Property Valuation Information

- Serial Number : 354550104

- Tax Year : 2024

- Owner Names : PAGE, CHERIE M (ET AL)

- Property Address : 684 S 2150 WEST - PLEASANT GROVE

- Tax District : 070 - PLEASANT GROVE CITY

- Acreage : 0.029

- Property Classification : RP - RES PRIMARY

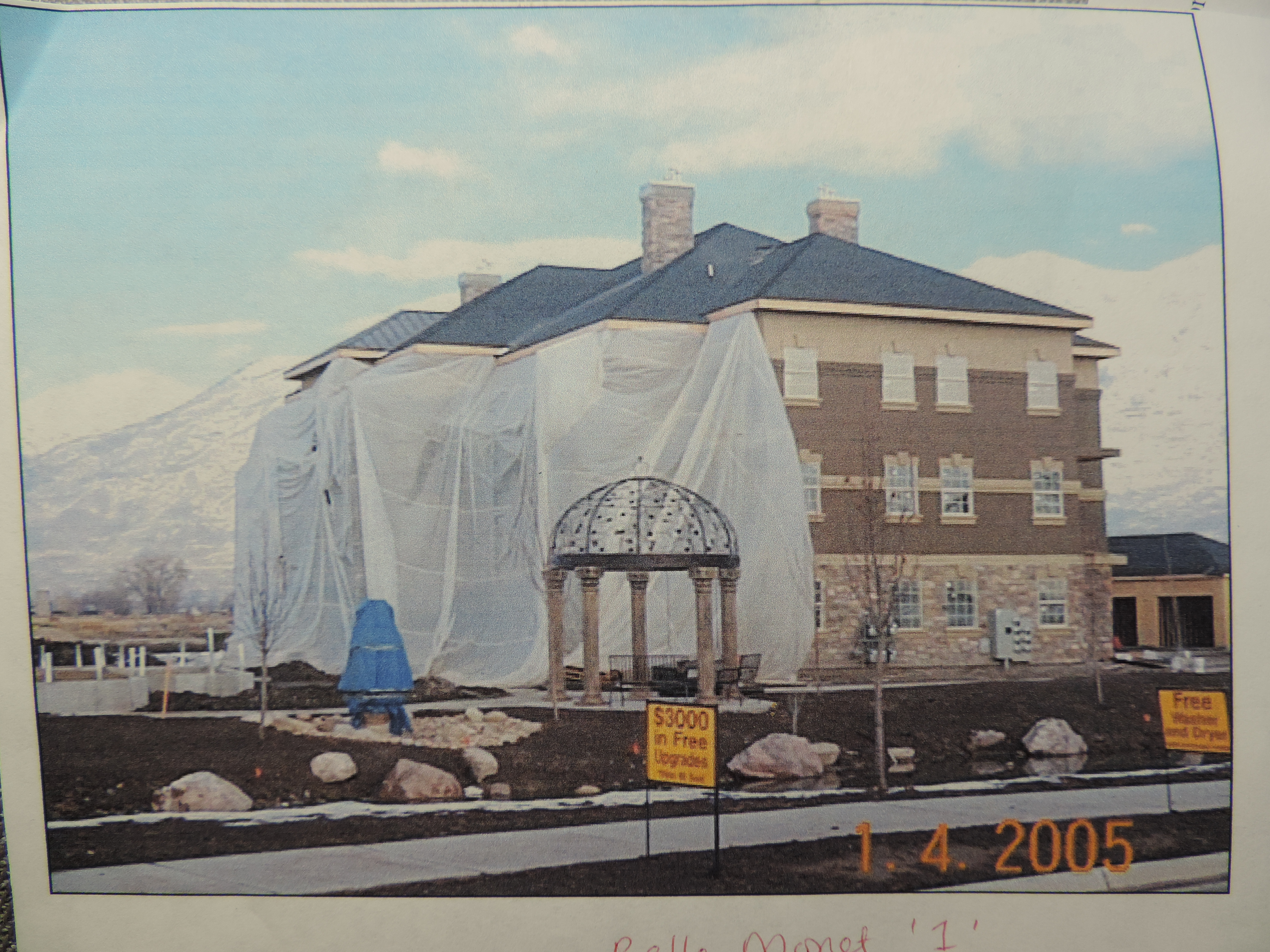

- Legal Description : UNIT 104, BUILDING 1, BELLE MONET CONDOMINIUMS PHASE 1. AREA 0.029 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $308,800 |

$314,500 |

|||||||

| Total Property Market Value | $308,800 | $314,500 | |||||||