Property Information

mobile view

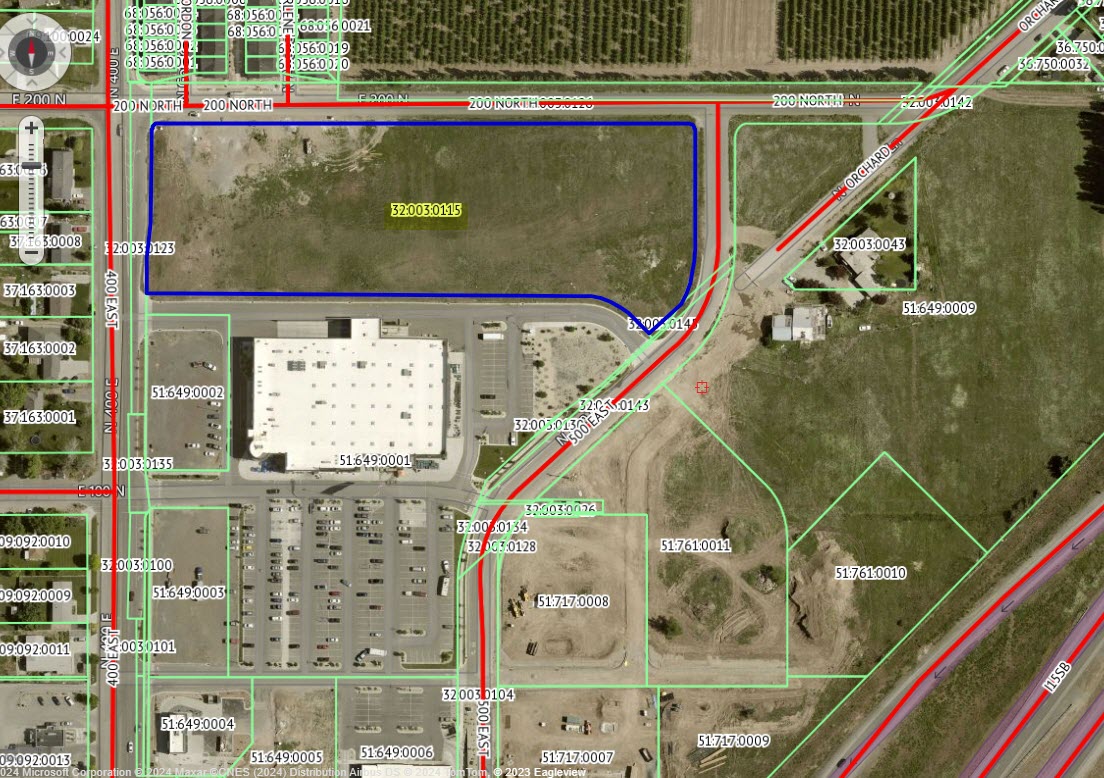

| Serial Number: 32:003:0115 |

Serial Life: 2020... |

|

|

Total Photos: 3

Total Photos: 3

|

| |

|

|

| Property Address: |

|

| Mailing Address: 1201 E 1220 N OREM, UT 84097-5433 |

|

| Acreage: 5.093085 |

|

| Last Document:

31330-2019

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 0 DEG 30' 42" E 1737.86 FT ALONG 1/4 SEC. LINE & S 89 DEG 29' 4" E 29.85 FT FR N 1/4 COR. SEC. 1, T10S, R1E, SLB&M.; N 0 DEG 30' 56" E 53.5 FT; N 6 DEG 47' 35" E 54.87 FT; N 0 DEG 30' 56" E 139.43 FT; ALONG A CURVE TO R (CHORD BEARS: N 45 DEG 19' 35" E 16.91 FT, RADIUS = 12 FT); S 89 DEG 51' 46" E 376.98 FT; S 89 DEG 46' 13" E 432.01 FT; ALONG A CURVE TO R (CHORD BEARS: S 44 DEG 46' 13" E 16.97 FT, RADIUS = 12 FT); S 0 DEG 13' 47" W 181.28 FT; ALONG A CURVE TO R (CHORD BEARS: S 14 DEG 37' 55" W 85.07 FT, RADIUS = 171 FT); S 47 DEG 49' 42" W 67.3 FT; N 42 DEG 10' 40" W 27.48 FT; ALONG A CURVE TO L (CHORD BEARS: N 65 DEG 49' 52" W 92.28 FT, RADIUS = 115 FT); N 89 DEG 29' 4" W 666.49 FT TO BEG. AREA 5.093 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$2,019,000 |

$0 |

$0 |

$2,019,000 |

$0 |

$0 |

$0 |

$0 |

$1,914 |

$0 |

$1,914 |

$2,019,000 |

| 2023 |

$1,989,200 |

$0 |

$0 |

$1,989,200 |

$0 |

$0 |

$0 |

$0 |

$1,756 |

$0 |

$1,756 |

$1,989,200 |

| 2022 |

$1,156,200 |

$0 |

$0 |

$1,156,200 |

$0 |

$0 |

$0 |

$0 |

$1,776 |

$0 |

$1,776 |

$1,156,200 |

| 2021 |

$1,156,200 |

$0 |

$0 |

$1,156,200 |

$0 |

$0 |

$0 |

$0 |

$1,741 |

$0 |

$1,741 |

$1,156,200 |

| 2020 |

$1,156,200 |

$0 |

$0 |

$1,156,200 |

$0 |

$0 |

$0 |

$0 |

$1,731 |

$0 |

$1,731 |

$1,156,200 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

190 - SANTAQUIN CITY |

| 2024 |

$20,274.80 |

$0.00 |

$20,274.80 |

$0.00 |

|

|

Click for Payoff

|

190 - SANTAQUIN CITY |

| 2023 |

$19,911.89 |

$0.00 |

$19,911.89 |

$0.00 |

|

$0.00

|

$0.00 |

190 - SANTAQUIN CITY |

| 2022 |

$11,220.92 |

$0.00 |

$11,220.92 |

$0.00 |

|

$0.00

|

$0.00 |

190 - SANTAQUIN CITY |

| 2021 |

$13,161.02 |

$0.00 |

$13,161.02 |

$0.00 |

|

$0.00

|

$0.00 |

190 - SANTAQUIN CITY |

| 2020 |

$20.33 |

$0.00 |

$20.33 |

$0.00 |

|

$0.00

|

$0.00 |

190 - SANTAQUIN CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 178060-2020 |

11/10/2020 |

11/10/2020 |

R FARM |

UTAH COUNTY TREASURER |

CHARLESWORTH, LESTER |

| 154318-2020 |

09/24/2020 |

10/05/2020 |

WD |

CL CHRISTENSEN BROTHERS INC |

BARTCO HOLDINGS LLC 50%INT (ET AL) |

| 154317-2020 |

09/24/2020 |

10/05/2020 |

WD |

RG DEVELOPMENT LC BY (ET AL) |

CL CHRISTENSEN BROTHERS INC |

| 154316-2020 |

09/24/2020 |

10/05/2020 |

W FARM |

RG DEVELOPMENT LC (ET AL) |

WHOM OF INTEREST |

| 73270-2020 |

01/09/2020 |

05/29/2020 |

RESOL |

SANTAQUIN CITY CORPORATION |

WHOM OF INTEREST |

| 42284-2020 |

03/26/2020 |

04/01/2020 |

REL |

MOUNTAIN VIEW ORCHARDS LLC (ET AL) |

CMJ LIMITED LIABILITY PARTNERSHIP |

| 101935-2019 |

10/01/2019 |

10/07/2019 |

RESOL |

SANTAQUIN CITY CORPORATION |

WHOM OF INTEREST |

| 31330-2019 |

04/12/2019 |

04/15/2019 |

SP WD |

CJM LIMITED LIABILITY LIMITED PARTNERSHIP |

RG DEVELOPMENT LC 50%INT (ET AL) |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/11/2024 10:05:35 PM |