 185.4 FT FR E 1/4 COR. SEC. 34, T6S, R2E, SLB&M.; N 93.15 FT; S 89 DEG 51' 15" W 64.2 FT; S 5 DEG 36' 17" E 93.54 FT; N 89 DEG 51' 15" E 55.1 FT TO BEG. AREA 0.127 AC. TOTAL AREA .523 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $682,200 |

$657,900 |

|||||||

| Total Property Market Value | $682,200 | $657,900 | |||||||