Property Information

mobile view

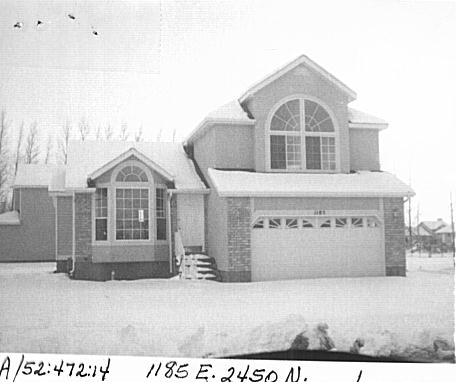

| Serial Number: 52:472:0014 |

Serial Life: 1994... |

|

|

Total Photos: 1

Total Photos: 1

|

| |

|

|

| Property Address: 1185 E 2450 NORTH - LEHI |

|

| Mailing Address: 11067 N 5550 W HIGHLAND, UT 84003-9577 |

|

| Acreage: 0.202 |

|

| Last Document:

87013-1994

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 14, PLAT B, STAFFORD ESTATES SUBDV. AREA 0.202 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| 2022... |

|

TRACY, KEVIN MICHAEL |

|

| 2022... |

|

TRACY, RACHEL |

|

| 2022NV |

|

TRACY, KEVIN MICHAEL |

|

| 2017-2021 |

|

SEEGMILLER, LEISHA |

|

| 2017-2021 |

|

SEEGMILLER, LUKE W |

|

| 2012-2016 |

|

VAN HORN, AMY JEAN |

|

| 2012-2016 |

|

VAN HORN, MARK ANDREW |

|

| 2002-2011 |

|

VANHORN, AMY |

|

| 2002-2011 |

|

VANHORN, MARK |

|

| 1996-2001 |

|

ERCANBRACK, CLISS |

|

| 1996-2001 |

|

ERCANBRACK, NEAL J |

|

| 1995 |

|

IVORY HOMES |

|

| 1994 |

|

PALMER, DONALD S |

|

| 1994 |

|

PALMER, HELEN DE ANN |

|

| 1994 |

|

PALMER, HELEN DEANN |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$198,700 |

$0 |

$198,700 |

$0 |

$249,200 |

$0 |

$249,200 |

$0 |

$0 |

$0 |

$447,900 |

| 2023 |

$0 |

$192,900 |

$0 |

$192,900 |

$0 |

$261,000 |

$0 |

$261,000 |

$0 |

$0 |

$0 |

$453,900 |

| 2022 |

$0 |

$196,800 |

$0 |

$196,800 |

$0 |

$294,100 |

$0 |

$294,100 |

$0 |

$0 |

$0 |

$490,900 |

| 2021 |

$0 |

$123,000 |

$0 |

$123,000 |

$0 |

$239,700 |

$0 |

$239,700 |

$0 |

$0 |

$0 |

$362,700 |

| 2020 |

$0 |

$113,900 |

$0 |

$113,900 |

$0 |

$224,000 |

$0 |

$224,000 |

$0 |

$0 |

$0 |

$337,900 |

| 2019 |

$0 |

$113,900 |

$0 |

$113,900 |

$0 |

$194,800 |

$0 |

$194,800 |

$0 |

$0 |

$0 |

$308,700 |

| 2018 |

$0 |

$109,000 |

$0 |

$109,000 |

$0 |

$183,600 |

$0 |

$183,600 |

$0 |

$0 |

$0 |

$292,600 |

| 2017 |

$0 |

$91,400 |

$0 |

$91,400 |

$0 |

$163,500 |

$0 |

$163,500 |

$0 |

$0 |

$0 |

$254,900 |

| 2016 |

$0 |

$77,400 |

$0 |

$77,400 |

$0 |

$142,200 |

$0 |

$142,200 |

$0 |

$0 |

$0 |

$219,600 |

| 2015 |

$0 |

$75,300 |

$0 |

$75,300 |

$0 |

$126,000 |

$0 |

$126,000 |

$0 |

$0 |

$0 |

$201,300 |

| 2014 |

$0 |

$72,600 |

$0 |

$72,600 |

$0 |

$122,200 |

$0 |

$122,200 |

$0 |

$0 |

$0 |

$194,800 |

| 2013 |

$0 |

$58,800 |

$0 |

$58,800 |

$0 |

$121,500 |

$0 |

$121,500 |

$0 |

$0 |

$0 |

$180,300 |

| 2012 |

$0 |

$49,500 |

$0 |

$49,500 |

$0 |

$112,500 |

$0 |

$112,500 |

$0 |

$0 |

$0 |

$162,000 |

| 2011 |

$0 |

$46,400 |

$0 |

$46,400 |

$0 |

$120,600 |

$0 |

$120,600 |

$0 |

$0 |

$0 |

$167,000 |

| 2010 |

$0 |

$43,106 |

$0 |

$43,106 |

$0 |

$138,012 |

$0 |

$138,012 |

$0 |

$0 |

$0 |

$181,118 |

| 2009 |

$0 |

$93,400 |

$0 |

$93,400 |

$0 |

$98,700 |

$0 |

$98,700 |

$0 |

$0 |

$0 |

$192,100 |

| 2008 |

$0 |

$108,600 |

$0 |

$108,600 |

$0 |

$104,500 |

$0 |

$104,500 |

$0 |

$0 |

$0 |

$213,100 |

| 2007 |

$0 |

$112,000 |

$0 |

$112,000 |

$0 |

$107,700 |

$0 |

$107,700 |

$0 |

$0 |

$0 |

$219,700 |

| 2006 |

$0 |

$65,700 |

$0 |

$65,700 |

$0 |

$106,600 |

$0 |

$106,600 |

$0 |

$0 |

$0 |

$172,300 |

| 2005 |

$0 |

$62,000 |

$0 |

$62,000 |

$0 |

$100,600 |

$0 |

$100,600 |

$0 |

$0 |

$0 |

$162,600 |

| 2004 |

$0 |

$43,224 |

$0 |

$43,224 |

$0 |

$121,703 |

$0 |

$121,703 |

$0 |

$0 |

$0 |

$164,927 |

| 2003 |

$0 |

$43,224 |

$0 |

$43,224 |

$0 |

$121,703 |

$0 |

$121,703 |

$0 |

$0 |

$0 |

$164,927 |

| 2002 |

$0 |

$43,224 |

$0 |

$43,224 |

$0 |

$121,703 |

$0 |

$121,703 |

$0 |

$0 |

$0 |

$164,927 |

| 2001 |

$0 |

$43,224 |

$0 |

$43,224 |

$0 |

$121,703 |

$0 |

$121,703 |

$0 |

$0 |

$0 |

$164,927 |

| 2000 |

$0 |

$40,396 |

$0 |

$40,396 |

$0 |

$110,730 |

$0 |

$110,730 |

$0 |

$0 |

$0 |

$151,126 |

| 1999 |

$0 |

$40,396 |

$0 |

$40,396 |

$0 |

$110,730 |

$0 |

$110,730 |

$0 |

$0 |

$0 |

$151,126 |

| 1998 |

$0 |

$35,749 |

$0 |

$35,749 |

$0 |

$97,991 |

$0 |

$97,991 |

$0 |

$0 |

$0 |

$133,740 |

| 1997 |

$0 |

$35,749 |

$0 |

$35,749 |

$0 |

$97,991 |

$0 |

$97,991 |

$0 |

$0 |

$0 |

$133,740 |

| 1996 |

$0 |

$34,799 |

$0 |

$34,799 |

$0 |

$95,387 |

$0 |

$95,387 |

$0 |

$0 |

$0 |

$130,186 |

| 1995 |

$0 |

$31,635 |

$0 |

$31,635 |

$0 |

$88,040 |

$0 |

$88,040 |

$0 |

$0 |

$0 |

$119,675 |

| 1994 |

$0 |

$18,500 |

$0 |

$18,500 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$18,500 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2024 |

$2,105.02 |

$0.00 |

$2,105.02 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2023 |

$1,964.71 |

$0.00 |

$1,964.71 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2022 |

$2,191.82 |

$0.00 |

$2,191.82 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2021 |

$1,947.57 |

$0.00 |

$1,947.57 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2020 |

$1,835.59 |

$0.00 |

$1,835.59 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2019 |

$1,613.13 |

$0.00 |

$1,613.13 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2018 |

$1,617.35 |

$0.00 |

$1,617.35 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2017 |

$1,457.61 |

$0.00 |

$1,457.61 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2016 |

$1,353.46 |

$0.00 |

$1,353.46 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2015 |

$1,306.99 |

$0.00 |

$1,306.99 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2014 |

$1,272.29 |

$0.00 |

$1,272.29 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2013 |

$1,276.85 |

$0.00 |

$1,276.85 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2012 |

$1,179.15 |

$0.00 |

$1,179.15 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2011 |

$1,207.83 |

$0.00 |

$1,207.83 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2010 |

$1,229.55 |

$0.00 |

$1,229.55 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2009 |

$1,158.61 |

$0.00 |

$1,158.61 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2008 |

$1,216.47 |

$0.00 |

$1,216.47 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2007 |

$1,220.80 |

$0.00 |

$1,220.80 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2006 |

$1,056.16 |

$0.00 |

$1,056.16 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2005 |

$1,125.03 |

$0.00 |

$1,125.03 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2004 |

$1,125.17 |

$0.00 |

$1,125.17 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2003 |

$1,110.56 |

$0.00 |

$1,110.56 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2002 |

$1,015.41 |

$0.00 |

$1,015.41 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2001 |

$1,010.87 |

$0.00 |

$1,010.87 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2000 |

$939.84 |

$0.00 |

$939.84 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1999 |

$904.68 |

$0.00 |

$904.68 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1998 |

$769.70 |

$0.00 |

$769.70 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1997 |

$762.42 |

$0.00 |

$762.42 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1996 |

$696.62 |

$0.00 |

$696.62 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1995 |

$715.41 |

$0.00 |

$715.41 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 1994 |

$259.78 |

$0.00 |

$259.78 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 59909-2021 |

03/30/2021 |

03/30/2021 |

RSUBTEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC (ET AL) |

SEEGMILLER, LUKE W & LEISHA |

| 52155-2021 |

03/19/2021 |

03/19/2021 |

SP WD |

TRACY, KEVIN MICHAEL |

TRACY, KEVIN MICHAEL & RACHEL |

| 52154-2021 |

03/19/2021 |

03/19/2021 |

D TR |

TRACY, KEVIN MICHAEL |

UNITED WHOLESALE MORTGAGE LLC |

| 52141-2021 |

03/19/2021 |

03/19/2021 |

WD |

SEEGMILLER, LUKE W & LEISHA |

TRACY, KEVIN MICHAEL |

| 16130-2016 |

02/26/2016 |

02/26/2016 |

REC |

FIRST AMERICAN TITLE INSURANCE COMPANY TEE |

VANHORN, MARK & AMY |

| 15323-2016 |

02/23/2016 |

02/25/2016 |

D TR |

SEEGMILLER, LUKE W & LEISHA |

W J BRADLEY MORTGAGE CAPITAL LLC |

| 15322-2016 |

02/24/2016 |

02/24/2016 |

WD |

VAN HORN, MARK ANDREW TEE (ET AL) |

SEEGMILLER, LUKE W & LEISHA |

| 110696-2013 |

10/29/2013 |

12/03/2013 |

REC |

UTAH COMMUNITY CREDIT UNION TEE |

VAN HORN, MARK (ET AL) |

| 44465-2013 |

04/25/2013 |

05/07/2013 |

RSUBTEE |

JPMORGAN CHASE BANK (ET AL) |

VANHORN, MARK & AMY |

| 35489-2013 |

04/08/2013 |

04/12/2013 |

WD |

VAN HORN, MARK & AMY |

VAN HORN, MARK ANDREW & AMY JEAN TEE |

| 35488-2013 |

04/08/2013 |

04/12/2013 |

D TR |

VANHORN, MARK & AMY |

AMERICAN LENDING NETWORK INC |

| 85269-2011 |

11/17/2011 |

11/29/2011 |

WD |

VAN HORN, MARK ANDREW & AMY JEAN |

VAN HORN, MARK ANDREW & AMY JEAN TEE |

| 26969-2009 |

03/11/2009 |

03/13/2009 |

REC |

UTAH COMMUNITY CREDIT UNION TEE |

VAN HORN, MARK & AMY |

| 25080-2009 |

02/23/2009 |

03/10/2009 |

RC |

UTAH COMMUNITY FEDERAL CREDIT UNION |

WHOM OF INTEREST |

| 20522-2009 |

02/23/2009 |

02/27/2009 |

D TR |

VAN HORN, MARK & AMY |

UTAH COMMUNITY CREDIT UNION |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 110820-2007 |

06/27/2007 |

08/01/2007 |

REC |

KEY BANK NATIONAL ASSOCIATION TEE |

VANHORN, MARK & AMY |

| 78601-2007 |

05/23/2007 |

05/29/2007 |

RC |

UTAH COMMUNITY CREDIT UNION |

WHOM OF INTEREST |

| 78592-2007 |

05/23/2007 |

05/29/2007 |

D TR |

VANHORN, MARK & AMY |

UTAH COMMUNITY CREDIT UNION |

| 125388-2003 |

07/24/2003 |

08/07/2003 |

RSUBTEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC (ET AL) |

VANHORN, MARK & AMY |

| 52103-2003 |

03/24/2003 |

04/04/2003 |

SUB AGR |

KEY BANK NATIONAL ASSOCIATION |

CHASE MANHATTAN MORTGAGE CORPORATION |

| 52102-2003 |

03/31/2003 |

04/04/2003 |

D TR |

VANHORN, MARK & AMY |

CHASE MANHATTAN MORTGAGE CORPORATION |

| 584-2002 |

12/10/2001 |

01/03/2002 |

REC |

CHICAGO TITLE INSURANCE COMPANY SUCTEE |

ERCANBRACK, NEAL J & CLISS |

| 583-2002 |

11/15/2001 |

01/03/2002 |

SUB TEE |

COUNTRYWIDE HOME LOANS INC |

CHICAGO TITLE INSURANCE COMPANY SUCTEE |

| 133918-2001 |

12/06/2001 |

12/19/2001 |

D TR |

VAN HORN, MARK & AMY |

KEY BANK NATIONAL ASSOCIATION |

| 70880-2001 |

07/16/2001 |

07/18/2001 |

D TR |

VAN HORN, MARK & AMY |

SECURITY NATIONAL MORTGAGE COMPANY |

| 70659-2001 |

07/16/2001 |

07/18/2001 |

WD |

ERCANBRACK, NEAL J & CLISS |

VANHORN, MARK & AMY |

| 36292-1996 |

04/04/1996 |

05/01/1996 |

REC |

FIRST SECURITY BANK OF UTAH TEE |

ERCANBRACK, NEAL J & CLISS |

| 18259-1996 |

02/27/1996 |

03/05/1996 |

AS |

MEDALLION MORTGAGE COMPANY INC |

ACCUBANC MORTGAGE CORPORATION |

| 18258-1996 |

02/29/1996 |

03/05/1996 |

D TR |

ERCANBRACK, NEAL J & CLISS |

MEDALLION MORTGAGE COMPANY INC |

| 76846-1995 |

11/06/1995 |

11/08/1995 |

RESOL |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 16814-1995 |

02/22/1995 |

03/20/1995 |

REC |

GUARDIAN TITLE COMPANY OF UTAH COUNTY TEE |

IVORY HOMES |

| 1452-1995 |

01/05/1995 |

01/09/1995 |

D TR |

ERCANBRACK, NEAL J & CLISS |

FIRST SECURITY BANK OF UTAH |

| 1451-1995 |

01/05/1995 |

01/09/1995 |

SP WD |

IVORY HOMES BY (ET AL) |

ERCANBRACK, NEAL J & CLISS |

| 87014-1994 |

10/06/1994 |

11/14/1994 |

D TR |

IVORY HOMES BY (ET AL) |

FIRST SECURITY BANK OF UTAH |

| 87013-1994 |

10/12/1994 |

11/14/1994 |

WD |

PALMER, DONALD S & HELEN DEANN (ET AL) |

IVORY HOMES |

| 83318-1994 |

10/25/1994 |

10/28/1994 |

REC |

BANK OF AMERICAN FORK TEE |

PALMER, DONALD S & HELEN DE ANN |

| 62205-1994 |

07/18/1994 |

08/03/1994 |

REC |

ZIONS FIRST NATIONAL BANK TEE |

PALMER, DONALD S & HELEN DEANN |

| 94074-1993 |

11/23/1993 |

12/23/1993 |

S PLAT |

PALMER, HELEN DE ANN & DONALD S (ET AL) |

STAFFORD ESTATES PLAT B |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/24/2024 11:51:31 AM |