Property Valuation Information

- Serial Number : 411320032

- Tax Year : 2024

- Owner Names : GASKILL, STEPHEN P

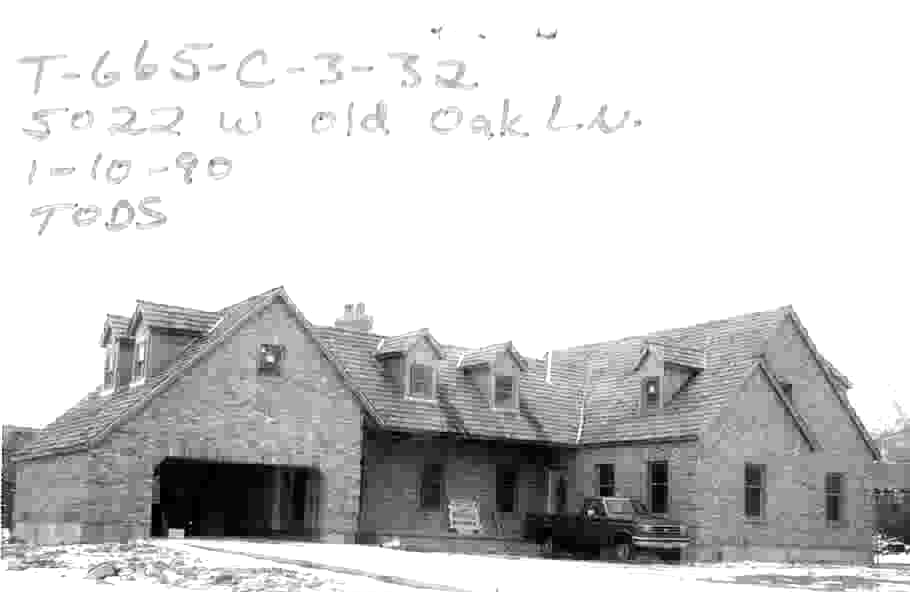

- Property Address : 5022 W OLD OAK LN - HIGHLAND

- Tax District : 045 - HIGHLAND CITY

- Acreage : 0.552

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 32, PLAT C, HIDDEN OAKS INC PHASE III SUBDV. AREA 0.552 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $1,138,500 |

$1,089,800 |

|||||||

| Total Property Market Value | $1,138,500 | $1,089,800 | |||||||