Property Valuation Information

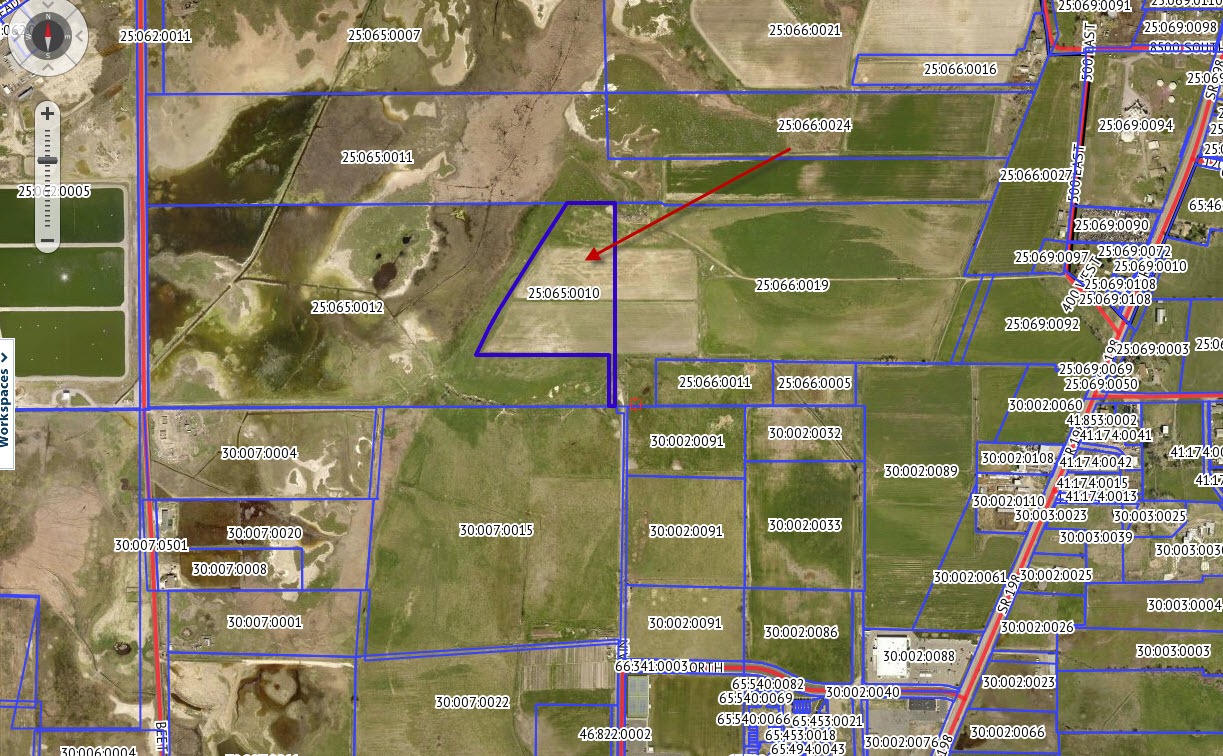

- Serial Number : 250650010

- Tax Year : 2025

- Owner Names : DIAMOND CREEK DEVELOPMENT LLC

- Property Address :

- Tax District : 180 - SALEM CITY

- Acreage : 12.229

- Property Classification : V - VACANT

- Legal Description : COM AT SE COR. SEC. 35 T8S R2E SLB&M.; N 1217.9 FT; S 89 DEG 45' 37" W 288.02 FT; S 33 DEG 4' 48" W 315.79 FT; S 32 DEG 6' 51" W 441.25 FT; S 29 DEG 43' 14" W 121.05 FT; S 26 DEG 18' 33" W 179.85 FT; S 89 DEG 32' 16" E 801.6 FT; S 0 DEG 23' 56" W 305.55 FT; E 35.23 FT TO BEG. AREA 12.229 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Vacant | $1,035,600 |

$1,035,600 |

|||||||

| Greenbelt Land Value | $250 |

$249 |

|||||||

| Total Property Market Value | $1,035,600 | $1,035,600 | |||||||

Note:

Greenbelt values are shown for reference only and are not part of the total property market value, but are utilized as part of the proposed tax calculations