Property Valuation Information

- Serial Number : 460630015

- Tax Year : 2024

- Owner Names : PELLANNE, FRIDDA V

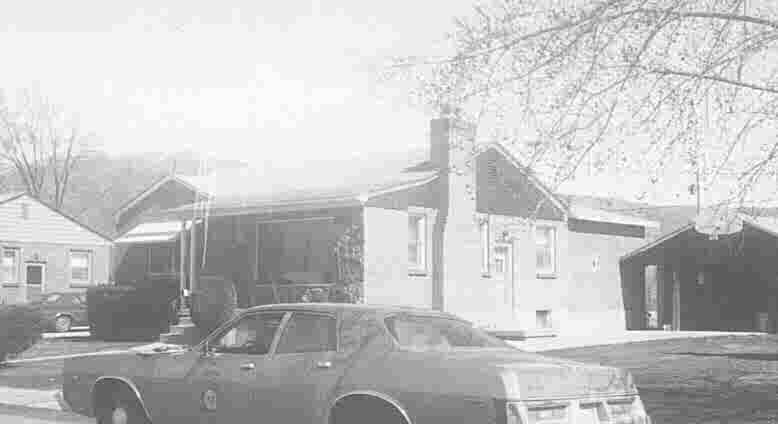

- Property Address : 946 N 75 EAST - OREM

- Tax District : 090 - OREM CITY

- Acreage : 0.18

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 22, BLK 2, PLAT B, MEMMO GARDENS SUBDIVISION.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $416,700 |

$430,500 |

|||||||

| Total Property Market Value | $416,700 | $430,500 | |||||||