Property Information

mobile view

| Serial Number: 30:025:0005 |

Serial Life: 1987... |

|

|

Total Photos: 7

Total Photos: 7

|

| |

|

|

| Property Address: 830 N MAIN - PAYSON |

|

| Mailing Address: PO BOX 50267 PROVO, UT 84605 |

|

| Acreage: 1.94 |

|

| Last Document:

92066-2011

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 683.046 FT & W 468.146 FT FR NE COR SEC 8, T9S, R2E, SLM; S 4 DEG 46'03"W 254.637 FT; E 346.175 FT; N 250 FT; N 89 DEG 20'18"W 325 FT TO BEG. AREA 1.941 ACRES. SUBJ TO R/W

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

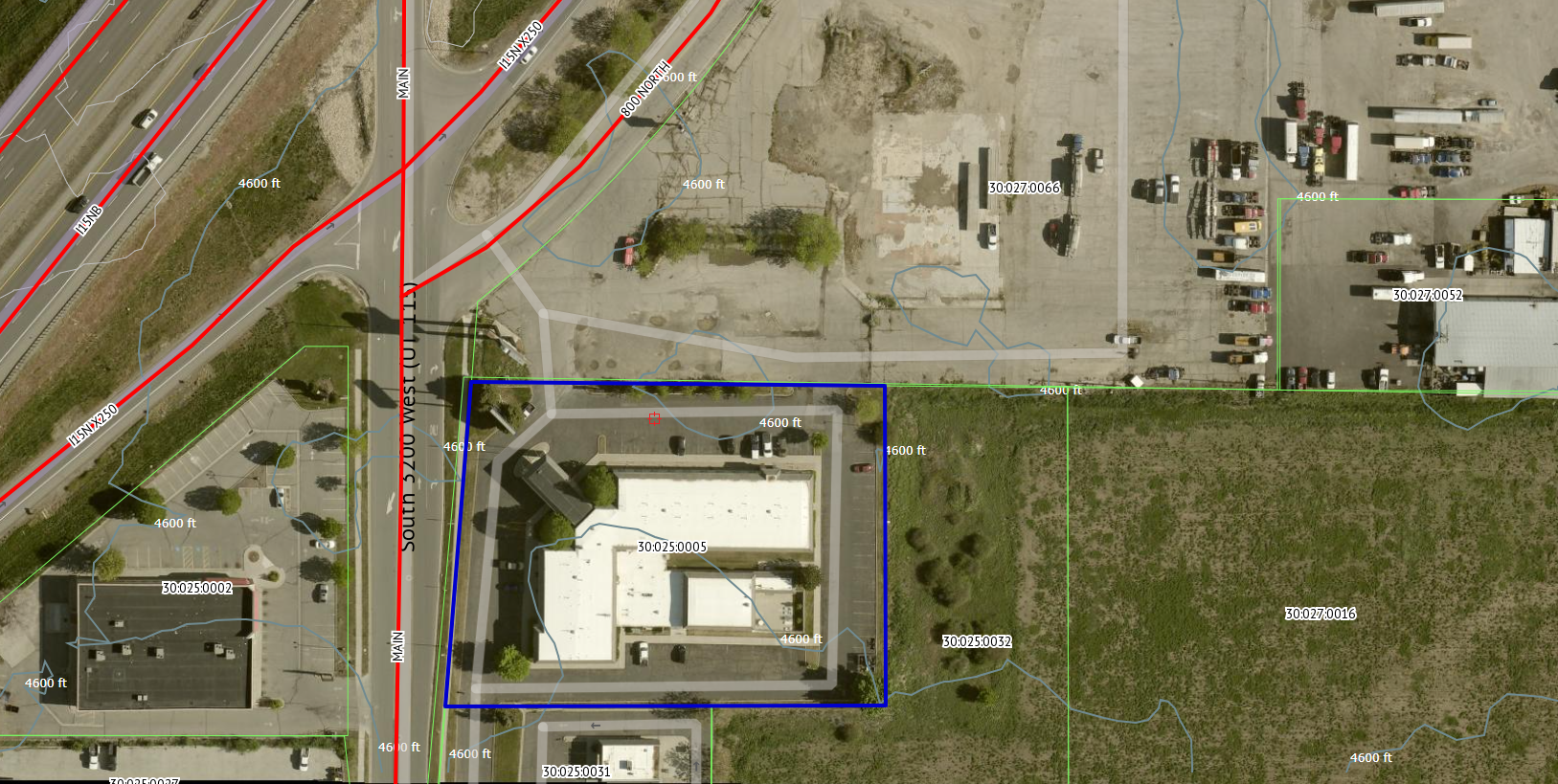

- Aerial Image

| 2012... |

|

EREKSON, ALMA Y |

|

| 2012... |

|

EREKSON, MARY LOU A |

|

| 2012... |

|

LWJ FAMILY LLC |

|

| 2012NV |

|

EREKSON, ALMA Y |

|

| 2012NV |

|

EREKSON, MARY LOU A |

|

| 2012NV |

|

JOHNSON, LORENE W |

|

| 2006-2011 |

|

EREKSON, ALMA Y |

|

| 2006-2011 |

|

EREKSON, MARY LOU A |

|

| 2006-2011 |

|

JOHNSON, DENNIS A |

|

| 2006-2011 |

|

JOHNSON, LORENE W |

|

| 2003-2005 |

|

EREKSON, ALMA Y |

|

| 2003-2005 |

|

EREKSON, MARY LOU A |

|

| 2003-2005 |

|

JOHNSON, DENNIS A |

|

| 2003-2005 |

|

JOHNSON, LORENE W |

|

| 1987-2002 |

|

EREKSON, ALMA Y |

|

| 1987-2002 |

|

JOHNSON, DENNIS A |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$1,193,600 |

$0 |

$0 |

$1,193,600 |

$2,028,600 |

$0 |

$0 |

$2,028,600 |

$0 |

$0 |

$0 |

$3,222,200 |

| 2023 |

$1,137,000 |

$0 |

$0 |

$1,137,000 |

$1,750,100 |

$0 |

$0 |

$1,750,100 |

$0 |

$0 |

$0 |

$2,887,100 |

| 2022 |

$1,137,000 |

$0 |

$0 |

$1,137,000 |

$1,896,200 |

$0 |

$0 |

$1,896,200 |

$0 |

$0 |

$0 |

$3,033,200 |

| 2021 |

$1,000,700 |

$0 |

$0 |

$1,000,700 |

$930,300 |

$0 |

$0 |

$930,300 |

$0 |

$0 |

$0 |

$1,931,000 |

| 2020 |

$932,100 |

$0 |

$0 |

$932,100 |

$1,481,700 |

$0 |

$0 |

$1,481,700 |

$0 |

$0 |

$0 |

$2,413,800 |

| 2019 |

$800,300 |

$0 |

$0 |

$800,300 |

$1,486,900 |

$0 |

$0 |

$1,486,900 |

$0 |

$0 |

$0 |

$2,287,200 |

| 2018 |

$762,200 |

$0 |

$0 |

$762,200 |

$1,265,300 |

$0 |

$0 |

$1,265,300 |

$0 |

$0 |

$0 |

$2,027,500 |

| 2017 |

$733,500 |

$0 |

$0 |

$733,500 |

$1,265,300 |

$0 |

$0 |

$1,265,300 |

$0 |

$0 |

$0 |

$1,998,800 |

| 2016 |

$698,900 |

$0 |

$0 |

$698,900 |

$1,265,300 |

$0 |

$0 |

$1,265,300 |

$0 |

$0 |

$0 |

$1,964,200 |

| 2015 |

$672,700 |

$0 |

$0 |

$672,700 |

$1,265,300 |

$0 |

$0 |

$1,265,300 |

$0 |

$0 |

$0 |

$1,938,000 |

| 2014 |

$653,400 |

$0 |

$0 |

$653,400 |

$1,100,300 |

$0 |

$0 |

$1,100,300 |

$0 |

$0 |

$0 |

$1,753,700 |

| 2013 |

$610,700 |

$0 |

$0 |

$610,700 |

$1,100,300 |

$0 |

$0 |

$1,100,300 |

$0 |

$0 |

$0 |

$1,711,000 |

| 2012 |

$610,700 |

$0 |

$0 |

$610,700 |

$1,100,300 |

$0 |

$0 |

$1,100,300 |

$0 |

$0 |

$0 |

$1,711,000 |

| 2011 |

$610,700 |

$0 |

$0 |

$610,700 |

$1,100,300 |

$0 |

$0 |

$1,100,300 |

$0 |

$0 |

$0 |

$1,711,000 |

| 2010 |

$198,100 |

$0 |

$0 |

$198,100 |

$1,100,300 |

$0 |

$0 |

$1,100,300 |

$0 |

$0 |

$0 |

$1,298,400 |

| 2009 |

$198,100 |

$0 |

$0 |

$198,100 |

$1,100,300 |

$0 |

$0 |

$1,100,300 |

$0 |

$0 |

$0 |

$1,298,400 |

| 2008 |

$198,100 |

$0 |

$0 |

$198,100 |

$1,100,300 |

$0 |

$0 |

$1,100,300 |

$0 |

$0 |

$0 |

$1,298,400 |

| 2007 |

$188,700 |

$0 |

$0 |

$188,700 |

$1,047,900 |

$0 |

$0 |

$1,047,900 |

$0 |

$0 |

$0 |

$1,236,600 |

| 2006 |

$188,691 |

$0 |

$0 |

$188,691 |

$1,047,854 |

$0 |

$0 |

$1,047,854 |

$0 |

$0 |

$0 |

$1,236,545 |

| 2005 |

$188,691 |

$0 |

$0 |

$188,691 |

$1,047,854 |

$0 |

$0 |

$1,047,854 |

$0 |

$0 |

$0 |

$1,236,545 |

| 2004 |

$188,691 |

$0 |

$0 |

$188,691 |

$1,047,854 |

$0 |

$0 |

$1,047,854 |

$0 |

$0 |

$0 |

$1,236,545 |

| 2003 |

$188,691 |

$0 |

$0 |

$188,691 |

$1,047,854 |

$0 |

$0 |

$1,047,854 |

$0 |

$0 |

$0 |

$1,236,545 |

| 2002 |

$188,691 |

$0 |

$0 |

$188,691 |

$1,047,854 |

$0 |

$0 |

$1,047,854 |

$0 |

$0 |

$0 |

$1,236,545 |

| 2001 |

$161,828 |

$0 |

$0 |

$161,828 |

$898,674 |

$0 |

$0 |

$898,674 |

$0 |

$0 |

$0 |

$1,060,502 |

| 2000 |

$151,241 |

$0 |

$0 |

$151,241 |

$898,674 |

$0 |

$0 |

$898,674 |

$0 |

$0 |

$0 |

$1,049,915 |

| 1999 |

$151,241 |

$0 |

$0 |

$151,241 |

$898,674 |

$0 |

$0 |

$898,674 |

$0 |

$0 |

$0 |

$1,049,915 |

| 1998 |

$145,424 |

$0 |

$0 |

$145,424 |

$864,110 |

$0 |

$0 |

$864,110 |

$0 |

$0 |

$0 |

$1,009,534 |

| 1997 |

$123,241 |

$0 |

$0 |

$123,241 |

$732,297 |

$0 |

$0 |

$732,297 |

$0 |

$0 |

$0 |

$855,538 |

| 1996 |

$123,241 |

$0 |

$0 |

$123,241 |

$732,297 |

$0 |

$0 |

$732,297 |

$0 |

$0 |

$0 |

$855,538 |

| 1995 |

$123,241 |

$0 |

$0 |

$123,241 |

$732,297 |

$0 |

$0 |

$732,297 |

$0 |

$0 |

$0 |

$855,538 |

| 1994 |

$72,071 |

$0 |

$0 |

$72,071 |

$732,297 |

$0 |

$0 |

$732,297 |

$0 |

$0 |

$0 |

$804,368 |

| 1993 |

$72,071 |

$0 |

$0 |

$72,071 |

$732,297 |

$0 |

$0 |

$732,297 |

$0 |

$0 |

$0 |

$804,368 |

| 1992 |

$66,120 |

$0 |

$0 |

$66,120 |

$671,832 |

$0 |

$0 |

$671,832 |

$0 |

$0 |

$0 |

$737,952 |

| 1991 |

$58,000 |

$0 |

$0 |

$58,000 |

$671,832 |

$0 |

$0 |

$671,832 |

$0 |

$0 |

$0 |

$729,832 |

| 1990 |

$58,000 |

$0 |

$0 |

$58,000 |

$671,832 |

$0 |

$0 |

$671,832 |

$0 |

$0 |

$0 |

$729,832 |

| 1989 |

$28,227 |

$0 |

$0 |

$28,227 |

$1,307,322 |

$0 |

$0 |

$1,307,322 |

$0 |

$0 |

$0 |

$1,335,549 |

| 1988 |

$28,228 |

$0 |

$0 |

$28,228 |

$1,307,323 |

$0 |

$0 |

$1,307,323 |

$0 |

$0 |

$0 |

$1,335,551 |

| 1987 |

$0 |

$0 |

$15,743 |

$15,743 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$15,743 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2024 |

$31,661.34 |

$0.00 |

$31,661.34 |

$0.00 |

|

|

Click for Payoff

|

170 - PAYSON CITY |

| 2023 |

$28,290.69 |

$0.00 |

$28,290.69 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2022 |

$30,219.77 |

$0.00 |

$30,219.77 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2021 |

$21,808.71 |

$0.00 |

$21,808.71 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2020 |

$27,864.91 |

$0.00 |

$27,864.91 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2019 |

$25,753.87 |

$0.00 |

$25,753.87 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2018 |

$23,687.28 |

$0.00 |

$23,687.28 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2017 |

$23,879.66 |

$0.00 |

$23,879.66 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2016 |

$23,621.47 |

$0.00 |

$23,621.47 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2015 |

$23,467.24 |

$0.00 |

$23,467.24 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2014 |

$21,082.98 |

$0.00 |

$21,082.98 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2013 |

$21,531.22 |

$0.00 |

$21,531.22 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2012 |

$21,856.31 |

$0.00 |

$21,856.31 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2011 |

$21,337.88 |

$0.00 |

$21,337.88 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2010 |

$15,788.54 |

$0.00 |

$15,788.54 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2009 |

$14,953.67 |

$0.00 |

$14,953.67 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2008 |

$13,909.76 |

$0.00 |

$13,909.76 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2007 |

$13,140.11 |

$0.00 |

$13,140.11 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2006 |

$14,599.89 |

$0.00 |

$14,599.89 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2005 |

$15,542.13 |

$0.00 |

$15,542.13 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2004 |

$15,585.41 |

$0.00 |

$15,585.41 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2003 |

$14,146.07 |

$0.00 |

$14,146.07 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2002 |

$13,807.26 |

$0.00 |

$13,807.26 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2001 |

$12,061.09 |

$0.00 |

$12,061.09 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2000 |

$11,812.59 |

$0.00 |

$11,812.59 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1999 |

$11,214.14 |

$0.00 |

$11,214.14 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1998 |

$10,516.32 |

$0.00 |

$10,516.32 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1997 |

$9,830.13 |

$0.00 |

$9,830.13 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1996 |

$9,683.83 |

$655.43 |

$10,339.26 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1995 |

$9,678.70 |

$1,228.45 |

$10,907.15 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1994 |

$11,319.07 |

$1,468.09 |

$12,787.16 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1993 |

$9,915.60 |

$1,839.12 |

$11,754.72 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1992 |

$11,040.68 |

$0.00 |

$11,040.68 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1991 |

$12,062.47 |

$0.00 |

$12,062.47 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1990 |

$12,264.75 |

$0.00 |

$12,264.75 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1989 |

$20,073.65 |

($7,261.34) |

$12,812.31 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1988 |

$16,010.57 |

($7,261.34) |

$8,749.23 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1987 |

$189.26 |

$0.00 |

$189.26 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 92066-2011 |

12/17/2011 |

12/21/2011 |

WD |

JOHNSON, LORENE W |

LWJ FAMILY LLC |

| 92065-2011 |

12/17/2011 |

12/21/2011 |

WD |

JOHNSON, LORENE W & WESTLYN D TEE (ET AL) |

JOHNSON, LORENE W |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 99679-2004 |

07/15/2004 |

08/30/2004 |

WD |

JOHNSON, LORENE W & WESTLYN D TEE (ET AL) |

JOHNSON, LORENE W & WESTLYN D TEE |

| 53526-2002 |

05/09/2002 |

05/09/2002 |

WD |

JOHNSON, DENNIS A (ET AL) |

JOHNSON, DENNIS A & LORENE W TEE (ET AL) |

| 18711-2001 |

02/08/2001 |

02/28/2001 |

N |

SALT LAKE ORGANIZING COMMITTEE FOR (ET AL) |

WHOM OF INTEREST |

| 88589-1994 |

|

11/21/1994 |

WD |

WRIGLEY, KARL A & BARBARA LEE |

AINGE, DANIEL R & MICHELLE T TEE |

| 2433-1992 |

01/16/1992 |

01/21/1992 |

REC |

ZIONS FIRST NATIONAL BANK TEE |

JOHNSON, DENNIS A (ET AL) |

| 38457-1990 |

11/20/1990 |

11/20/1990 |

REC |

SECURITY TITLE AND ABSTRACT COMPANY TEE |

WRIGLEY, KARL A & BARBARA LEE |

| 35093-1987 |

08/31/1987 |

09/15/1987 |

R LN |

BRAITHWAITE & WEBER DRYWALL (ET AL) |

WHOM OF INTEREST |

| 29747-1987 |

08/03/1987 |

08/03/1987 |

N LN |

JOHNSON, DENNIS (ET AL) |

BRAITHWAITE, EDWIN L DBA (ET AL) |

| 7798-1987 |

|

03/04/1987 |

EAS |

WRIGLEY, KARL A & BARBARA LEE (ET AL) |

PAYSON CITY CORPORATION |

| 42355-1986 |

12/10/1986 |

12/10/1986 |

TR D |

JOHNSON, DENNIS A (ET AL) |

ZIONS FIRST NATIONAL BANK |

| 30270-1986 |

09/11/1986 |

09/11/1986 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 18031-1986 |

05/30/1986 |

06/10/1986 |

SUB AGR |

PRUDENTIAL CAPITAL GROUP |

JOHNSON, DENNIS A (ET AL) |

| 18030-1986 |

05/20/1986 |

06/10/1986 |

EAS |

CENTRAL DISTRIBUTING COMPANY |

JOHNSON, DENNIS A (ET AL) |

| 18029-1986 |

06/06/1986 |

06/10/1986 |

EAS |

WILSON, GLADYS SMITH (ET AL) |

EREKSON, ALMA Y (ET AL) |

| 18028-1986 |

06/10/1986 |

06/10/1986 |

EAS |

WRIGLEY, KARL A & BARBARA L (ET AL) |

JOHNSON, DENNIS (ET AL) |

| 18027-1986 |

06/10/1986 |

06/10/1986 |

WD |

WRIGLEY, KARL A & BARBARA LEE |

JOHNSON, DENNIS A (ET AL) |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/18/2024 9:48:10 AM |