Property Valuation Information

- Serial Number : 520180008

- Tax Year : 2024

- Owner Names : LOWE, AARON J & CAROLINE M

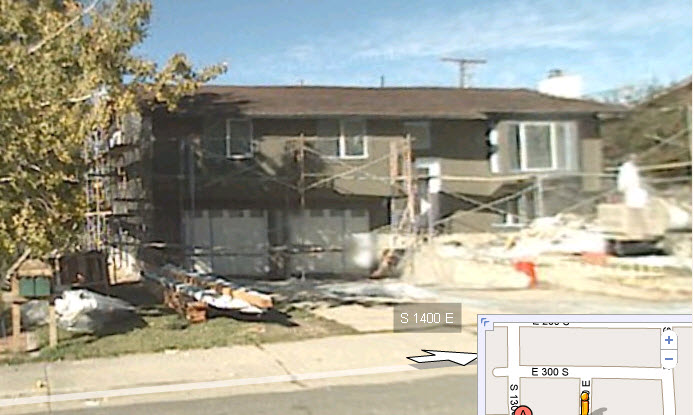

- Property Address : 382 S 1400 EAST - PLEASANT GROVE

- Tax District : 070 - PLEASANT GROVE CITY

- Acreage : 0.35

- Property Classification : RP - RES PRIMARY

- Legal Description : COM NE COR LOT 4, PLAT A, SEGO LILLY HILL SUB; W 190.11 FT; S 18 DEG 42'W 13.47 FT; S 7 DEG 41'E 67.85 FT; E 185.13 FT; N 00 DEG 10'E 80 FT TO BEG. AREA .35 ACRES.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $429,600 |

$430,300 |

|||||||

| Total Property Market Value | $429,600 | $430,300 | |||||||