Property Valuation Information

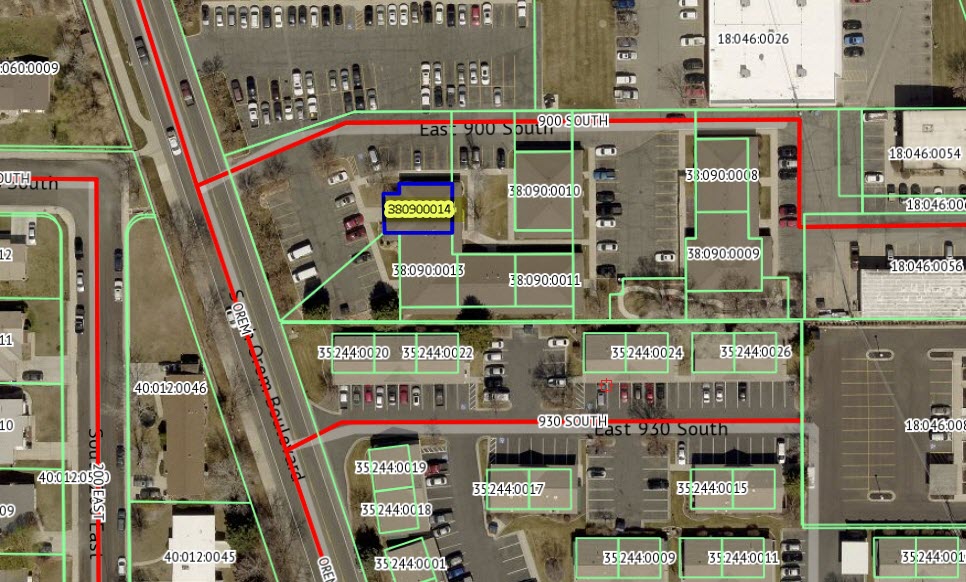

- Serial Number : 380900014

- Tax Year : 2024

- Owner Names : PGW HOLDINGS LLC

- Property Address : 901 S OREM BLVD - OREM

- Tax District : 090 - OREM CITY

- Acreage : 0.01

- Property Classification : COP - COMM PUD

- Legal Description : UNIT 7, PHASE I, EVERGREEN SQUARE PUD AMENDED.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $441,000 |

$448,100 |

|||||||

| Total Property Market Value | $441,000 | $448,100 | |||||||