Property Valuation Information

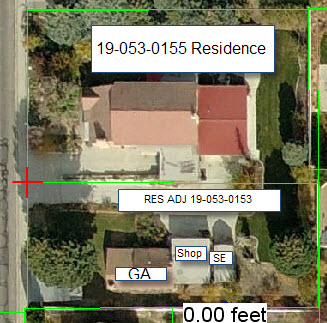

- Serial Number : 190530153

- Tax Year : 2024

- Owner Names : DAVIS, MICHEAL G (ET AL)

- Property Address : 2063 S MAIN - OREM

- Tax District : 090 - OREM CITY

- Acreage : 0.246571

- Property Classification : RA - RESIDENTIAL-ADJOINING

- Legal Description : COM S 0 DEG 9' 11" E 425.56 FT & E 31.86 FT FR NW COR. SEC. 35, T6S, R2E, SLB&M.; S 89 DEG 42' 49" E 157.92 FT; S 0 DEG 7' 23" E 67.42 FT; S 89 DEG 52' 37" W 158.06 FT; N 68.55 FT TO BEG. AREA 0.247 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $195,800 |

$195,800 |

|||||||

| Total Property Market Value | $195,800 | $195,800 | |||||||