Property Valuation Information

- Serial Number : 341930011

- Tax Year : 2024

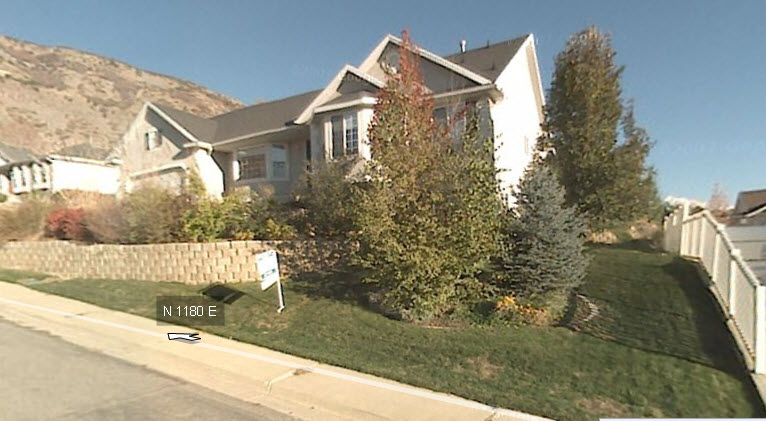

- Owner Names : POWELL, STEVEN E & KATHERINE L

- Property Address : 524 N 1180 EAST - PLEASANT GROVE

- Tax District : 070 - PLEASANT GROVE CITY

- Acreage : 0.253

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 11, PLAT H, AUTUMN COVE. AREA 0.253 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $592,200 |

$580,800 |

|||||||

| Total Property Market Value | $592,200 | $580,800 | |||||||