Property Valuation Information

- Serial Number : 490440010

- Tax Year : 2024

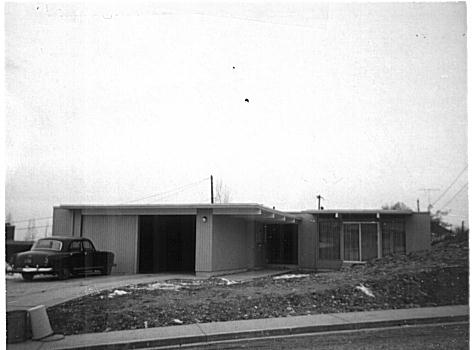

- Owner Names : CROOKSTON, MICHAEL & JUDY

- Property Address : 1941 N 360 EAST - PROVO

- Tax District : 110 - PROVO CITY

- Acreage : 0.28

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 1, DEE PETERSON SUB. ALSO: COM SE COR LOT 1, DEE PETERSON SUB; 13.69 FT ALONG ARC OF 225 FT RAD CUR L (CHD N 17 DEG 02'24"W 13.69 FT); 89.34 FT ALONG ARAC OF 275 FT RAD CUR R (CHD 09 DEG 28'33"W 88.95 FT); S 15 DEG 10'E 109.07 FT; N 65 DEG 47'W 10.83 FT TO BEG. AREA .28 ACRE.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $550,600 |

$596,700 |

|||||||

| Total Property Market Value | $550,600 | $596,700 | |||||||