Property Valuation Information

- Serial Number : 470960002

- Tax Year : 2024

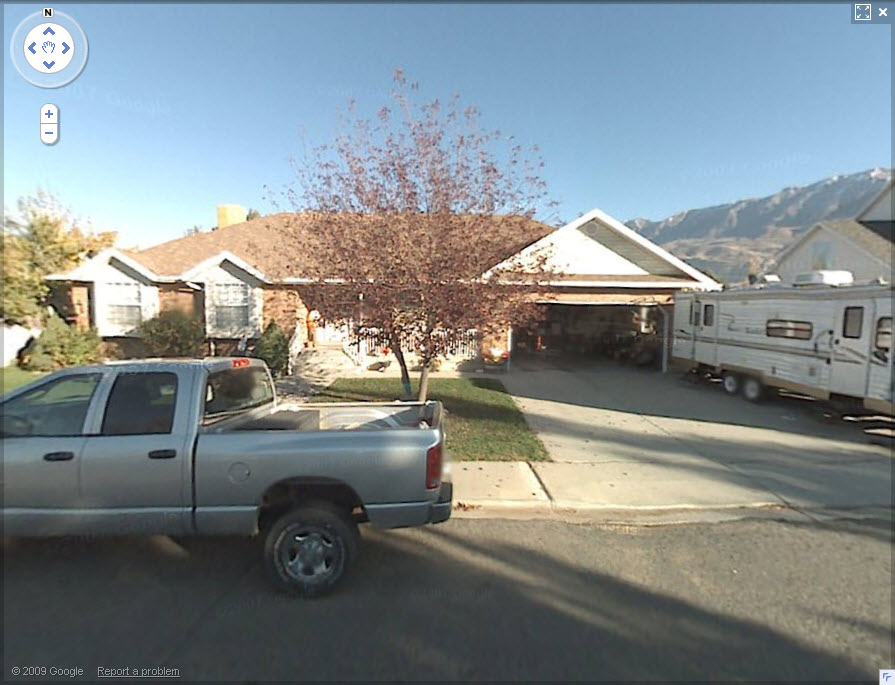

- Owner Names : PEACOCK, BEVERLY & NEIL F

- Property Address : 864 W 1500 NORTH - OREM

- Tax District : 090 - OREM CITY

- Acreage : 0.21

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 2, PLAT E, NORTH CREST SUB. AREA .21 ACRE

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $542,100 |

$543,500 |

|||||||

| Total Property Market Value | $542,100 | $543,500 | |||||||