Property Valuation Information

- Serial Number : 400130078

- Tax Year : 2024

- Owner Names : SMITH, GARRET (ET AL)

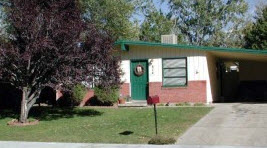

- Property Address : 614 N 980 WEST - OREM

- Tax District : 090 - OREM CITY

- Acreage : 0.179874

- Property Classification : RP - RES PRIMARY

- Legal Description : S 48 FT OF LOT 8, BLK 4, GENEVA HEIGHTS AMENDED SUB AREA 0.123 AC. ALSO N 22 FT OF LOT 7, BLK 4, GENEVA HEIGHTS AMENDED SUB AREA 0.057 AC. TOTAL AREA .18 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $340,800 |

$341,100 |

|||||||

| Total Property Market Value | $340,800 | $341,100 | |||||||