Property Valuation Information

- Serial Number : 270440020

- Tax Year : 2024

- Owner Names : BAKER, SANDRA LISTON (ET AL)

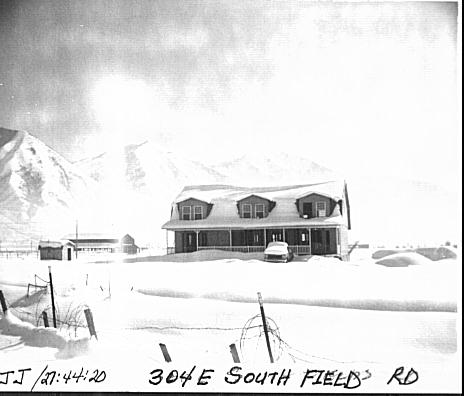

- Property Address : 304 E SOUTH FIELD RD - SPANISH FORK

- Tax District : 120 - NEBO SCHOOL DIST S/A 6-7-8

- Acreage : 5.44

- Property Classification : RPO - RP PLUS ACREAGE

- Legal Description : COM S 950.84 FT & E 1918.06 FT (BASED ON UT ST COORDINATE SYSTEM, CEN ZONE) FR W 1/4 COR SEC 31, T8S, R3E, SLM; S 57-39'51"E 74.69 FT; S 59-20'55"E 39.12 FT; S 74-27'32"E 79.76 FT; S 73-40'45"E 79.91 FT; S 10'20"E 856.84 FT; N 48-46'10"W 438.21 FT; N 16-52'35"E 30 FT; N 49-21'26"W 161.42 FT; N 1-54'29"E 145.22 FT; S 57-39'51"E 200 FT; N 1-54'29"E 500 FT TO BEG. AREA 5.44 ACRES.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $1,112,900 |

$1,131,200 |

|||||||

| Non-Primary Residential | $326,400 |

$326,400 |

|||||||

| Total Property Market Value | $1,439,300 | $1,457,600 | |||||||