Property Valuation Information

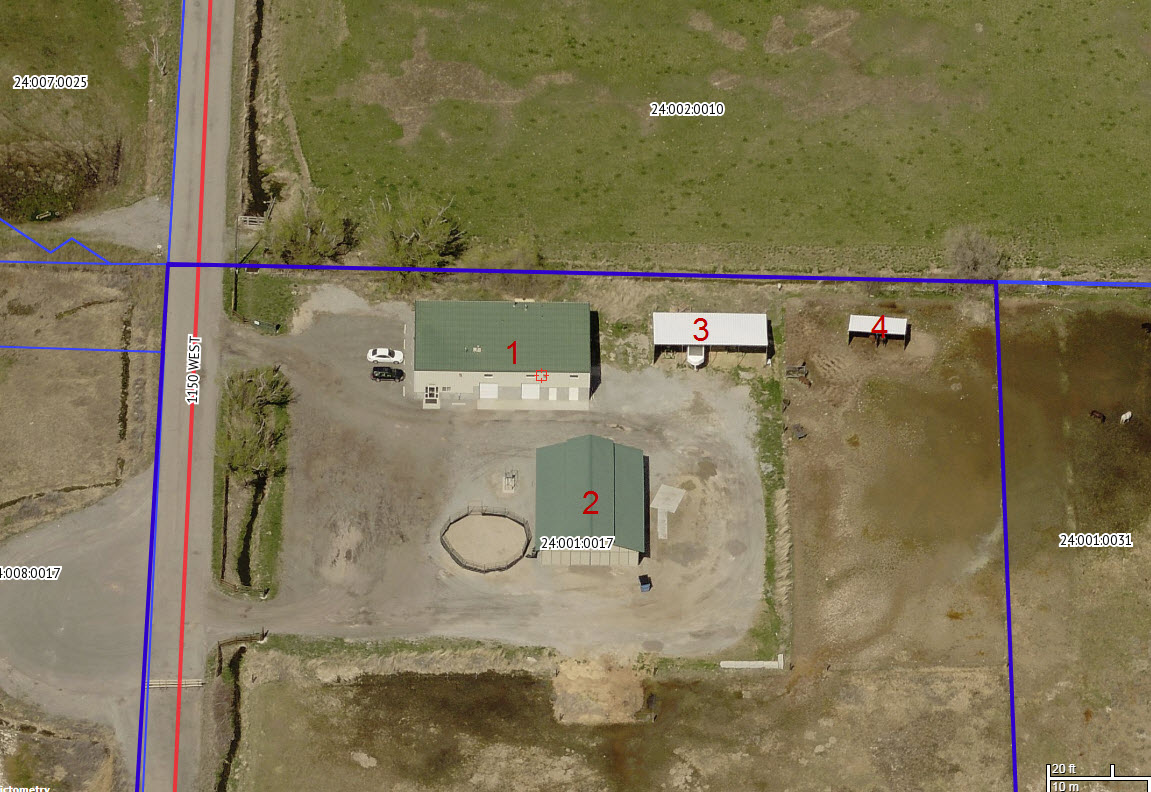

- Serial Number : 240010017

- Tax Year : 2025

- Owner Names : HADERLIE, LESLIE ANN MACDONALD & PAUL MORRIS

- Property Address : 3226 N 1150 WEST - SPANISH FORK

- Tax District : 150 - SPANISH FORK CITY

- Acreage : 3.000052

- Property Classification : C - COMMERCIAL

- Legal Description : COM AT W1/4 COR. SEC. 1, T8S, R2E, SLB&M.; S 361.5 FT; E 361.5 FT; N 361.5 FT; W 361.5 FT TO BEG. AREA 3.000 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Non-Primary Residential | $1,194,500 |

$1,194,500 |

|||||||

| Total Property Market Value | $1,194,500 | $1,194,500 | |||||||