Property Valuation Information

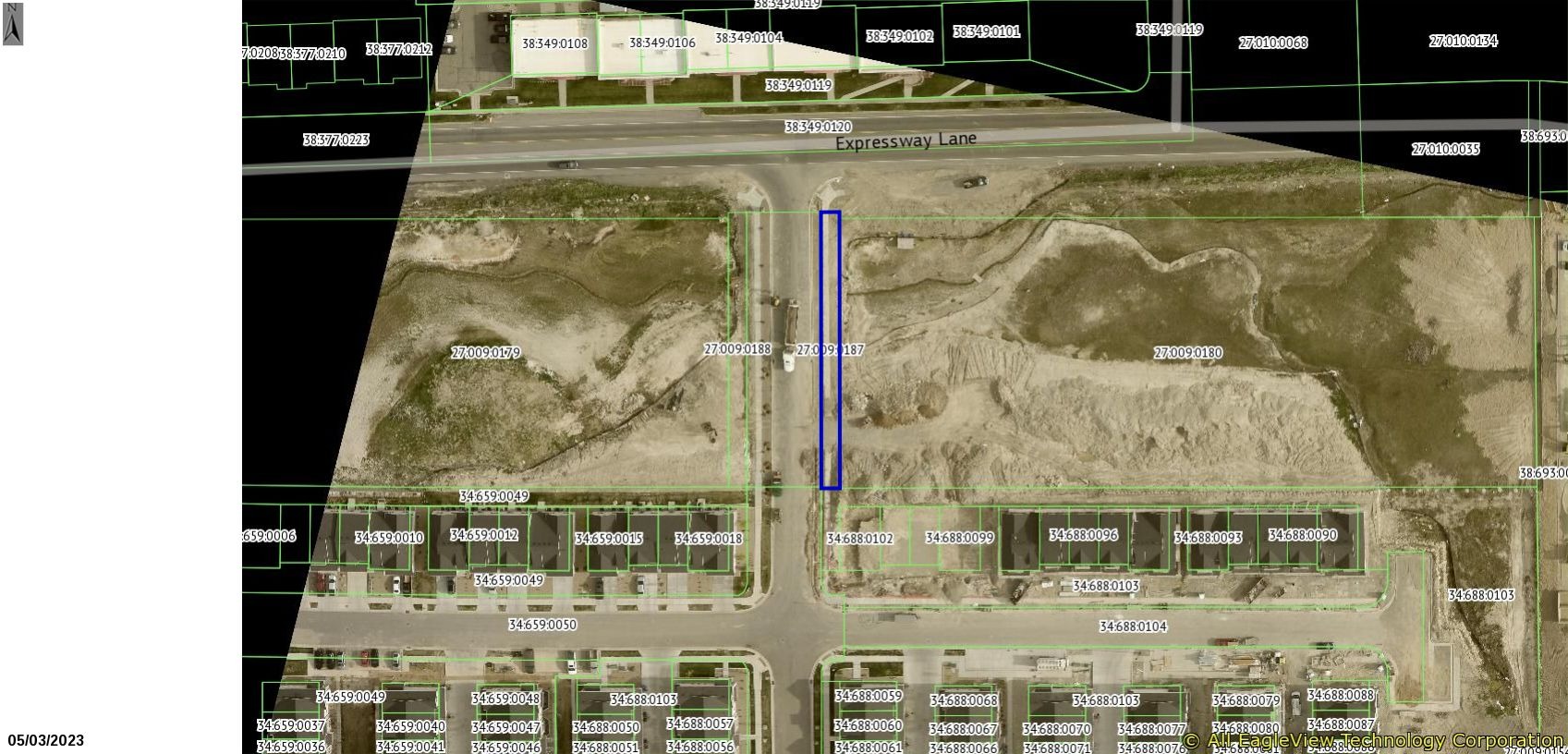

- Serial Number : 270090187

- Tax Year : 2024

- Owner Names : SPF TH LLC

- Property Address :

- Tax District : 150 - SPANISH FORK CITY

- Acreage : 0.076848

- Property Classification : V - VACANT

- Legal Description : COM S 217.97 FT & E 746.13 FT FR W 1/4 COR. SEC. 17, T8S, R3E, SLB&M.; N 222.56 FT; N 1 DEG 21' 9" E .47 FT; N 89 DEG 36' 41" E 15 FT; S 223.13 FT; W 15.02 FT TO BEG. AREA 0.077 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Vacant | $8,200 |

$9,100 |

|||||||

| Total Property Market Value | $8,200 | $9,100 | |||||||